Crytocurrency Upside And Downside

Over a decade, creating and trading of digital assets (cryptocurrency) has proven to be a substitute to the usual traditional form of dealings in financial suites. Banks and other financial institutions experience a tremendous downstream due to a new means of wealth acquisition and storage.

Nevertheless, financial institutions still play a vital role in the smooth running and survival of cryptocurrency due to its dependency nature which is as a result of its volatility. To some extent, crypto assets can be a store of value but the fear of missing out is the root of its volatility as the market is unstable hence scaring investors away.

Just as cryptocurrency can bestow fortune overnight, so high also is its power to wreck. Over the years, since inception of Bitcoin, investors are having sleepless nights due to the fear of losing their funds. Even though there are smart ones with Bot power, many investors cannot fathom how to deal with the market complexities. This however accounts for less adoption of cryptocurrency.

a: Could there be solution?

ai - Using cryptocurrencies for everyday transactions is quite inconvenient because of the high fluctuations (i.e high volatility) in price. A good instance is spotted in 2018 market downturn where cryptocurrencies experienced serious crash in prices. Bitcoin for instance went from peak price $20,000 to as low as $3,800. Many lost heavily as there was no umbrella to shield the heavy downpour of loss. This is one big restrictions for investors who wish to be part of the game.

a-ii: Introduction Of StableCoin

src

A "stable Coin" is a cryptocurrency pegged to another stable asset, such as gold or the U.S. dollar. It’s a global currency in cryptospace not tied to a central bank and has low volatility. Its aim is to provide cushion against volatility effect where traders/investors can hide for safety in time of price hike until it recovers. It can be pegged to a cryptocurrency, fiat money, or to exchange-traded commodities (such as precious metals or industrial metals). For Bitcoin and Ethereum for instance, it is usual to see 5% to 20% increase or decrease in daily aggregate price of each which makes it practically unpalatable and inconvenient for daily transactions. With stable Coin, the latter is reinstalled and volatility minimized.

src

A "stable Coin" is a cryptocurrency pegged to another stable asset, such as gold or the U.S. dollar. It’s a global currency in cryptospace not tied to a central bank and has low volatility. Its aim is to provide cushion against volatility effect where traders/investors can hide for safety in time of price hike until it recovers. It can be pegged to a cryptocurrency, fiat money, or to exchange-traded commodities (such as precious metals or industrial metals). For Bitcoin and Ethereum for instance, it is usual to see 5% to 20% increase or decrease in daily aggregate price of each which makes it practically unpalatable and inconvenient for daily transactions. With stable Coin, the latter is reinstalled and volatility minimized.

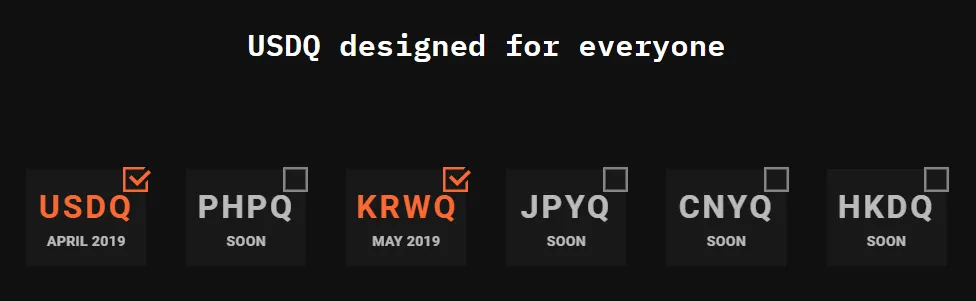

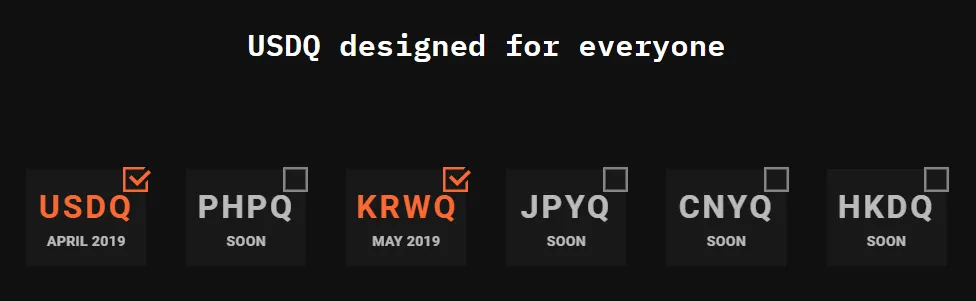

QDAO is an ecosystem that provides one of its kind decentralized stable assets against volatility by providing collateral for cryptocurrencies in the platform's stable coin (s) (USDQ, KRWQ, JPYQ, PHPQ and CNYQ) while still helping investors/users of the platform retain their cryptos. To put out confusion you may experience with this, QDAO simply allows you collateralize your crypto and get a simple stable trading asset and after the trading, you give it back and return your crypto.

The minimum value for an investments cannot be guaranteed by popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) etc hence it would be a wise decision to protect one's investment in such ecosystem as QDAO's until he can be sure of stability of the crypto assets.

Some benefits of QDAO's platform and token issuance.

- QDAO's aasets can be traded on the secondary market as regular stable coins such as KRWQ which has a very minimal volatility helping traders be efficient in their daily trading activities. It also helps them be on the safer side irrespective of what may happen on the secondary market.

- On QDAO's platform, the environment is quite immaterial in price determination as threshold has been set where the coin cannot go below a certain pegged price. USDQ for instance is one of its kind ERC - 20 decentralized stable asset proposed to cap the stability in this regard where it is set as a standard contract backed by Bitcoin assets. Each of the assets on the platform is set against fiat currencies they represent - PHP, KRW, JPY, CNY, HKD and USD in ratio as displayed in image below. USDQ and KRWQ already issued and amount is shown below as at the time of writing this post while others are on the queue.

- Holding stable coin on the QDAO platform brings more benefits as : earning more money for the holders, conferring the right to community governance to the holder by participating in the system control using the QDAO token.

- The issuance of USDQ is to rip off the need of Banks as middleman in making some mythical deposit into private account, for real store of value and high transparency. With regards to the nature of decentralized stable coin, it can’t fall or take off with big fluctuations. It is coded with self-stabilizing algorithms where it acts utmost as in stability and the market itself will always keep the price stable.

QDAO USDQ Tokens are already listed and trading on BTCNEXT, BTC Alpha and HOTBIT.

Conclusion

With QDAO stable assets, the undoubtedly game changer, traders will be more effective in their crypto dealings, existing investors will have more confidence in cryptocurrency and new investors willing to come in. This however will have a multiple effect and subsequently shape global economy into better form.

Join QDAO Community. Click On Image

src

src