I didn’t publish a price post yesterday and we had a lot of developments over the last 48 hours.

There’s quite a bit to discuss, so I’ll get right to it.

If you recall from my post for December 9th, I had this image showing the three different uptrend lines – each increasing in their velocity upward.

Compare that to the current 1-month chart from Poloniex (below). I have the same trend lines in the same colors. The orange line shows us the steepest upward move that started later on December 2nd. This line was broken on December 10th at the $0.23 range – which was serving as a short-term support line. The blue line – which began on November 24th – is an intermediate uptrend line that points to ~$0.19, where it is currently being tested. The red line is pointing at the $0.15-$0.16 range where there has been some pretty solid support, albeit on relatively lower volumes.

If the price breaks through the blue uptrend line at ~0.19, it will most likely fall to the next uptrend line (red). This red line is a 24-day trend that began on November 18th. If the price does not hold here, we will most likely revisit $0.10, which is the long-term low for STEEM.

Taking a look at the 1-week Poloniex chart, we see the current downward slide from the peak last Tuesday. This downward movement has been steady along that trend line for three days. We also see the break below the $0.20 support line that had been tested and held on several occasions previously. More likely than not, this will prove to be the new resistance line for now.

There are a few things happening at the moment that I believe will continue pushing the price lower.

First is this most recent multi-day trend (highlighted in the image above) which points down and currently has good momentum.

Second is the increasing volume, which has proven to ultimately be the bane of the STEEM price. As volume picks up, the price spikes have faltered and STEEM either hits new lows or returns to them. Until this changes, we shouldn’t expect anything dramatically different.

Third is the relatively low support based on Poloniex buy orders. Currently, at ~$0.18, there is less than $20,000 in total orders. The next somewhat significant step up in buy orders is ~$0.15.

Fourth – the power down schedules. If we see these accounts sell on the exchanges, the STEEM price is almost guaranteed to fall. I don’t like making predictions of this nature because I don’t want people to trade based on my opinion of the charts and data, but looking at the current trends and the total increase of STEEM Power that will be liquid, there just doesn’t seem to be enough support out there to soak it up. Even if selling is not immediate, just knowing that it can be dumped at any time will likely be enough to keep buyers on their heels.

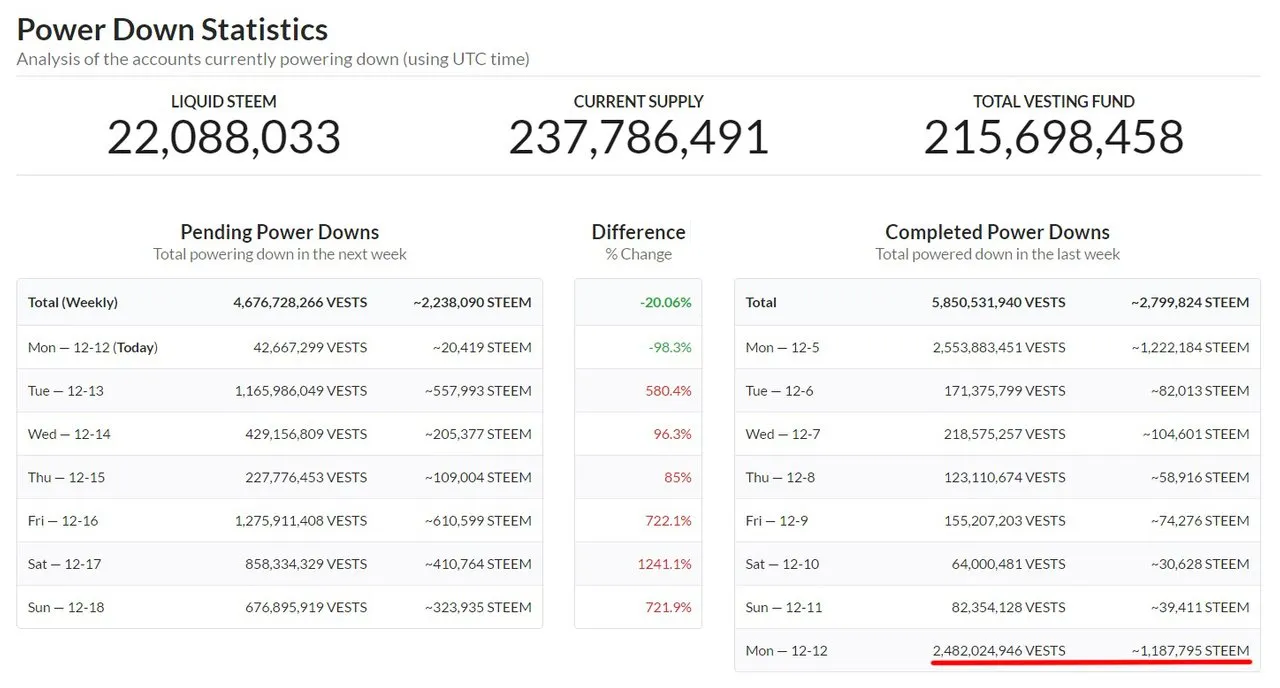

Let’s look at the current schedule from Steemdb.com, just to get an idea of how much we’re talking about. The chart is showing 7.2+ billion vests (3.4+ million STEEM) powering down from December 12th through December 18th. (I’m including the figure on the bottom right with the rest of the top-left figures.) The week prior saw a total of 1.6+ million STEEM becoming available, so there will be more than double the STEEM becoming liquid this week than there was last week. We can see that the latter half of the week shows some rather large increases from the previous week – between 700% and over 1200%. These are power downs that started on the 9th, 10th, and 11th – a few days after the hard fork was completed.

There are a few factors that should be considered. We know that the inflation rate has been cut, so the total number of STEEM being produced has been dramatically lowered. This can’t be discounted when we’re talking about how much STEEM is in circulation – whether locked up as an investment or hitting the exchanges.

We must also remember that not all of these accounts are going to be selling. This is only what is available to be potentially sold. However, as already stated, the mere fact that this STEEM is available can be enough to scare traders and investors from buying this week – especially if we consider where the current price is before these power down schedules are completed. Trend and support lines are being tested and are falling on lower volume and prior to the availability of an increased number of STEEM.

We also know that many of these accounts that are powering down – and several of the larger ones doing so – have already been powering down and have sold into the previously low STEEM prices. We should expect that they will likely continue to sell the larger amount of STEEM at the current prices. Unless there are some deep pockets willing to buy in at what I believe is a very risky entry point for short to mid-term trading, there won’t be enough support to catch the currently falling price.

I’m going to make a prediction here that is 100% opinion based on what I see – do not use this as trading advice. I believe the price will fall to ~$0.15-$0.16 by the end of Tuesday and that we could see $0.10 by the end of the week. I hope I’m wrong about that, but this is certainly not a time to panic. We knew that this would happen, so if you’re in this for the long-term, remain patient and stick with your long-term objectives as a user on Steemit and a holder of STEEM.

If you’re going to trade this market, be careful. It could get ugly for you very quickly. There’s probably money to be made, but it’s not worth the risk, in my opinion.

Good luck.

Disclaimer: I am not a professional advisor and this info should not be used for trading. I would be flattered that you think so highly of my fairly basic analysis, but it would not be prudent to use this for transacting with real money.

*Charts are from coinmarketcap.com and poloniex. Analysis is current as of approximately 12:30am EST, December 12th, 2016.

Follow me: @ats-david