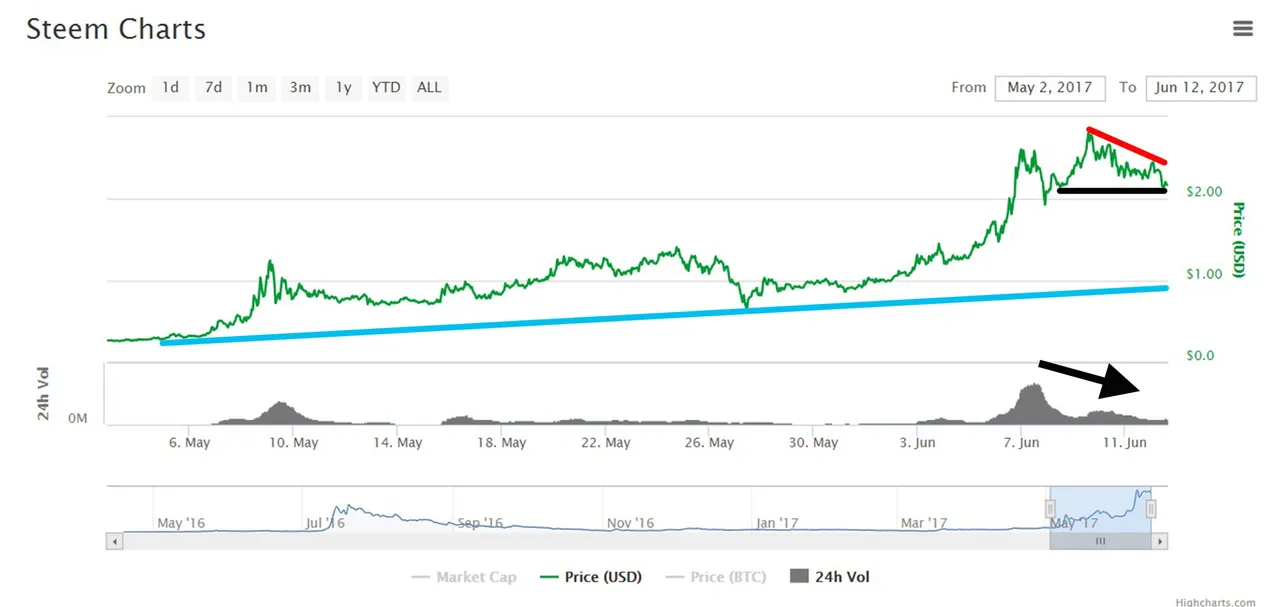

The STEEM-Bitcoin price continues to show some strength from its most recent upward move.

In my last Price Analysis post, this is what I said about the STEEM-BTC prices:

That being said, the 100K satoshi line does have a small amount of data and it could prove to be a big psychological hurdle - round numbers tend to be that way in markets and trading. There is currently ~550 BTC (~$1.5 million) of sell orders on Poloniex that would need to be overcome in order to push through that price.

If the price falls back on a correction, the stronger line of support would be around 75K satoshis, then 65-68K below. A 50% retracement from this most recent move would be around 73-74K.

Well, over the last few days, the STEEM-BTC price retreated to ~71.5K satoshis, then rose to 0.00099998 BTC on Poloniex. It then retreated back to ~75K satoshis and has touched off of that line four times. The short-term trend is currently down (red line) and will likely remain pointing down. Currently, the price would need to overcome ~87K satoshis in order to break that trend line. Another touch or two off of the 75K support line (black) could be too much for support to hold and may send prices to 70K or lower.

The STEEM-BTC price is trading well above its 20 and 50-day moving averages, so there is a lot of room for the price to fall or for the averages to catch up to a sideways moving price. The price could dip below the 20-day moving average, just as it did a couple of weeks ago. As long as the 50-day moving average holds, the bullish trend would remain pretty strong.

The price has been trading in a fairly strong upward channel over the past month and there aren't any indications that this will change in the short-term. Momentum appears to be turning over and volume has been dropping rapidly once again, so we could see another leg down from the current trading range. Bitcoin prices have been faltering over the past 24 hours, which means we could see a general sell-off in many of the alt coins as well, just as we saw a couple of weeks ago.

The STEEM-U.S. Dollar price has been very strong but is currently in a relatively sharp decline (red line). If it can hold around $2.15 (black line), it would be a good show of strength for prices. However, volume - which has been fairly low - would need to pick up once again to confirm support and to resume the upward climb.

What can we expect based on current data?

With a large sell-off in Bitcoin over the last few hours, the rest of the crypto market could get quite volatile and we could see some support break down. The STEEM-BTC price has been trending lower and has already tested support at 75K satoshis a few times. Buying power could get exhausted and give way to selling pressures. If that happens, we could see the price test support around 70K satoshis. If that doesn't hold, we could see another test around 67-68K satoshis.

If prices cannot hold there, 63-64K would be the next level of support.

If prices happen to break through to the upside, the resistance targets will likely be between 90K and 94K satoshis, and then 100K again.

For anyone looking to accumulate STEEM, I still think 75K would be a good place to start averaging in. For the more risk-tolerant, be careful trading this market right now. Keep an eye on Bitcoin prices and continue watching the STEEM trading volume for confirmation of a move in either direction, either below support or above resistance.

If you're trading, always remember:

Never invest or trade what you cannot afford to lose and put tight stop-losses in when prices creep lower towards the support lines.

As always, if you have any critiques or comments about my non-professional analysis, please let me know. If you decide to trade this market, good luck to you!

Disclaimer: I am not a professional adviser and this info should not be used for trading. These are only my interpretations and opinions, and while I would be flattered that you think so highly of my fairly basic analysis, it would not be prudent to use this for transacting/trading with real money.

*Charts are from Poloniex and Coinmarketcap.com. Analysis is current as of approximately 1:00pm EST, June 12, 2017.