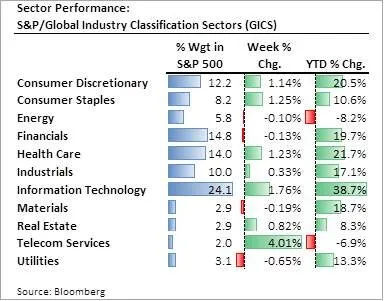

The US capital markets had an up week this last week, with the NASDAQ leading the major indicies at +1.41%. As the 2017 calendar year draws nearer to the end, the tech heavy NASDAQ also has a solid lead over the S&P 500, Dow Jones Industrial Average, and the Russell 2000 at 28.9% vs 19.5%, 24.7% and 12.8% respectively

In economic news, the Fed increased the federal funds rate by 0.25%, which is now at a range of 1.25%-1.50%. The Fed also guided 3 rate increases for 2018, assuming their indicators continued to stay strong. On a side note, the banks will delay a corresponding increase on cash deposits so they can make a larger spread - not a bad time to own the banks right now.

In political news, the proposed tax law changes under the Tax Cuts and Jobs Act look to be close to being finalized, despite the hoops put out there this week by McCain and Rubio. It looks like corporate tax cuts will not come through until 2019, but markets should stay strong as the boost to EPS is anticipated. A side effect to delay though, is that many companies may try to push taxable income into future years by delaying revenue recognition or increasing expenses under the higher tax rate - this could cause some short term volatility as EPS might be comparatively bad in 2018, with 2019 being particularly strong.

Overall, outlook on the US Capital Markets remains positive, though fewer potential market pushing events are on the horizon and markets are trading at historical highs. The next few months should be should be interesting.

Good luck out there,

Brian