Alphabet Inc. has adopted a new accounting standard that will result in a number of changes in its earnings results, one of which could bring the value of its investment in Uber Technologies Inc. into public view.

Previously profits or losses from nonmarketable stock—as in, privately held companies, such as startups—wasn’t recorded in companies’ financial statements but because of the new rules, Alphabet GOOGL, -1.11% GOOG, -1.36% will now include such investments on its income statement in the “Other Income and Expense” line item. That change begins Monday, when the Google parent company expects to report first-quarter earnings after the bell.

Back in 2013, Alphabet’s venture capital arm known now as GV, dropped $258 million into Uber’s war chest at a $3.76 billion valuation, and Alphabet gained an additional 0.34% of Uber’s equity, equal to about $245 million, as part of a settlement of the self-driving lawsuit between the two Silicon Valley companies.

With Uber’s current valuation of $48 billion for secondary shares most recently bought by the Softbank-led funding round and $70 billion for the remaining primary share, Alphabet’s stake may get recorded as more than $3 billion, according to Barlcays analyst Ross Sandler.

Read also: Google and Amazon in SEC’s sights, but refusing to give in

Excluding the Uber investment, Sandler would expect $377 million in other income and expenses, but taking it into account bumps the number up an eye-popping 1,131.9% to $4.36 billion. The resulting change would also push earnings up 50% to $13.85 a share, compared with $9.28 a share without the impact, Sandler wrote.

The significant per-share bump doesn’t take into account GV or other Alphabet unit investments, which will also likely have to be marked up or down and potentially offset the Uber gains.

The changes to Alphabet’s accounting also include the company moving Nest from “Other Bets”—an accounting category that includes its experimental businesses—to the Google unit, and specifically within the hardware team. As a result, the company will include it in “Google Other,” a revenue bucket that also houses the company’s cloud division as well as app store sales.

Lastly, Google said it would begin providing cost-per-impression data from Google’s network revenue instead of the cost-per-click data it has provided investors. Network revenue comes from third-party sites that use AdSense, DoubleClick and Admob products to place ads. Alphabet chief accountant Amie Thuener said the company is making the change because impression-based revenue is a more significant driver of growth than clicks.

