Buy physical Silver.

I believe Silver has a bright future and in this post I'll explain to you why. Silver is the second most utilized commodity on the planet only behind oil. It's the worlds best conductor of electricity and is used in 1000's of applications.

Our modern day life does not exist without Silver.

It's in the computer you're reading this on, your smart phone, tablet and television. Silver is in the mirror in your bathroom, your light switches and within the walls of your home. It's in your microwave, dishwasher and water purifier. Your watch, the battery in it and possibly even your clothing contain some Silver. Silver has countless uses in the medical field and solar panels as we know them wouldn't exist without it.

Great, so we know Silver is useful, now let's look at some numbers!

Silver reached its' most recent historical high of $48 in August of 2011. For it to get back to $48 from where it's at today, $16.55, it has 290% upside potential.

The Gold to Silver Ratio.

For thousands of years the Gold to Silver (price) ratio has hovered around 15 to 1 because there's about 15 times the amount of Silver on the planet than Gold.

The current Gold to Silver ratio is 80 to 1.

According to Keith Neumeyer, CEO of First Majestic Silver, his mines are pulling 9 ounces of Silver out of the ground for every 1 ounce of Gold. IE, the in ground Gold to Silver ratio at First Majestic Silver is 9 to 1. If Gold didn't move a cent from where it's at and the Gold to Silver reflected the 9 to 1 in ground supply, Silver could reach $146. If it got back to 20 to 1 we'd see Silver at $66.

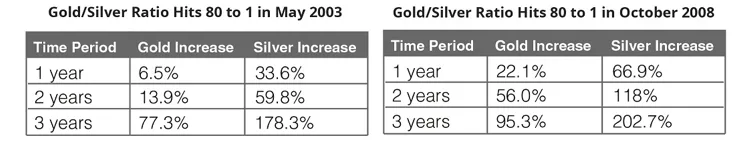

The last 2 times the ratio touched 80 to 1, Silver significantly outperformed Gold for the following 3 years as seen below.

All the numbers we've looked at above are very conservative.

What could happen to the price of Silver if the dollar is no longer the World's Reserve Currency, or if we have another economic crisis, or we experience hyperinflation like's occurring in Venezuela?

Nobody knows for certain what will or won't happen in the future but being able to pick up Silver at these levels seems like a no brainer in my humble opinion. Only time will tell but I look forward to doing a follow up post a few years now!

It goes without saying that I'm not telling you what to do with your money nor is this investment advice.