Data Center REITs are amongst the best investments that you've probably never heard of. I highly recommend adding them to your stock market portfolio. In this post, I will be analyzing one such Global Data Center REIT known as Digital Realty (NYSE: DLR). Please note that I am pulling the infographics below from Digital Realty's May 2018 Investor Presentation which you can access in their Investor Relations Site.

Overview

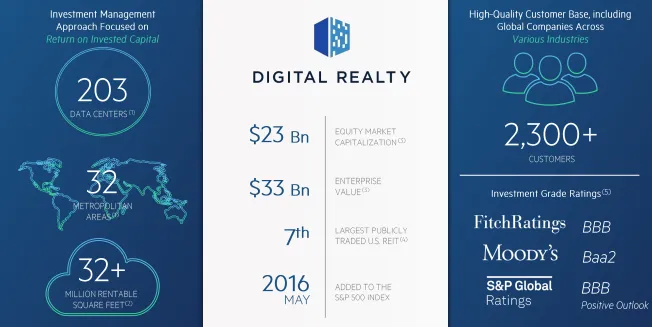

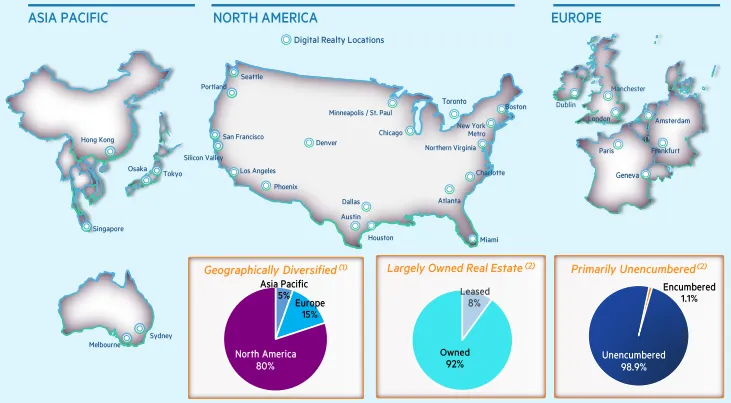

Digital Realty has 203 Data Centers around the world and spans North America, AsiaPac & Europe with 80% of its Data Centers in North America and 92% of its properties owned vs 8% leased. It has a Market Cap of $23 Billion and is among the top 10 largest publicly traded US REITs.

Financials

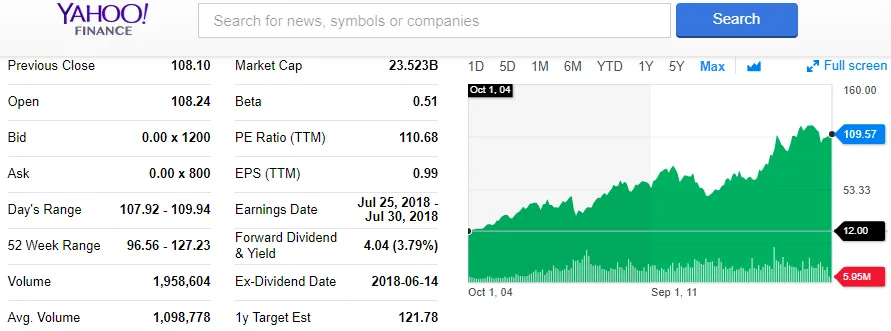

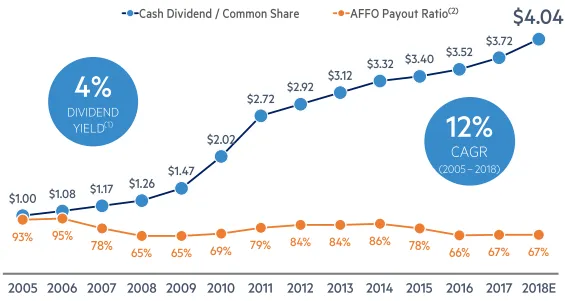

DLR is trading at around $110 and has come a long way from its establishment in 2004 where it started trading at around $12 a share. I believe Digital Realty has a really good story and that its value will continue to grow for shareholders because it is at the forefront of the digital transformation trend which we will see drive growth in the tech sector in the next decade. It's cash dividend has a 4% yield and its dividends have had a 12% Compound Annual Growth Rate since 2005.

