This is a short review of my BTS/STEEM market making on bitshares using DEXbot. Is it more profitable to just hodl or to spend some time and energy on market-making (trading) activities?

I have used staggered orders strategy. It is anticipated it should work the best when after some price volatility exchange rate will go back to the initial value. Realistically, this may or may not happen. Here after 2 months STEEM value relative to BTS lost almost 50%.

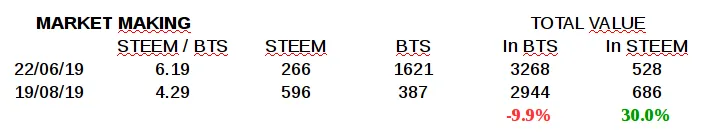

Market Making

On June 22nd STEEM / BTS exchange rate was 6.19 BTS for 1 STEEM. Starting balances were of almost equal. The total value of assets expressed in BTS was 3268 or in STEEM 528. Until 19th of August, most of the value was moved to STEEM. Exchanging remaining STEEM to BTS would give 2944 BTS which means 10% loss. Exchanging remaining BTS to STEEM would give 686 STEEM which means 30% profit.

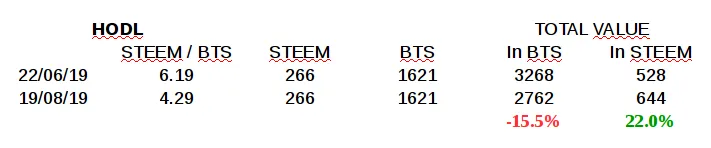

Hodl

How does it compare to simply keeping STEEM and BTS? BTS value of the portfolio would lose a bit more, about 15%. The value expressed in STEEM would be still in the green, with a 22% gain instead of 30%.

Conclusion

Trading performance in this strongly trending market was slightly better than the simple buy and hold strategy. Market making requires spending resources like time and comes with risks (including human and machine errors) that can hurt performance. Just holding is maintenance-free. Based on pure numbers, leaving aside trading risks and efforts, market-making performed slightly better than hodl strategy.