This is part of a series on how much delegators get from investing in bid-bots. See https://busy.org/@verodato/the-return-of-the-bid-bot for more information.

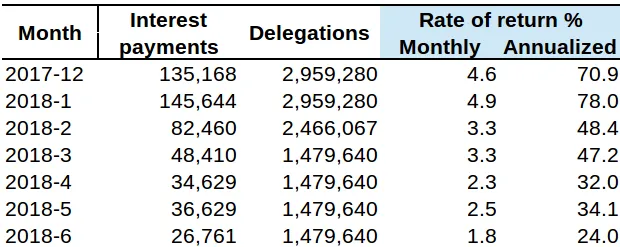

The @upme bid-bot was created at the end of August 2017. It has a very hight delegator concentration: the @freedom account has delegated 99.4% of the @upme total delegation received, as can be seen in the chart above.

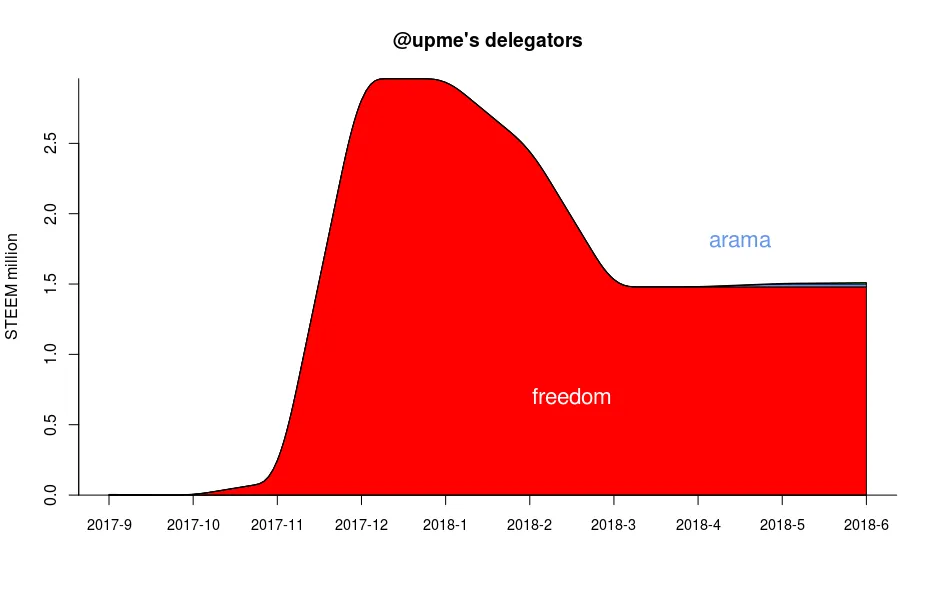

This bid-bot's expenses are mostly done via “encrypted memo”. The refunds to users of the bid-bot are the second main type of transfer memo and account for 6.7% of the @upme expenses, as shown in the chart below.

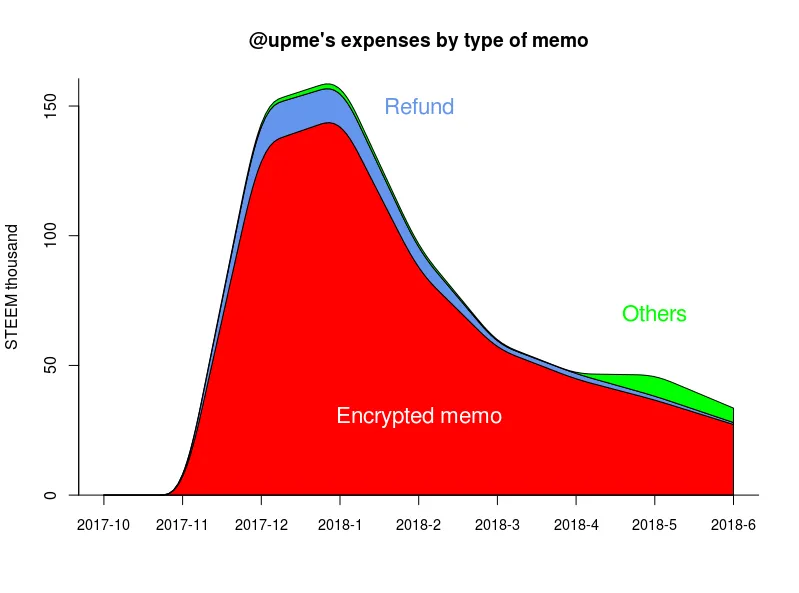

When expenses are aggregated by their destination account, most of them, as was expected, go to the main delegating account, @freedom. We can see in the chart below that two relatively important destination accounts are exchanges: Bittrex and Binance.

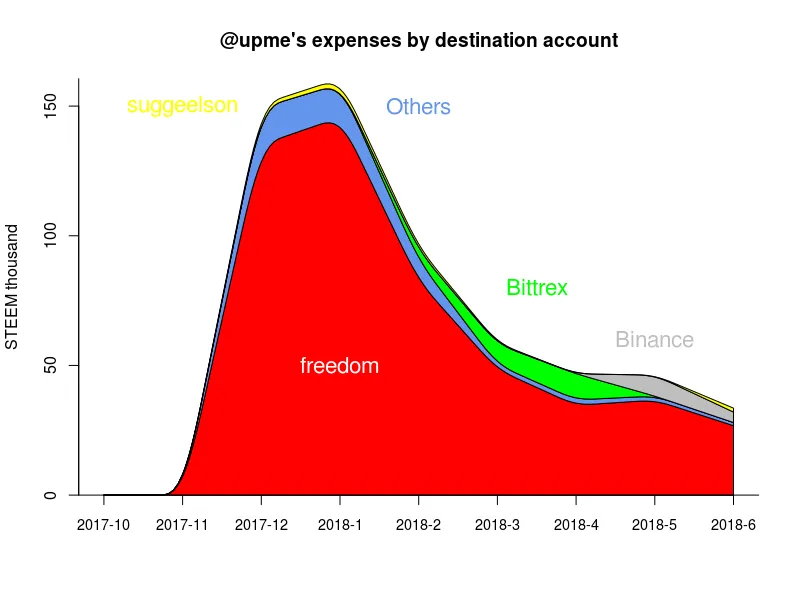

Given that one delegator is so dominant, we estimate the @freedom rate of return on delegations to @upme as the rate of return of this bid-bot. The table below shows the dollar values of the estimated cash flow between @freedom and @upme. The annualized rate of return went from a high of 78% in January 2018 to a low of 24% in June 2018. The total interest payments to the delegator in this period was USD 509,701 and the monthly average delegation value was USD 2,043,312. So we find a 25% rate of return on investment for the 7 months period. This is equivalent to a nice 46% annualized rate of return on investment in the @upme bid-bot.