Content adapted from this Zerohedge.com article : Source

by Tyler Durden

We noted earlier that US equity futures were extending losses after the close, but the real panic action is in the volatility complex.

Putting today's VIX move in context, this is among the biggest ever...

And it appears Morgan Stanley was right to bet on VIX hitting 30...

But the real action is in the super-crowded short-vol space.

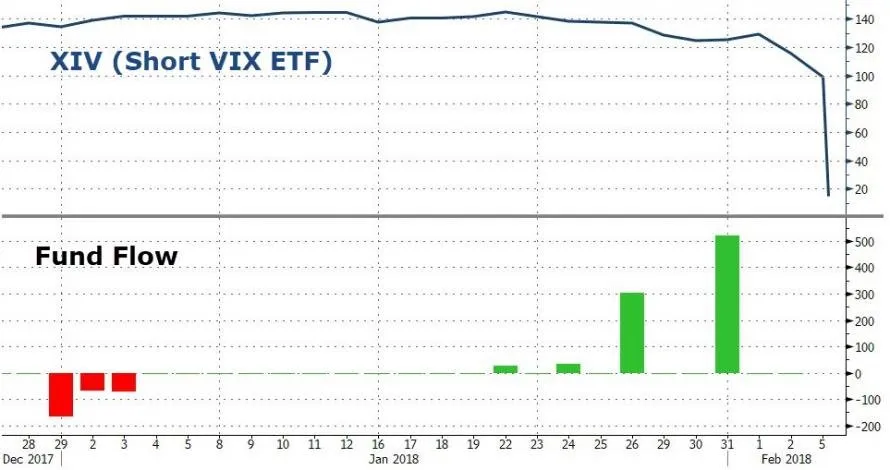

XIV - The Short VIX ETF - after its relentless diagonal move higher as one after another Target manager sold vol for a living... just disintegrated after-hours, down a stunning 90% to $10.00.

Which is a problem because as we explained last summer, the threshold for an XIV termination event is a -80% drop. What does this mean? Well, in previewing today's events last July, Fasanara Capital explained precisely what is going on last July:

Additional risks arise as 'liquidity gates' may be imposed, even in the absence of a spike in volatility. In 2012, for example, the price of TVIX ETN fell 60% in two days, despite relatively benign trading conditions elsewhere in the market. The reason was that the promoter of the volatility-linked note announced that it temporarily suspended further issuances of the ETN due to "internal limits" reached on the size of the ETNs. Furthermore, for some of the volatility-linked notes, the prospectus foresee the possibility of 'termination events': for example, for XIV ETF a termination event is triggered if the daily percentage drop exceeds 80%. Then a full wipe-out is avoided insofar as it is preceded by a game-over event.

The reaction of the investor base at play – often retail – holds the potential to create cascading effects and to send shockwaves to the market at large. This likely is a blind spot for markets.

Others expect the same:

Data is chaotic now but key numbers show $VXX IV value at +96.10 % for the day and $SVXY IV down -96.67%. It's likely $XIV & $SVXY terminated. If so their final values will be set by what value the futures were when they closed out their position. Likely at least down 80%.

— Vance Harwood (@6_Figure_Invest) February 5, 2018

Those curious can read more on what a XIV termination event is here.

Also, recall that last Thursday saw investors poured a record $520 million into an exchange-traded note that gains when VIX drops...

They chose... poorly.

As one veteran trader (who has seen numerous volatility cycles) exclaimed, "I've never seen anything like this... this is it" referring to the start of the unwind of the biggest aggregate short volatility position the market have ever known.