MetaStable Capital, is a hedge-fund backed by some of the biggest names in Silicon Valley. It is funded by such titans of venture capital as Andreessen Horowitz, Sequoia Capital, Union Square Ventures, Founders Fund and many more. According to a Fortune article, MetaStable's returns since its inception now exceed 1,000%.

MetaStable owns about a dozen different cryptocurrencies, including Bitcoin, Ethereum and Monero. In fact, the fund owns about 1% of all outstanding Monero (worth about $6 million). Some of the bitcoin owned by the fund were actually picked up by one of the founders for free back when bitcoin was in its infancy.

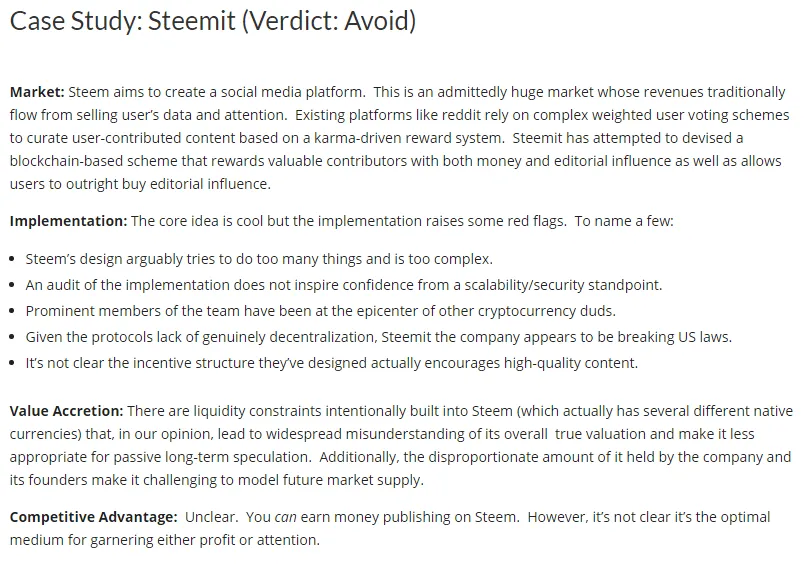

However, a case study put out by MetaStable asks investors to avoid Steem. The team does not believe in the Steemit platform at all. Here's the analysis published by the hedge fund:

To recap, some of the points made by MetaStable:

- Steemit is too complex due to multiple currencies (Steem, Steem Power, Steem Dollar)

- Steemit has an incentive system that is unproven for encouraging high-quality content

- Steemit appears to be breaking US laws

- Steemit may not be scalable or entirely secure

I'm interested in knowing how the Steemit community reacts to these allegations. As I see it, this case study by MetaStable is a vote of no-confidence in the Steem currencies as long-term passive investment options. This does not reflect on the success or failure of Steemit as a platform for content.

What do you think?

Sources: Fortune Article, MetaStable Website