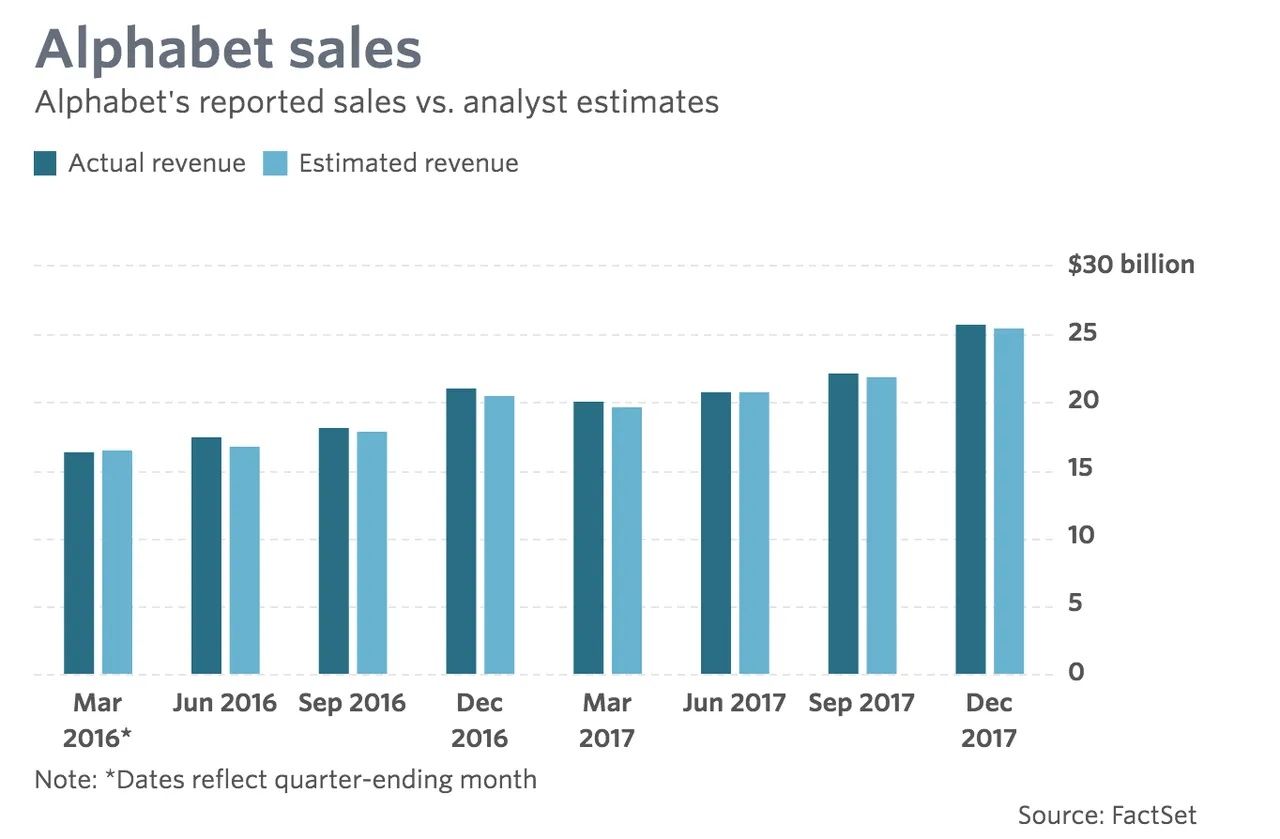

Earnings: On average, analysts polled by FactSet model earnings of $9.28 a share and adjusted earnings of $11.75. Contributors to Estimize, which crowdsources estimates from analysts, fund managers and academics, predict earnings of $9.35 on average.

