Afternoon everyone….

We all stack silver rounds and bars. But there are times when it’s not just silver.

There are vintage rounds and bars, then there are truly rare vintage rounds and bars.

The two companies that have the highest collectibility, recognition and popularity are Engelhard and Johnson Matthey.

Why you might ask?

They were the two biggest refineries in the world for decades. While Engelhard was a Newark, New Jersey based company they expanded to many countries over the years including Canada, England and Australia.

Johnson Matthey was located in Ontario, Canada and later added a refinery in Utah.

Neither of these companies produce any silver and gold anymore. Engelhard stopped producing silver in 1988, and Johnson Matthey stopped in 2000.

They both are “The GOLD STANDARD” in the industry. Their bars and rounds are highly sought after to this day. These two companies have the most information available for research of their items of any vintage mints. This is due to their high collectibility.

Both mints produced millions over bars over their decades of being in business. Some of the frequently seen bars and rounds have hundreds of thousands that were produced.

Experts in the vintage bars and rounds field believe that 30-45% of these bars and rounds have been melted down over the years. Since there have been three large spikes in silver since those bars and rounds were produced, making the metal content more relevant than the name on it.

I have lived through two large spikes of silver, and can tell you first hand that when silver spikes to $40 or more, it doesn’t matter if you have American Silver Eagles or generic rounds or bars. Coin shops, pawn shops or smelters pay the same amount for all silver during these massive spikes.

But then there’s extremely low mintage bars….

When I talk extremely low mintage bars or rounds, I mean that the initial mintage is under 5,000 produced. If you take the 30-45% rule into affect, that would mean roughly 3,000 are still in existence.

If you do the numbers that’s extremely low mintage. There are 7.88 billion people in the world, they say .01% own silver. That’s over 7 million people that own silver. They say 15% of that 7 million are considered stackers, that’s 1,500,000 people are possible looking for these types of items. That’s means that less than one in 500 stackers could possible own this bar that I’m going to share with you.

