Good morning my steemit family, today I am taking some recommendation from a fellow steemian reader who suggested that I rename one of my blog and simplify the tag pinning the main issue. So here it is

Greetings my Steemit family, keeping you inform as usual, today I am going into a topic that affects us all especially those finishing College, attending University, thinking about it or those done with it........STUDENT LOAN

Its the topic that has everyone on the edge, and most people are wondering what this new administration would do about it. If you have been keeping your eyes on the graduation speeches, one commencement speaker in particular made headlines when she was "BOOED" during her speech at a historically black university. Here is a link capturing the moment during the ceremony blob:https://www.washingtonpost.com/2c07d752-2a88-4365-a27e-2119c19cfee2

Many called it disrespectful and other simply said the students were acting within their rights (share your thoughts as comments below). As you now know that speaker happen to be no other person than Education Secretary Betsy Devos, the very person given the mandate to shape their future.

So you may ask what makes this topic so edgy.....simply put ITS THE TRILLION DOLLAR PIE, that would make some folks very rich and others live very miserable in the name of EDUCATION AND EMPOWERMENT

So here are some of the facts, Secretary of Education, Betsy DeVos announce plans to streamline student loan repayment and provide better customer service and support for students......hmmmm, nothing clear but here are some of the propose details

- All student loan repayment services would be streamlined under one company. Currently, four companies are bidding to be the provider: Navient, Pennsylvania Higher Education Assistance Agency (or American Education Services and FedLoan Servicing) and Nelnet and Great Lakes Educational Loan Services (which are submitting a contract together).

- Because there would be one provider, students would no longer have to sign into multiple accounts with multiple servicers to pay student loans. Everything would be located in the same place.

- This streamlined process would allow the federal government to better monitor the servicer to make sure that student borrowers are being treated fairly and receiving adequate customer service and support.

- It is proposed that it would also save taxpayers $130 million over the course of the next five years, as reported by USA Today College.

So lets cut into these changes and what is BS from solution, this is my main concern, I have a big problem with this "ONE UMBRELLA" drive, here is why, competition is healthy, it drives competitors to offer the lowest possible prices and give students the best possible option that fits with their profile. This has been highlighted in the USA Today College report that states "they are worried that handing over all federal student loans to one provider would create a “trillion dollar bank,” or a provider who has all of the power to determine repayment, refinancing and payment schedules." This can have disastrous consequences , as borrowers become numbers that the bankers use to increase their profitability

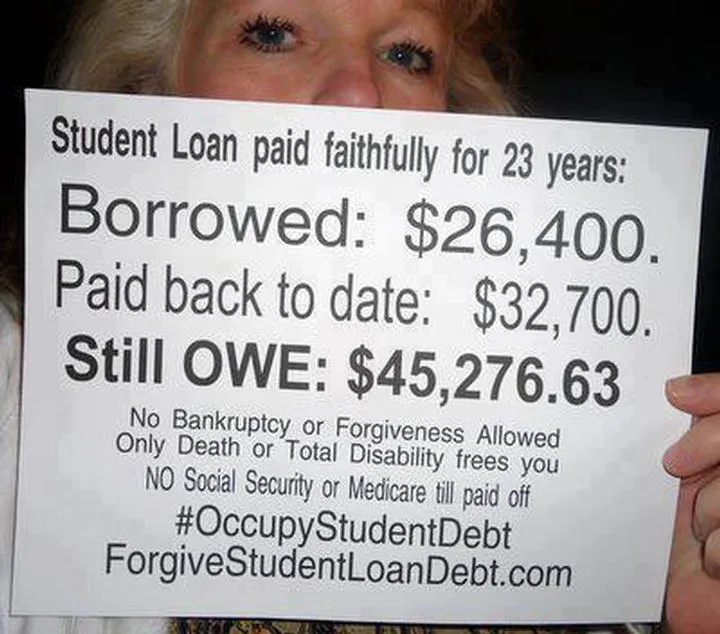

If that does not concern you, here is another detail that no one is highlighting there are plans to potentially eliminate the student loan forgiveness program for those serving in the public sector in the years to come, which would affect more than half a million people according to Business Insider. Here is what they intend to replace it "Trump and DeVos would like to make changes to Obama’s rule to forgive the student loan balance after 20 years if borrowers made consistent monthly payments at 10% of their income. Trump has proposed loan forgiveness after 15 years of consistent payment at 12.5% of income. While monthly payments would be a few hundred dollars higher; borrowers would save thousands of dollars over the lifetime of the loan repayment and be forgiven sooner.".... As I see it, either way, you are f.... that's 12.5% of your monthly income....

So how does the Student Loan repayment look, here is a snapshot of the big players...

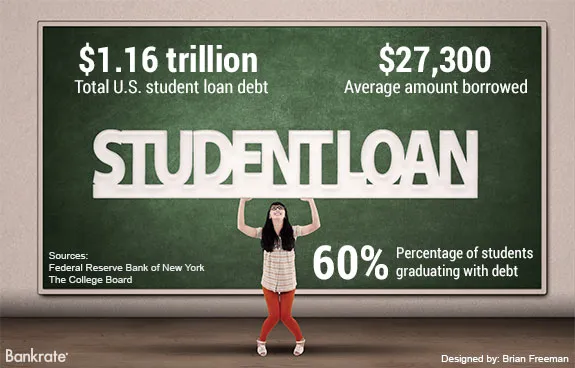

- $1.4 trillion in student loan debt spread across 44 million borrowers, according to USA Today College.

- $1 trillion of the student loan debt is federal student loans and the government currently outsources repayment to 9 different servicers (Cornerstone, Granite State, HESC/EdFinancial, MOHELA, Navient, Nelnet, Inc., Great Lakes Educational Loan Services, Inc., FedLoan Servicing and OSLA Servicing).

- Confusing and misleading terms, with some borrowers even entangled in lawsuits with servicers.

So here is my three cents on the matter, and this is my opinion and I encourage readers to sit with friends, family and yourself (yes yourself) an put a financial game plan in place. As you can see from above, this market is quite healthy and profitable and yep its growing every day. If you are thinking about a degree, think about a degree that pays an annual salary that's greater 3/4 of your student debt. By doing so, with careful planning and discipline you can pay off your student loan within 5 years of landing your job. If your degree can't afford you that opportunity, then you may have to give it some serious thought because you can be trapped in a financial scheme with increasing interest rates and uncertainty where you pay three times the amount you borrowed. This can greatly affect your ability to live a comfortable life, buy your home, car, etc.... the list goes on... what you definitely want to avoid is that 15 or 20 gross period because you would be royally f.... during that time period...

Please Upvote, Resteem and follow @daudimitch

Sources

Originally a post from the "The Trillion dollar investment>>> ARE YOU APART OF IT" that was rename "Student Loan and what you should know about it...." and tag "Student-Loan" https://steemit.com/trillion/@daudimitch/the-trillion-dollar-investment-are-you-apart-of-it