Source

I love trading. I trade because I believe that trading is the easiest way to get rich. I hate to lose money too, I also believe that trade is the fastest way to get wrecked, especially if you are trading in the volatile crypto market without insurance.

For those like me that want to earn a fortune trading, I believe that it is our job to make it rich trading before being on the wrong side of the trend wrecks us.

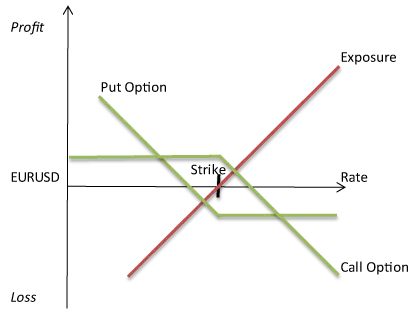

I normally trade stocks and fiat currency pairs like eurusd. These assets are popular and have high trading volumes. I may not be making astronomical gains at the moment, thanks to my capital base, but I'm certainly not logging in losses and it is all thanks to hedging with option.

OPTIONS: Think of it as a traders insurance policy against losses. ( for more info on options please google it )

I won't go into details about the derivative but I will tell you that the traditional option chains don't exists at the moment for Cryptos due to it relative novelty.

You won't find options for Cryptos in the traditional sense which is a problem for traders that want insurance against the volatile nature of crypto currencies

But I since discovered that I can mimic the traditional options trading binary options. With binary options I can mimic my favorite options trading strategy called the married put when I trade Cryptos.

I have been back testing a strategy which entails going long on bitcoins on an exchange like bittrex while simultaneously betting that the price of bitcoins will go down on this binary options trading platform called olymp trade.

This way, it doesn't matter what the price of bitcoins does because I win either way whether the price goes up or down.

I would also recommend deribit.com if you want to see something that is relatively close to trading bitcoins options in the traditional sense.

(The strategy discussed in this post is for advanced traders and not for beginners )

Please tell me what you think by kindly leaving a comment