17. August

Air Berlin, Germany's second-largest airline, filed for bankruptcy protection on Tuesday after shareholder Etihad Airways withdrew funding following years of losses.

Germany's Lufthansa is in talks to buy a majority of insolvent Air Berlin's aircraft, including the 38 aircraft that air berlin is already leasing from Germany's second-biggest carrier.

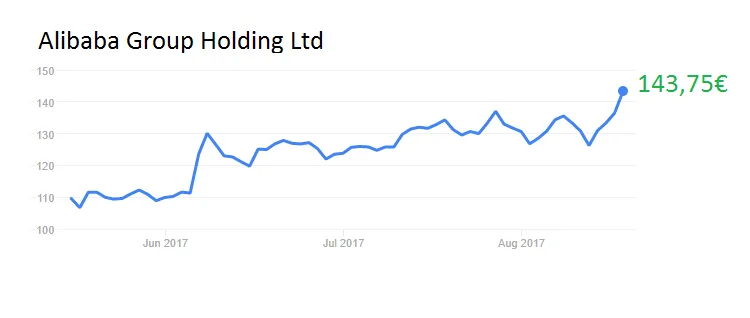

Alibaba Group Holding Ltd, China's largest e-commerce firm, reported first-quarter

revenue above Wall Street estimates.

The Chinese e-commerce titan posted adjusted earnings per share of $1.17 in the three

months ended June, up 65% from a year ago. Quarterly revenue rose 56% from the

year-earlier period to $7.4 billion

Alibaba, one of the most valuable companies in Asia is benefiting from more

Chinese consumers buying an increasing proportion of everything from food to

clothing to luxury items online.

Oil prices steadied on Thursday after U.S. data showed a big fall in crude

stockpiles but also an increase in production, taking U.S. crude output to

its highest in more than two years

West Texas Intermediate futures for September delivery settled down 77 cents,

or 1.62 percent, at $46.78 per barrel

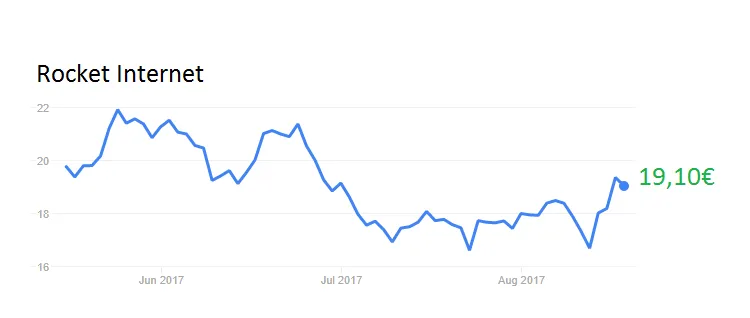

Questofinvest Portfolio - Rocket Internet

Rocket internet's share price is going up again.

On 29.06.17 I had bought the stock at a price of € 19.75, currently the price is again at € 19.10, which corresponds to -3.29%.

In the meantime, the price was already well below € 16.57, one of the low points.

The reason for the purchase were the forthcoming IPO of Delivery-Hero and the interesting participations as for example to HelloFresh.

As a long-term oriented investor, I had the stock on the watchlist and then bought this spontaneously. Not every idea in the middle of the night has to be a good one, but we will see how this ends in long term.

Although I consider course objectives of 53 € called by Berenberg analyst Sarah Simon for very high, but a potential of 40% upward, I consider for quite conceivable.

For the watchlist the stock is always worth, if it goes sustainably over 22.60 €, the stock is a

a purchase also from a charttechnical point of view.