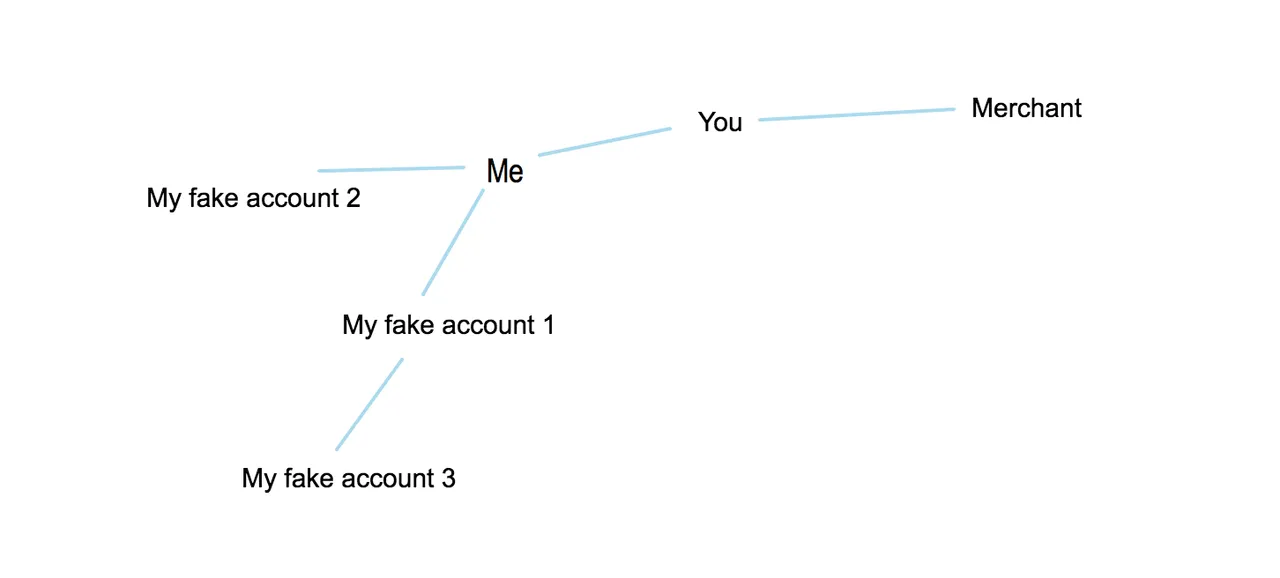

Me, who has received IOUs from her three fake accounts, has issued an IOU to You, and You has issued an IOU to Merchant. These IOUs produced dividend pathways, which are used in Swarm Redistribution that decays debt using transaction pathways.

