The horse for the cart is the promise of basic income as a reward. The whitepaper draft from a month ago describes the "engine" as the "tendency to chase security",

more on that, From coercion to rewards, incentives up a level in the triune brain model

On "survival instinct game theory"

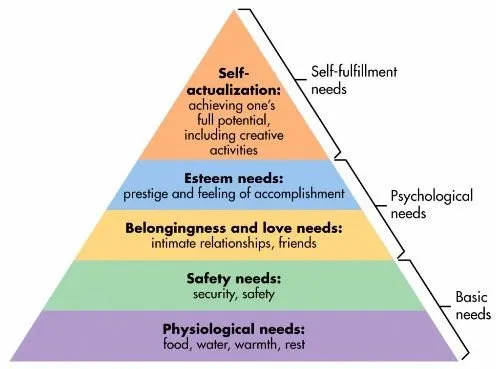

The "engine" of RES is that it runs on systemic biases which humans have, specifically the tendency to, when at the bottom of Maslows' hierarchy of needs, chase security.

If you look at pyramid schemes as "decentralized wealth transfer systems" that hijack the tendency to chase security (survival instincts), then that incentive is not only very successful, it is so successful that there is often legislation to try and prevent markets that run on Maslows' lower levels.

RES then uses "branching schemes", which are also decentralized wealth transfer systems, but in contrast to a pyramid scheme you are only connected to each branch for a short time, since your pathways decay as tax flows through them.

Systemic biases for irrational behavior as an "engine" and incentive in rule of law

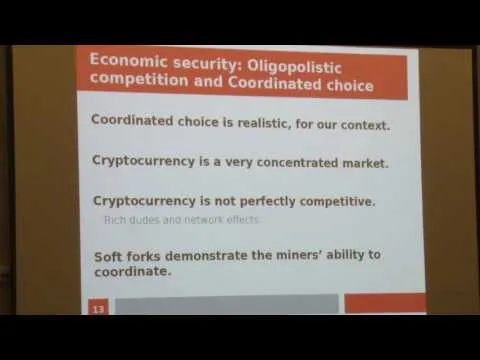

RES runs on systemic biases which human have, so that could be understood as "survival instinct game theory". Systems that run on those same incentives are pyramid schemes, ponzi schemes, and other markets that run on the tendency to chase security, an irrational behavior.

Universal basic income targets those irrational biases, and elevates people up Maslows' hierarchy of needs. The idea is then to use those survival instincts as an "engine", and to reward consumers with basic income. The RES currency would then, by attenuating survival biases, outcompete systems that run on those instincts, like pyramid schemes or ponzi schemes.

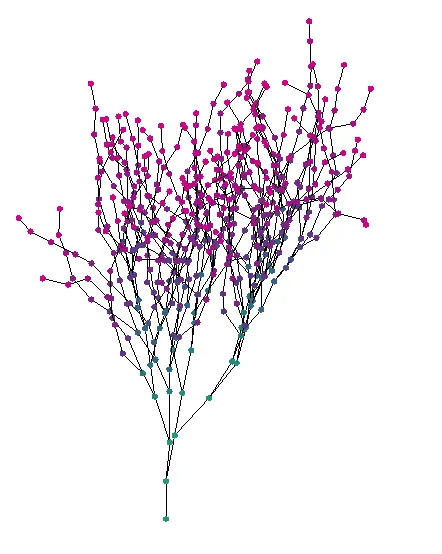

Linking transactions together into a web, the "transaction-web"

How it works is that when you transact with RES, you create a dividend pathway. These pathways link transactions together into "webs of consumption". They are ever-branching, and form temporary decentralized wealth transfer systems in a perpetuum mobile.

Look at "branching schemes" in the whitepaper draft for more details on what incentives are used under rule of law.

Transactions form branching schemes

When you pay Sam, you create a dividend pathway. When Sam then recieves transactions, part of that tax will flow via your pathway. When Sam makes transactions after the point in time where you made your payment to Sam, Sam will form dividend pathways that extend from him (pathways are time stamped and grow chronologically. ) Those Sam creates pathways to will then also grow new pathways that extend to them. These pathways, combined, grow a "branching scheme" that extends from your pathway.

The tax that is extracted with a "branching scheme" that extends from your pathway, flows back to you and also to those who have pathways to you. It is shared on every human within that decentralized wealth transfer system.

Your pathway decays with a rate of share = taxCollected / humans.length, the share you receive, and the decayRate increases exponentially over time, which balances the system so that those who turn over a lot more RES do not get a lot more pathways.

Pyramid schemes and ponzie schemes as a motif

RES shares the characteristics of a pyramid scheme in that pyramid schemes are "decentralized wealth transfer systems". If you think of Resilience as "decentralized wealth redistribution", then there is wealth transfer inherent to that.

One way to look at it is that technologies and systems which have been weaponized, can also be used for social good. Technology is a double edged sword, so you can use the technology of fire to cook food, and also to burn villages.

In the same way, you can use the instinct to chase security, and systemic biases which humans have and what could be called "survival instinct game theory" both to extort peope with ponzi schemes, and also potentially in a peaceful and positive way, for example in a "branching scheme".

Perpeetuum mobile "positive pyramid schemes"

RES shares the characteristics of a pyramid scheme in that pyramid schemes are "decentralized wealth transfer systems". If you think of Resilience as "decentralized wealth redistribution", then there is wealth transfer inherent to that. The idea of "positive pyramid schemes" was coined by Nathan Waters in one of his Futawe videos.

In contrast to a pyramid scheme, the pathways you produce, that link transactions together into a web, an idea which is a bit similar to Tim Berners-Lee's idea to link all documents on the internet together with the Hypertext Transfer Protocol (HTTP), which gave us the world wide web, those pathways decay when tax flows through them.

"branching schemes" are then transient, your pathway only connects to the branching scheme that grows from it for a limited amount of "decentralized wealth transfer".

This co-opting of survival instincts as an incentive is described in detail under "branching scemes" in the whitepaper draft from last month.

There is also an agent based model on agentbase.org that simulates swarm redistribution.

Risk/reward ration and the arrow of time

So in a pyramid scheme the first people to use it are the gainers and the later are the suckers. With RES, that risk/reward system is sped up across the arrow of time, so that each transaction you make with RES, say a payment to Sam, produces a transient, compressed pyramid-scheme-like "branching scheme".

RES could be compared to Ethereums' Casper, which is similar to proof-of-stake like what is already used by some systems, but sped up along the arrow of time, so that all the risks and rewards are compressed into shorter time spans.

Decentralized systems and abandoning the use of enforcement by a monopoly on violence

It's a market based system, not enforced by a monopoly on violence, so it competes with other markets and currencies.

In general, it would succeed if it benefits an economy. So, universal basic income decreases systemic biases which human have for irrational decision making, and improves the economy in that way, and there may be a selective pressure in favor of RES for that reason.

From rational choice theory to "survival instinct game theory"

The prisoners dilemma is a standard example of a game analyzed in game theory that shows how two completely rational individuals would act, what is called rational choice theory. In reality, humans display systemic biases, what could be called "survival instinct game theory".