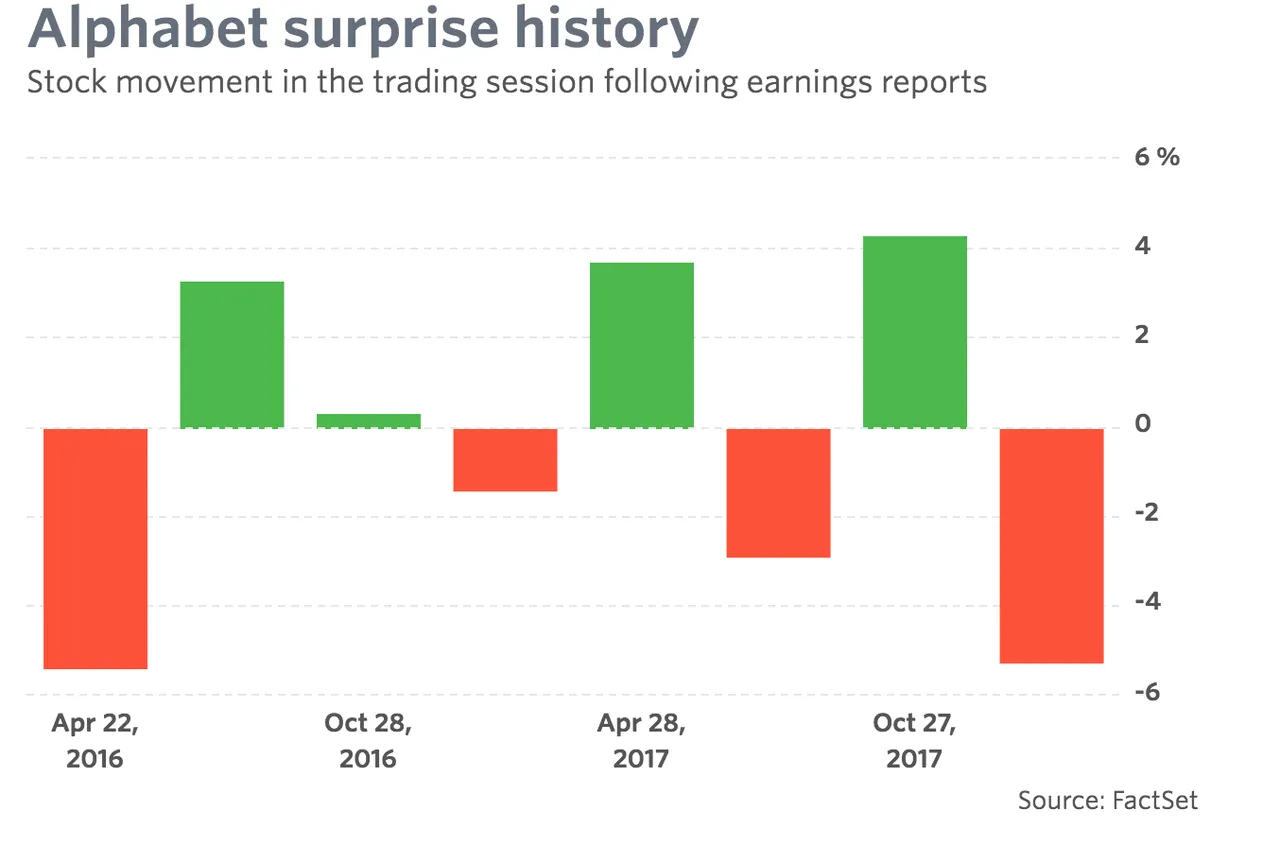

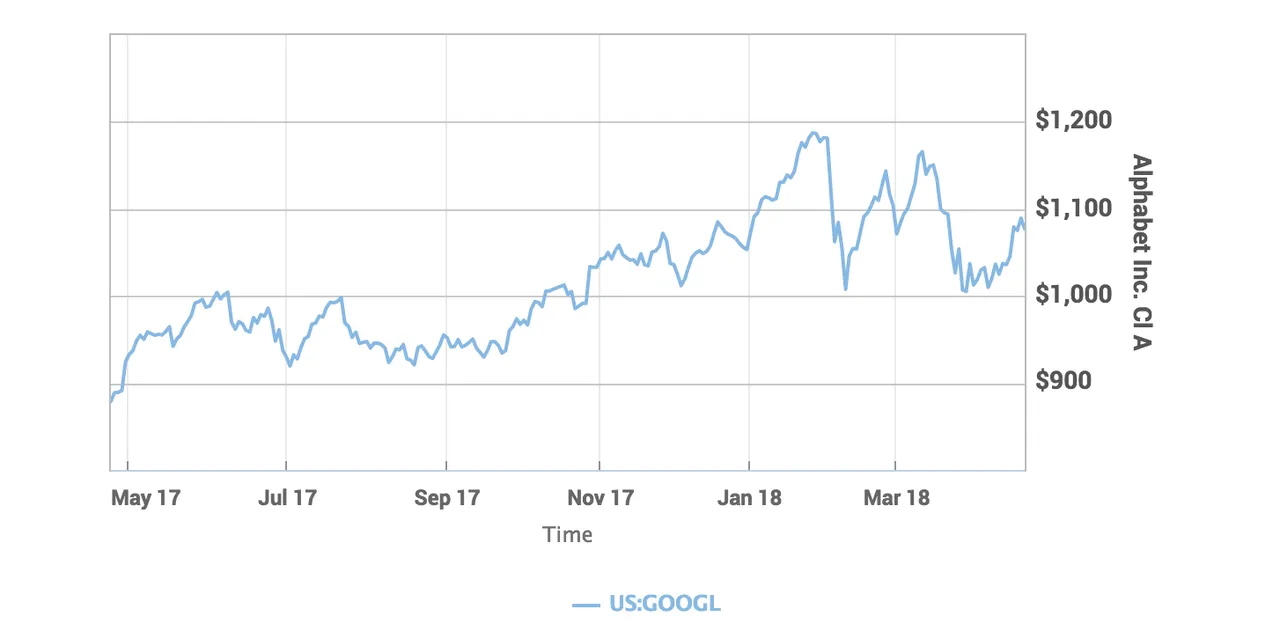

Stock movement: Alphabet’s class A shares have lost 4.7% this year, as the benchmark S&P 500 index SPX, -0.85% has gained less than 1%. The class A shares have dropped 7% in the past three months, compared with the S&P 500, which fell 4%.

Of the 45 analysts the cover Alphabet, 41 have the equivalent of a buy rating, two rate the stock a hold and two have a sell rating on the name. The average price target is $1,278, reflecting 17% upside from Thursday’s close.

What else to look for

Regulation and government activity is something that investors should be on the lookout for in this quarter and in the future.

While Facebook Inc. FB, -1.08% has borne the brunt of its debacle stemming from data improperly handled by Cambridge Analytica, the fallout has increased the possibility that the government will take further action that could also effect Google, according to RBC Capital Markets analyst Mark Mahaney. Coupled with President Donald Trump’s recent obsession with Amazon.com Inc. AMZN, -1.89% Mahaney wrote that there is an increased risk to Alphabet of getting wrapped up in a seeming backlash against tech companies.

European lawmakers are worth watching closely as well, as the EU has already fined Alphabet $2.7 billion for anticompetitive practices on its shopping site and has two additional cases open against the company. Mahaney wrote in the note to clients that the complaints surround local search, travel, maps and the company’s data-scraping activities.

“Based on numerous discussions with investors, we believe the market may be underappreciating the regulatory risk facing Alphabet,” wrote Mahaney, who has the equivalent of a buy rating on the name with a $1,285 price target.

Don’t miss: The YouTube and Instagram secret that Google and Facebook don’t want you to know

Sandler took a different view in a recent note to clients, saying concerns over regulation represent a good buying opportunity and suggests that investors could add to their existing positions in Alphabet.

“[The risks are] nothing new to long-term Google investors, and historically has created good entry points,” he wrote.

In terms of Google’s core advertising revenue from search and YouTube, Sandler wrote that he expects a modest deceleration from last quarter in the “sites” revenue growth. Sandler also expects the operating margin to decline compared with the year-earlier period because of the HTC acquisition. Sandler has the equivalent of a buy on the stock with a $1,330 price target.