While most initial coin offerings boast about their technological advancements related to artificial intelligence, Machine learning, Neural network and what not. Baltic fund comes up with a unique idea to generate money and fund such ideas in a closed and controlled environment. A Lithuania based startup incubator and accelerator, Baltic Fund aims to provide thriving environment for startups to grow themselves in first year of their establishment and reaps returns to the tune of 2X to 10X by selling controlling stake in these startups at the end of first year to business enterprises. This is a win-win for all stakeholders of the ecosystem, startups get an opportunity to develop their businesses in state of the art tangible and intangible facilities provided by Business Hive Vilnius, which is the parent company of Baltic fund , business enterprises get an opportunity to choose from a set of pre-verified startups and ideas while business hive Vilnius benefits with its investments becoming multifold (2X to 10X) in a year’s time, while earning the reputation of being able to create an ecosystem far away from the Silicon Valleys of the world providing an opportunity to Russian and Baltic countries technology enthusiasts to create and develop companies from scratch. The idea of doing it in the heartlands of Lithuania might sound vague if not crazy to many from the mainstream startup ecosystems, in reality it is an eye opener to the hidden talent and intellectual capital present in the Baltic and nearby countries. Thinking about these places as breeding grounds for startups is an idea far from reality from many. Well, not if their facts are straightened. From the year 2007, startups have raised close to 1 Bn Euro in the Baltic states. 300Mn of these have been raised through the ICO route in the last one year. Lithuania is particularly known for its fintech and cyber security startups and professionals . The number of companies applying for fintech license has grown from 16 to 32 from 2016 to 2017 as per bank of Lithuania. If this trend continues Lithuania could emerge as the center of fintech startups in EU. Highly developed infrastructural conditions and English prominent capital in Vilnius adds to the list of motivators for Lithuania an amazing place for startups and attracts foreign individuals who evaluate their options in Europe.

Irrespective of whether the facts above are sufficient for you to like Lithuania as a destination for startups incubation and acceleration, the idea and team behind Baltic Fund scores full marks in the unique approach laid out by them to create an environment for new businesses to grow and develop into great companies. The experience of Marius Parescius, CEO in creating new businesses in the fields of IT and security expert and the opportunity to work with the government as an advisor gives him an edge over various other ICOs and startups starting afresh. Also, Baltic Hive Vilnius as one of the oldest startup incubator in Baltics which gives it the distinct advantage of access to investors and enterprises who are willing to invest in startups. So, with strong credibility and an experienced management, Baltic fund might turn out be a promising ICO in the near future. More than a coin offering this is like an investment made into a fund which plans to multiply investments to 2 to 10 X a year. Even if they are haf as successful as they want to be, a 3 to 5 X multiple when you are investing in real companies can be a big stimulant for many.

The fact that Baltic Fund has a team of veterans who have been a part of startup incubation for years now ascertains that there will always be action for good. Also, there is no need to vet individual idea now as that part will be handled by the fund in itself. So, when you are investing into Baltic fund, you are essentially investing into many companies at once, the proportion time of exit and entry though is decided by the fund itself. More on this from the whitepaper itself, you can go an explore yourself : https://baltic.fund/BF_Whitepaper.pdf

TOKEN SALE DETAILS :

Baltic fund tokens:

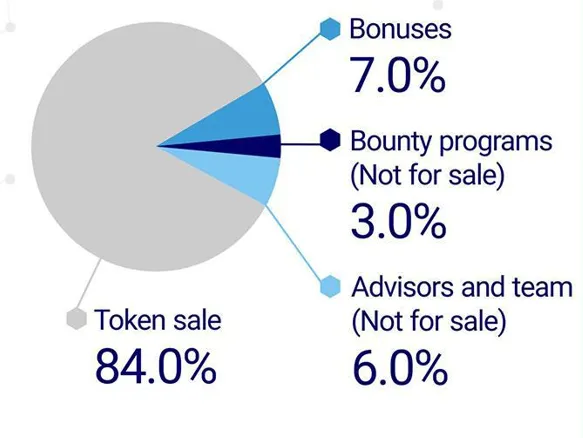

• 165.000.000 tokens to be issued

• 150.000.000 tokens for sale

• 15.000.000 tokens not for sale (advisors, team, bounty)

Token price:

• 1 Baltic Fund token = 0,00020 ETH for public pre-sale, 0,00025 ETH for sale

• Private pre-sale — min. payment amount — 10 ETH

• Minimum amount of purchase — 100 tokens

Bonuses:

• private pre-sale — 20% bonus (min. payment amount — 10 ETH, whitelisted investors only, 25% bonus for payments 300+ETH)

• pre-sale — 15% bonus (minimum amount of purchase — 100 tokens, +5% bonus for payments 100+ ETH)

sale — 10% bonus (minimum amount of purchase — 100 tokens, +5% bonus for payments 100+ ETH)

Stay updated on the same by joining their telegram group here : https://t.me/BalticFund

You can visit their website on https://baltic.fund/ to find more exciting things about them.