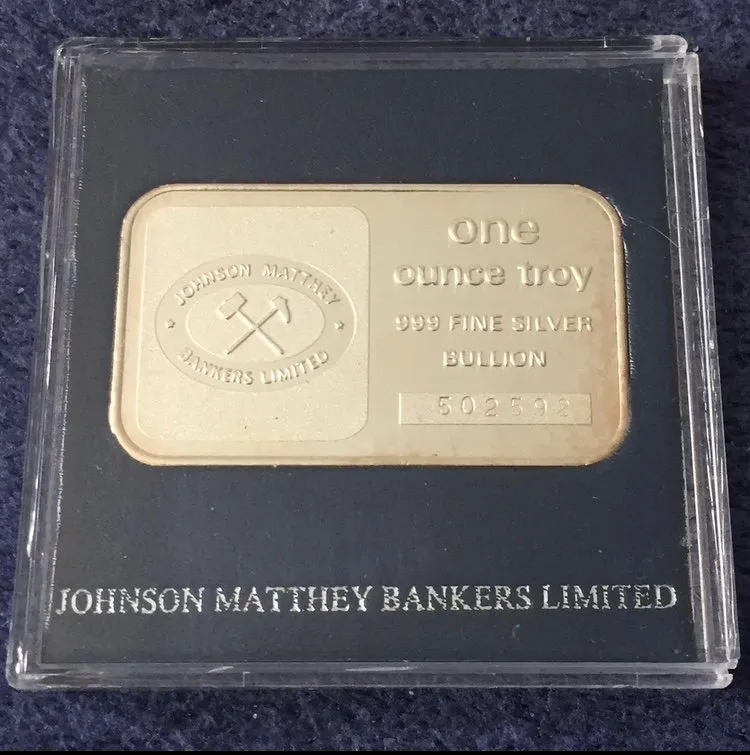

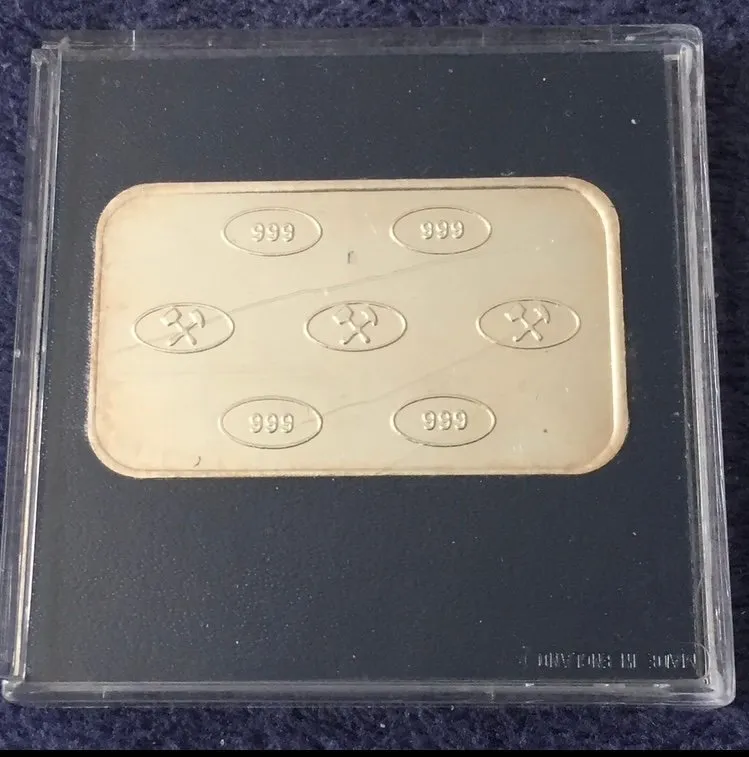

The bar is a Johnson Matthey “Bankers Limited” one ounce silver bar. It’s in its original case and is in pristine condition.

This is my bar, photos taken with my iPhone.

There are several websites that have information on Johnson Matthey and Engelhard bars out there. But the allengelhard.com website is by far the most informative and complete I’ve ever seen. If you are interested click on the link.

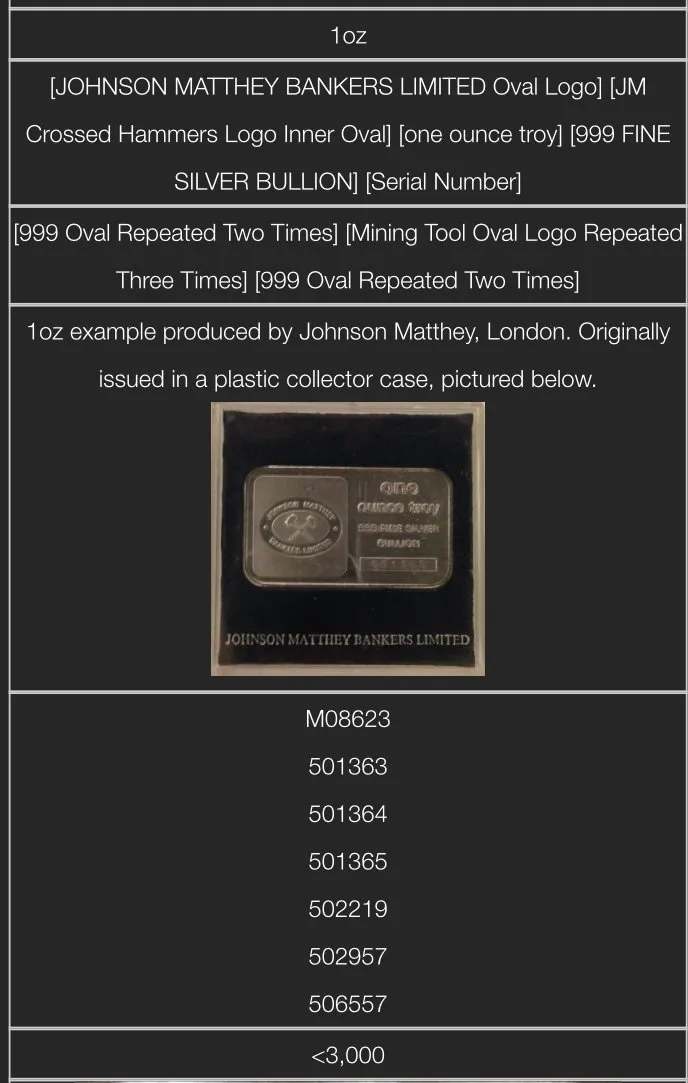

Here is a photo of the page pertaining to the bar I just shared with you from their website.

As you can read there were less than 3,000 of these minted. If we use the math of the experts. That would mean that less than 2,000 of these bars are still in existence.

I also checked a few auction sites. Great collection have not had any in their last six auctions. eBay does not currently have any up for auction, but they did have three sold in the last six months. The last was in February with a completed auction sale of $150.

this is the completed auction from eBay.

this is the completed auction from eBay.

So the bar sold for seven times its current spot value.

Would you rather have seven ounces or a piece of history?