Week 34 - Aug 20 Investment Moves

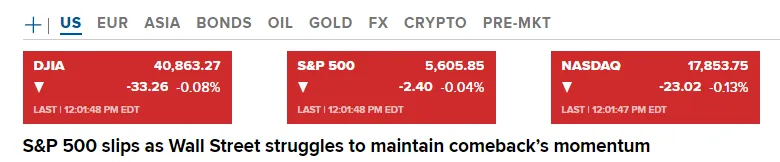

- Today's US market condition @ noon (EST)

- Aug 20 Options Trades

- Visa Iron Condor Explained (Oct 18, 2024)

- Bitcoin still between $55K-$60K

Today US market condition @ noon (EST)

The US market is mostly "FLAT". Sure, it shows RED across the board, but the percentage change is between 0.08% - 0.13%. The market is on an EIGHT-day GREEN streak so that it can turn GREEN in the next 4 hours.

The FED will lower rates in September. Some are guessing that if the FED does lower twice in 2024, the stock market will resume an upward trend.

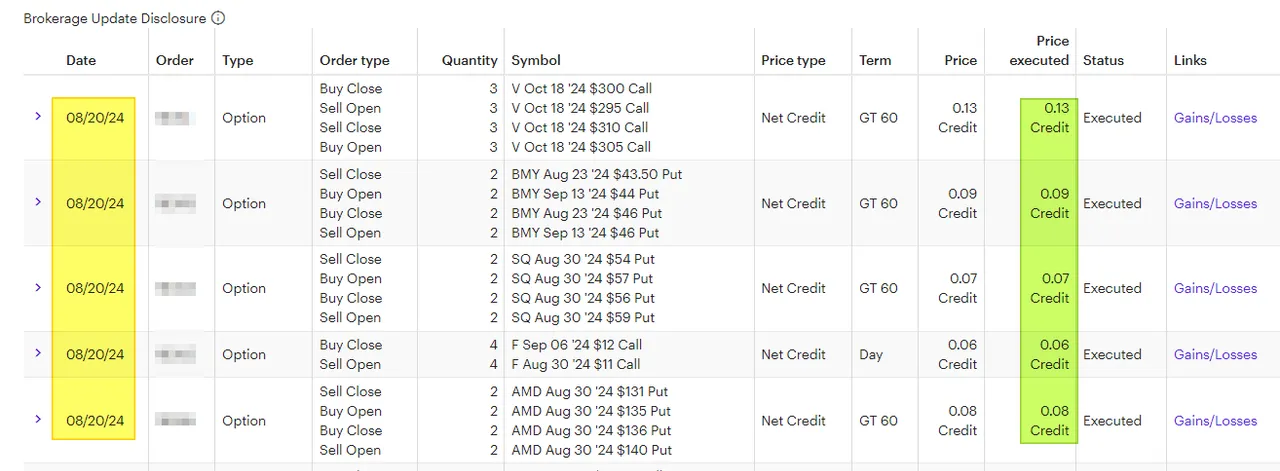

Aug 20 Options Trades

Here are my options trades for Aug 20, 2024.

Summary:

- Rolled Visa Call side (of an Iron Condor) down for $13 premium each.

- Rolled BMY Put credit spread OUT 3 weeks for $9 each.

- Rolled SQ Put credit spread up for $7 each.

- Rolled F covered call up and out for $6 each.

- Rolled AMD Put credit spread up for $8 each.