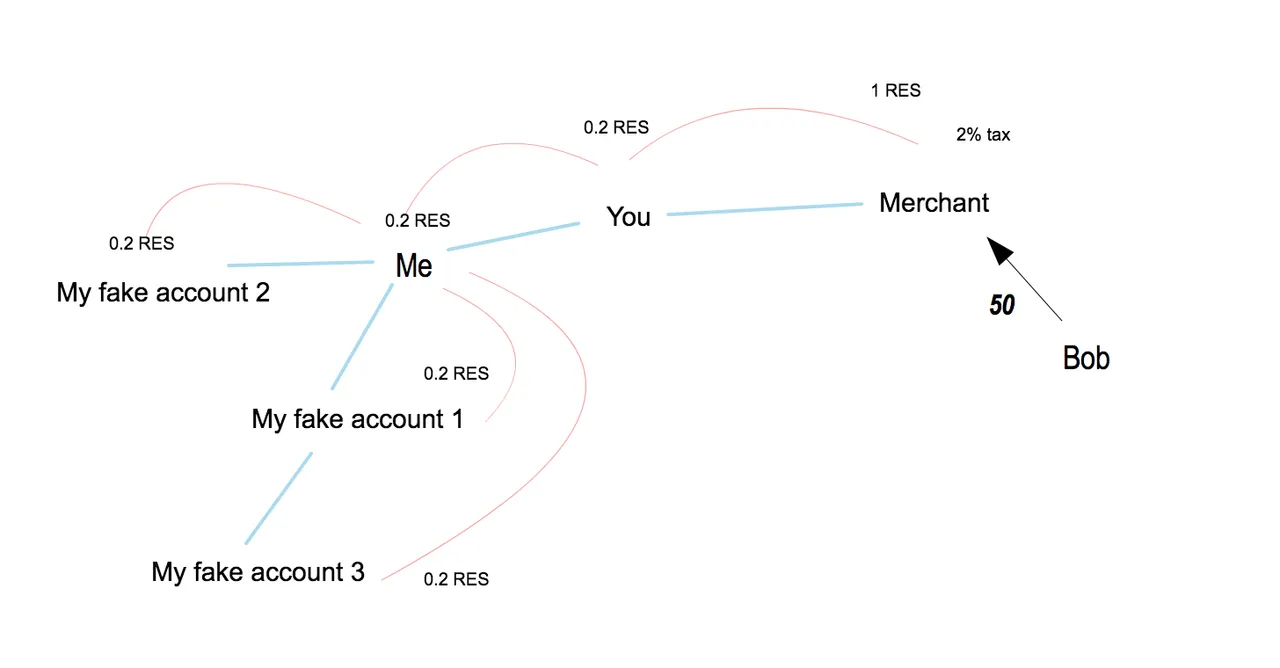

When Bob makes a payment and issues an IOU for 50 RES to Merchant, a small amount is taxed, in this example 2%, and sent for Swarm Redistribution.

The SR algorithm forgives debt, it is balanced to forgive debt up to a basic income per month. To prevent sybil attacks, it redistributes debt P2P, so any fake debt from scam accounts is circular and local to those accounts.

The credit lines for the IOUs that created the dividend pathways are during Swarm Redistribution decayed (dividend pathways are the credit lines.)

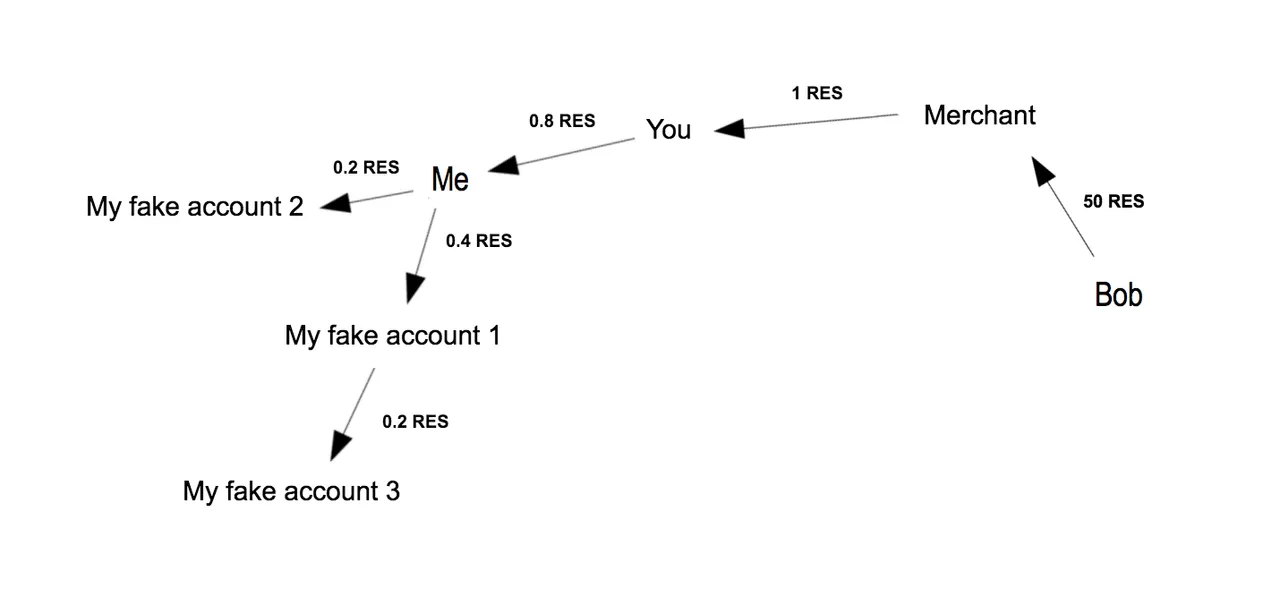

Who pays the price for scammers ?

In that example, the cost of letting the scammer Me into the trust network is on You, who has extended trust to Me. You would be giving away 0.3 RES, the amount that Me managed to scam, and so would have less IOUs from Me to redeem.

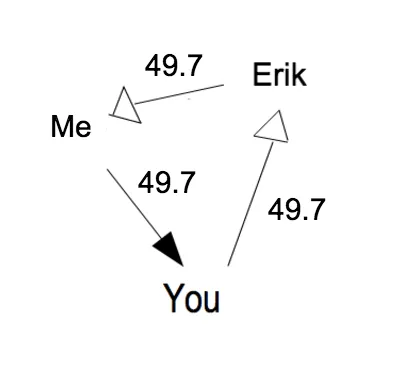

If the credit line and dividend pathway between Me and You was 50 RES, and I scammed you off an extra 0.3 RES, then you would only be able to redeem 49.7 RES via for example a transaction with Erik.