I've recently raised the alarm that the SPS DAO needs to be aware of its current situation with exchange listings and the fact that it doesn't have an active market maker. Today I'm going to outline the options that the DAO has, potential outcomes, and let the community discuss the topic further in the comments.

The first and easiest option that will eventually resolve all of these exchange issues on its own is to do nothing. If we choose to do nothing, we will very likely be delisted on most of our centralized exchange listings such as HTX (huobi), Crypto.com, and Gate.io. This will likely cause us to lose face in the wider crypto community, result in no direct fiat on/off ramps for SPS, and will leave the community entirely dependent on liquidity pools.

That said, liquidity pools are very much our friend anyway we go. With the "do nothing" option, we could still choose to pursue some strategic defi partnerships and open more liquidity pools. This could give us access to more chains that the community desires, such as Matic, SOL, or any other chain that hosts defi platforms.

The next set of options is related to doing something to maintain our listings on centralized exchanges (CEX) and having the potential to expand into more CEX in the future. We can either search out a reliable trading bot operator ourselves that the community wants to entrust with enough liquidity to cover our exchange listings and work out a payment arrangement with them or we can contract with a market maker.

As far as the community finding its own trading bot operator and providing them with liquidity and payments. I have no real suggestions as it's highly risky. I've seen one community recommendation for the user konvik that operates trading bots on hive-engine as well as on centralized exchanges. The community would be very much in a situation of trust with anyone they chose to do something like this with and may well lose all tokens provided.

The traditional option would be to hire a market maker (MM) to keep higher liquidity and potentially do arbitrage trading with our liquidity pools to maintain solid price and token availability on whichever platforms they are deployed on which generally leads to higher token accessibility and volume.

There are generally two models for how MMs operate. There are lending based contracts and there are subscription based contracts. I will provide a brief summary of how each operates below:

Lending based contracts require handing over large amounts of tokens (likely million+ USD worth) and not charging us a fee. That said they have custody of our tokens and the contracts will always have a "strike price" negotiated in which they can buy our tokens at whatever price is agreed upon in the contract. For example if we hire a lending based MM right now, they will likely request strike prices below 2 cents per SPS. If SPS goes up, they will buy out our tokens that are already in their custody at the agreed upon price and sell them for a profit.

The other option is a subscription based MM service. These providers require much lower liquidity, usually $30-60,000 USD per market (depending on size of the exchange), they charge monthly service fees, and some will actively arbitrage their positions as well with the liquidity pools to maintain our liquidity balances and allow for tighter spreads on the market.

To sum it up, a lending based model has no upfront fees, higher liquidity requirements, no active arbitrage, and we may have to sell tokens at a loss if price appreciates. Subscription based market makers have lower liquidity requirements, maintain our liquidity at a stable rate, have a tighter liquidity spread and no ability to buy out our tokens because we're paying them with cash up front.

While hiring a market maker involves a legally binding contract and is generally perceived as safe, it is never going to be a zero risk situation. Exchanges can grow insolvent, they can be hacked, or they can be shut down due to regulatory issues and we could lose whatever tokens our MM has on the platform.

I will now provide some examples from available charts of when we did and did not have market maker coverage for posterity:

In the chart below we can see a huge loss of volume in January 2023. SPS was using an undisclosed (NDA sorry) top level lending based MM for all of our exchanges. They decided to stop providing quality service as the bear market intensified and after a lengthy back and forth terminated service and returned our funds a few months later. This is when you see most remaining volume dry up:

Here is another chart for the SPS/USDT pair on HTX (formally Huobi) in which there was a subscription based MM, Flowdesk, being utilized to provide liquidity for that market. I'm sure you can see when their services were disabled quite easily a couple of weeks ago:

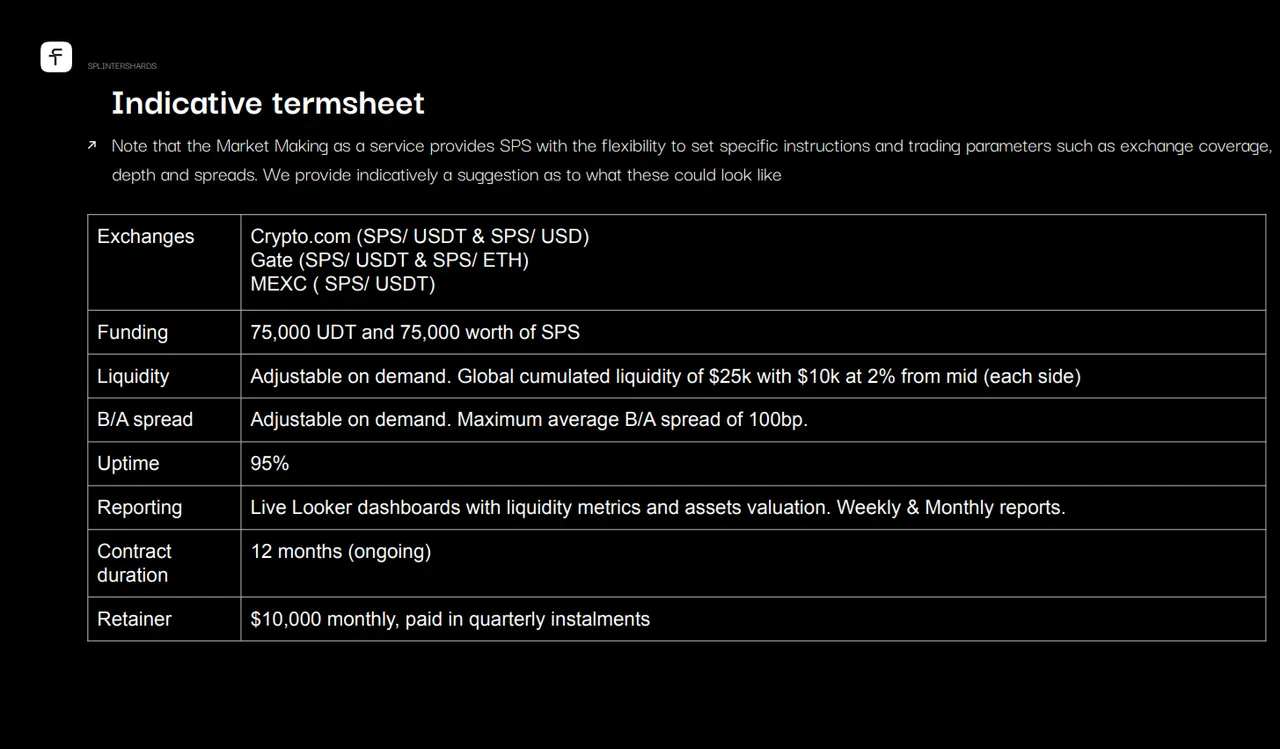

So now that we have examples of what our token health looks like with and without market making services. We have some idea of what they could cost, although the subscription based models are highly negotiable. Flowdesk for example (the only company that has outright allowed me to share their information with you) charges $3,500 per month per market and has shown a strong willingness to both negotiate with us and be completely transparent while working with the DAO. Their current offer can be seen here, but they are willing to adjust liquidity and potentially price depending on what we hire them for:

With all of this information at our disposal, it is now time to decide how we as a DAO want to proceed. My strong suggestion would be that we keep things civil in the comments, share our thoughts about which way we would like to proceed, and then we can make a proposal and approve or deny different approaches accordingly.

I will also publicly commit to seeing this particular project through if we want to take action regardless of how the DAO vote to hire me goes as well as offer to establish the same contacts I currently have with anyone the DAO could choose to hire or work with instead of me. Thanks for your time and consideration.