(Also the title of my next Shel Silverstein parody.)

So we've been thinking about the SBD debt ratio lately, with the changes in payouts, and @timcliff's HF20 proposal to change to print more SBD, and the potentially impending haircut. Don't worry if you didn't understand that, I'm about to give a short explanation.

Previously on Steem:

SBD are a debt instrument for Steem, essentially attempting to use the value of Steem to create a token that's consistently valued at $1 USD. (That's why they were originally called Steem Backed Dollars.) But the Steem system has methods for making sure that the debt doesn't become too high of a percentage of the total system value: as the ratio of SBD to total value approaches 5%, the system gradually stops creating more SBDs to limit the supply, and at that ratio exceeds 10% the system will stop treating SBD as $1 in order to keep it at a maximum of 10%.

Tim's change is to move the time the system stops printing SBD to 9% instead, but I'm not really interested in that today, I'm looking at the haircut at 10% and what it's going to mean.

The Haircut

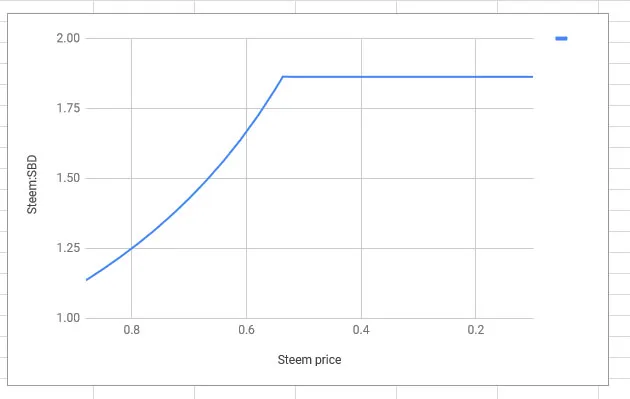

So I know we're all a little worried about what happens when/if the haircut comes, because it's new and has kind of a scary name and basic description. But the more I look at it, the less important I think it is. Obviously none of us are thrilled with either SBD or Steem losing value against USD, but in terms of the Steem ecosystem and the value of SBD, the haircut itself isn't a huge deal. If what you want is to hold the most Steem, holding SBD as it falls is a good plan, and the haircut doesn't change that. If Steem continues to fall, SBD will gain value against it for a while, and then when the haircut hits maintain it. Here's a chart assuming current supply levels:

1 SBD will be worth more Steem until Steem hits about $0.565, and then will maintain that level after the haircut cuts in. Essentially SBD will convert from a USD-stable token to a Steem-stable token.

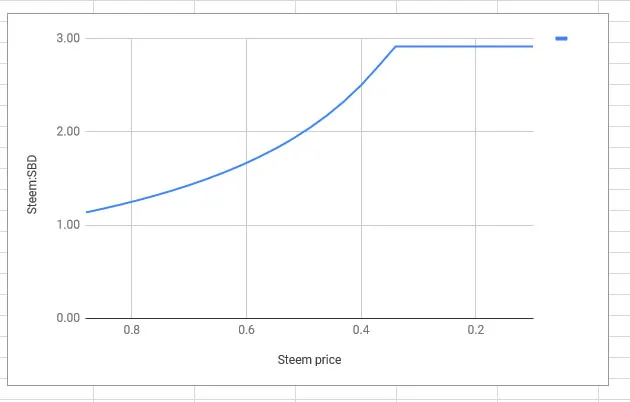

Now if people start converting significant amounts of SBD to Steem using the blockchain method, things could change a little bit because the supply would go down and thus the debt ratio would go down with it. A lower supply of SBD would move the graph up and to the right. Here's an example if about 1/3 of SBD were converted, note the changes to the Y axis.

That might lead to some interesting game theory questions about conversion. As long as the Steem price keeps going down it should be profitable to wait out your conversion as long as possible, as everyone else's conversion increases the value of your SBD. But if everyone waits then nothing happens.

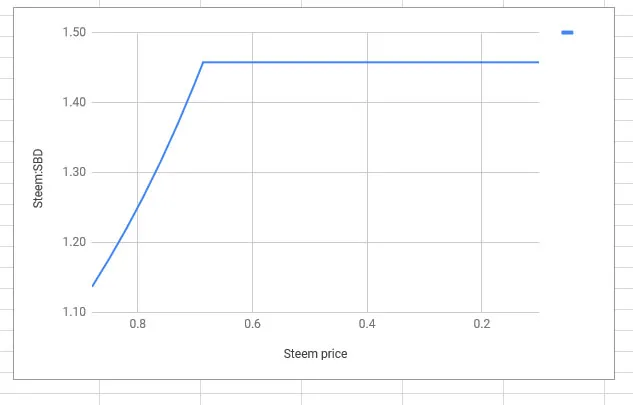

Similarly if Tim's change goes into effect and we start printing more SBD, the chart could move down and to the left. Here's what it looks like if we increase the supply of SBD by 1/3:

So if we get to the point of printing more SBD, holding them becomes somewhat more risky. But until then I think it makes a lot of sense to hold SBD, especially if you have the expectation that any rise in price will likely come from the general altcoin market and therefore affect Steem and SBD similarly.

It's worth paying attention to where the debt ratio is as we get close to HF20. If it's in the 5-9% range where we're going to start printing SBD again, at that point holding it might make less sense.