One of my problems with stock/forex/altcoins markets speculation is that I tend to (well I always in fact) enter a trade too early. In my early days I learnt a few times that “The market can stay irrational longer than you can stay solvent.”, especially when using large leverage. Now I no longer follow this path :D and reduced leverage to a reasonable level.

I decided that perhaps if I admit to my mistakes and try to describe the failures and the outcome I would improve my strategy.

Last month it happened with Nexium and now with STEEM/BTC.

This is a losing trade now, but I put little money it it, just 0.3 BTC and I can afford to lose it, this is why I decided do not close this trade and treat this as a lesson.

Here it goes. Please bear in mind that I forgot to check intra-market correlations and soaring BTC/USD.

Initial setup

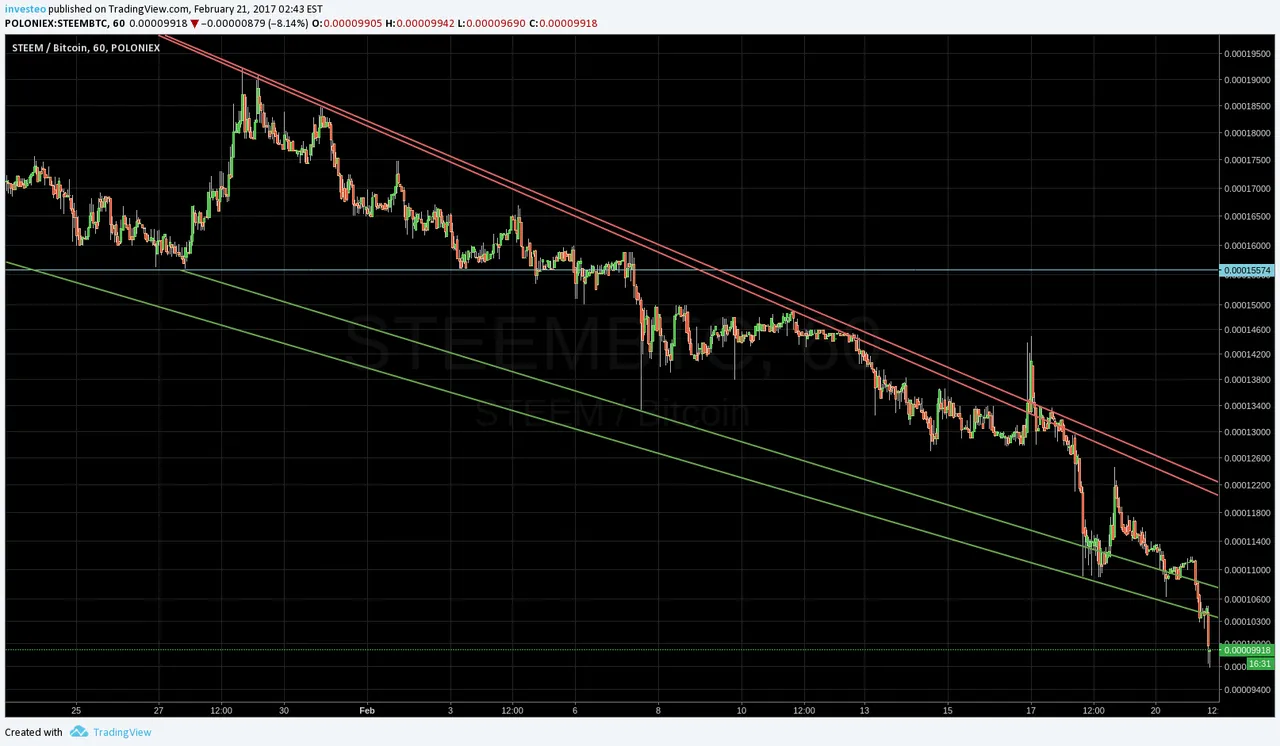

This trade was purely technical. Waiting for trendline breakout on a 1h chart and buying once the trendline was broken.

I entered the trade @ 13700k satoshi with TP @ 15k (9,4% profit) with estimated time frame 3 days - 1 week.

Immediately after the breakout large seller pushed price down and violated my previous support lines.

The action point now is to let this trade flowing with hard stop @ 5k satoshi trying to catch the bottom.

I think I found a candidate for a bottom: downwards channel inside of the downwards channel (orange one), and a support trendline starting from

27th november 2016 and New Years 2017 Eve's highs)

If the price will bounce from the lower thick green trendline and cross the upper bound of the orange channel, the plan is that the 3rd small descending channel will be born and once the third channel will be broken we will shall see this ;)

Let's see how it goes.

This is not an investment advice!