In short, FinTech is the contraction of Financial and Technology. It's an umbrella term describing everything related to technologies serving financial services, from technology bricks to products, services, and companies.

While Technology has always been part of financial services and operations, the term has seen a surprising increase of attention at the end of 2013.

Google Trends for search word "FinTech"

I have my personal explanation (guess) about the time of this surge and I'm curious to hear about yours so drop a message in my inbox if you want to share views on this ^^

FinTech ranges from traditional financial companies using new technologies, to totally new financial services offered by FinTech startups.

Extrapolating on this range of FinTech, it is useful to observe 2 broad categories of actors:

- Tech companies providing financial services

- Financial companies integrating technologies into their services

But the line between these actors is far from net. And it's one of the reasons why regulation has a major role in shaping the FinTech space and the future of financial services.

It seems obvious especially in the light of the recent financial and economic crisis that the financial sector is undergoing major transformations, which are at the root of the emergence of FinTech, for two main reasons:

- The cost of operations is too high and is considerably reduced by the use of new technologies

- Increased regulation and compliance requirements in post-2008 called upon inevitable transformation

To the extent that regulation played a role in the [big] banks' reluctance to re-enter the small-business market once the crisis had subsided, our findings reinforce the view that one of the consequences of heightened bank regulation may be to drive activity to the less-regulated, nonbank sector.

Chen et Al (2017), The Decline of Big-Bank Lending to Small Business: Dynamic Impacts on Local Credit and Labor Markets

I will elaborate further on the reasons and goals of the emergence of FinTech, but first let's take a closer look at what is considered FinTech through some examples:

Digital Banking

FinTech is a major part of Mobile and Web banking services. It is integral to the shift from traditional to digital banking and it represents the means by which banks have undertaken the digitization of their services to meet customers' new digital needs.

Remote Cheque Deposit with QNB Mobile banking

Lending and Personal Finance

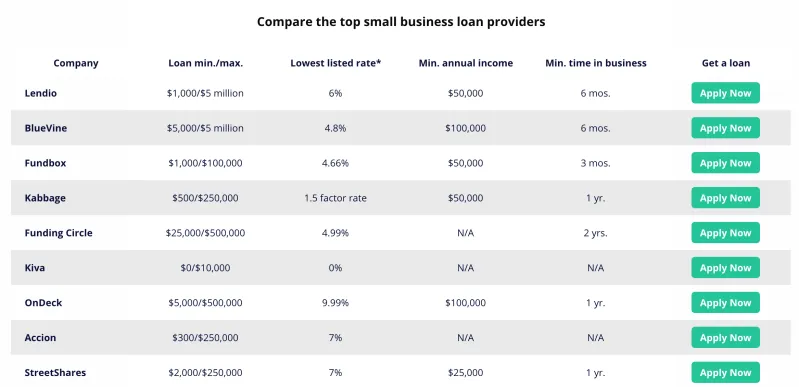

Digital technologies and platforms allowed the emergence of FinTech companies offering financial services traditionally offered by banks. Such is the case with LendingClub which offers peer-to-peer lending, and Kabbage which offers automated-lending for small business loans.

These new FinTech platforms offer innovative ways of credit scoring that allow faster application and process times. Besides reducing loan application and processing time from weeks to instants, this allows them to access business segments that are unaccessible for banks.

Screenshot from 11 Best Small Business Loans of 2020

- Kabbage is an online FinTech company providing funding directly to small businesses and consumers through an automated lending platform. It leverages its capabilities of loan assessment through integration with business IT and data analysis (shipping & accounting data).

- BlueVine , similar to Kabbage, also offers invoice financing where invoices act as collateral for a loan.

- LendingClub started as a Facebook app in 2007 and moved out to compete with other peer-to-peer lending platforms such as Prosper and Zopa.

International Money Transfer

Finally, could FinTech be a website or a mobile app that makes international money transfers cheaper?

Using Bitcoin protocol and other blockchain technology platforms is definitely much cheaper than inter-bank money transfers and international money exchanges like Western Union.

Cryptopay web interface

Today, theoretically speaking, anyone can transfer money overseas, almost instantaneously, cheaply and securely, without needing any financial intermediary. All they need to do is convert the money to a cryptocurrency of their choice and then send the amount from their wallet to the recipient's wallet. In most cases, the whole process takes few minutes.

Wallets being free and blockchain transfer fees being almost null, the main cost associated with this kind of transfer is the cost of money exchange from the local fiat to crypto and from crypto back to fiat money. However, accessing an exchange platform might be a challenge in some countries and the process may require more time for people who don't have access to banking services. So to say, financial intermediaries are here to stay, with or without cryptocurrencies mass adoption.

Beyond the individual and disintermediated case of blockchain money transfer, many companies use cryptocurrencies and blockchain technology to offer the possibility to transfer money overseas cheaply and securely.

There are different players in this field. I could separate them in 4 categories:

#1 Banks and traditional financial institutions

There are many initiatives aiming to replace legacy settlement systems especially in the case of cross-border payments.

The most famous initiatives are led by Ripple, and R3, but there are also initiatives by Stellar, Visa, and even J.P.Morgan. SWIFT the dominant messaging system for international payment had no choice but to open access to its GPI (Global Payment Innovation) to maintain its position despite the rise of these disruptors. Eventually, collaboration is the best way forward.

For a broader view on blockchain in banking, you can check out this state of the art analysis.

#2 Debit card providers

There are numerous FinTech startups providing the possibility to spend cryptocurrencies directly with prepaid debit cards (Visa and Mastercard). Generally, they provide custodian or non-custodian crypto-wallets and link them to prepaid debit cards thanks to agreements.

To name a few: paycent card, airtm , MCO Visa card by Crypto.com

#3 Crypto neobanks

FinTech startups closer to neo-banks offering bank accounts that integrate fiat and cryptocurrencies seamlessly, such as Revolut.

#4 Crypto "bureau de change"

FinTech startups providing a network of offices and /or people to exchange cryptocurrencies with local fiat currencies. BloomX pioneers personal remittance between Philippines and Australia.

Or directly a network of ATM, such as Bitcoin ATM.

FinTech is a bundle of technologies

It's easy to note that FinTech is all about bringing forward the power of digital technologies to provide the best experience in serving users' financial needs while reducing operational challenges for financial services providers.

Blockchain technology presents a wide range of advantages that makes it seem like a silver bullet in FinTech. It solves the operational challenges of a traditionally siloed sector. And it opens the gate for a more diverse and so more competitive sector. However, the best of FinTech is yet to come and it lies in the convergence of several technologies.

Posted from my blog with SteemPress : https://nadsnotes.com/2020/04/21/whats-fintech/