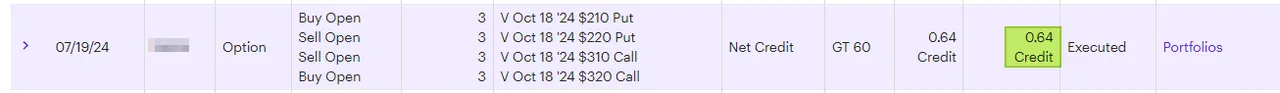

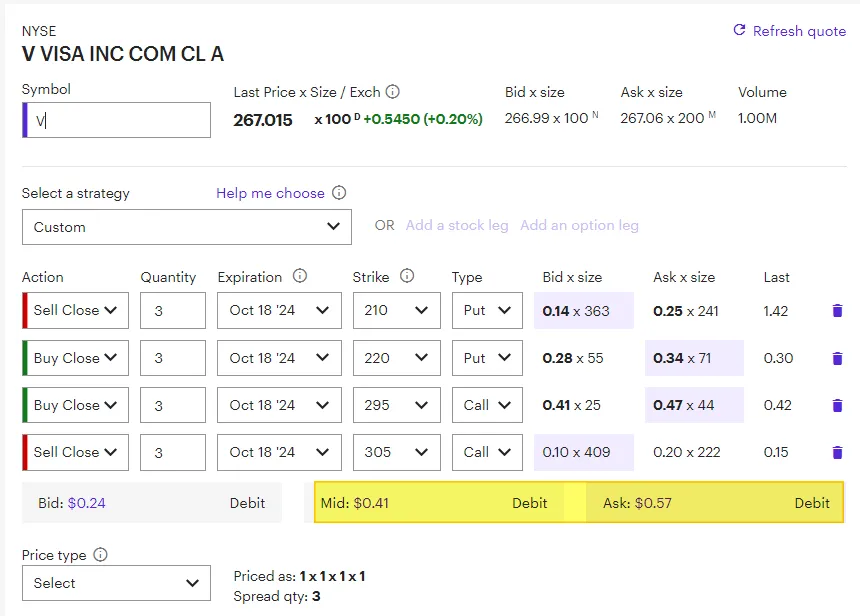

Visa Iron Condor Explained (Oct 18, 2024)

How did I make money on the Visa Iron Condor for Oct 18?

On July 19, I opened the Visa Iron Condor for $64 each. The goal is to let TIME decay and hopes that VISA stays within the range ($220 - $310).

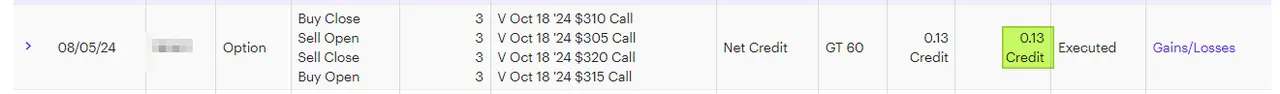

On Aug 5, I lower the CALL side by $5 in strike price for $13 premium each.

On Aug 12, I lower the CALL side by $5 in strike price for $8 premium each.

On Aug 20, I lower the CALL side by $5 in strike price for $13 premium each.

If I close this Iron Condor, I can close it each for $50 (or up to $57). Therefore you can see how the TIME Decay and even the added risk by lowering the strike price is still in my favor. I have plenty of time on this OPTION and I will let another 3-5 weeks decay before I decide if I should close the position.

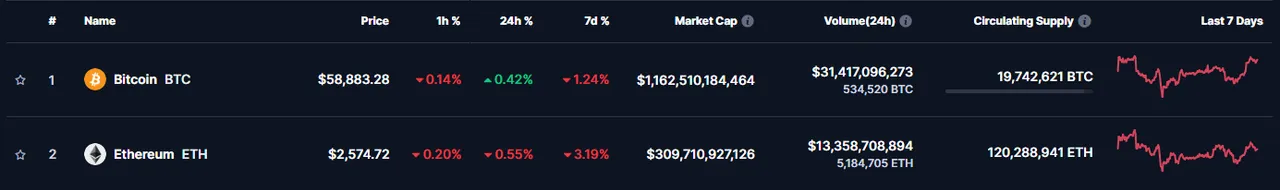

Bitcoin still between $55K-$60K

The price of BTC (bitcoin) has been boring to watch in the last 6 months. It been range bound during that time.

To see where we came from, let's go back 1 year and compare the last 6 months.

Here you can see, that BTC was around $24K a year ago. The market jumped a bit during the ETF rollout in Jan and then a pre-halving jump to over 60K! Since that time, you can see it trending down but it rebounds a bit before starting to go back down.

If you are DCA (Dollar Cost Averaging), then a downward price is a good thing because it gives you a chance to get in cheaper. Timing asset purchases are never easy and using DCA to put into BTC works. Ask anyone that did it years ago.

Do you want to support me? Join up and you too can earn money by posting or commenting on other's people content!

https://inleo.io/signup?referral=solving-chaos

That is all for today. Have a profitable day!