Digital Transformation & Drivers

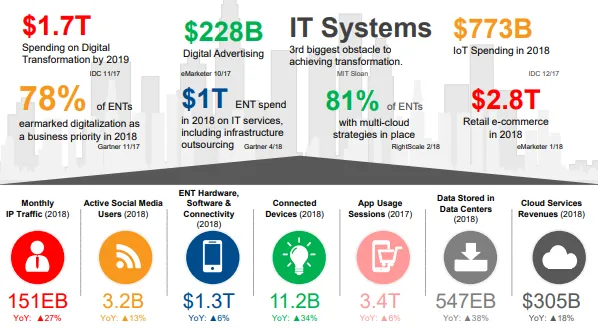

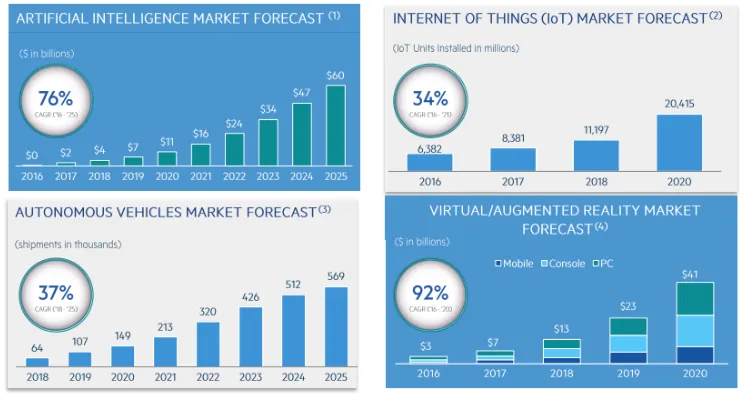

Because of the growth of the digital landscape in the last decade, DLR has seen its business grow significantly in the last decade servicing cloud to a variety of partners and offering colocation and interconnectivity via its data centers. Please have a look at near-term trends in IT, Cloud, IP Traffic, Social/Digital Media Usage, the Internet of Things (IoT), Artificial Intelligence (AI) and Virtual/Augmented Reality (VR/AR) delineated in the infographics above. These are high growth hotbeds that are disrupting and will disrupt every industry and company.

Foundation for Increasing Cloud Demand

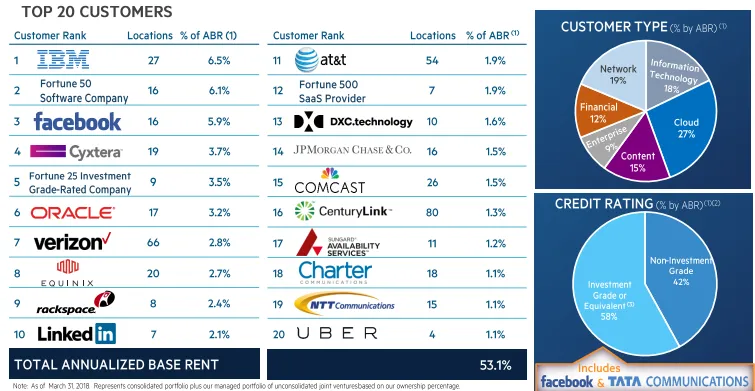

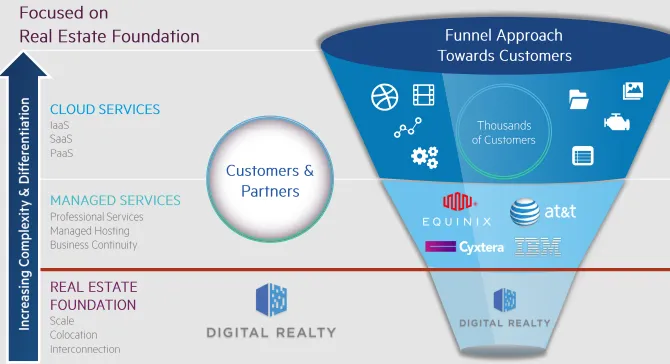

In my view, DLR is not only a relatively high growth REIT but it also relatively risk-free. DLR is at the foundation of the Digital Economy because of the nature of its very business. Major corporate clients such as IBM, Facebook, Oracle, AT&T & JPMorgan in a variety of industries from IT to Financial Services & Telecom rely on DLR's data centers for cloud services. The major theme of the economy in which we live in today's information overload world is data. But instead of competing in the data economy DLR services it and serves as the backbone by servicing Cloud computing and storage services. It is at the base of the funnel which has given us companies like Facebook, Netflix and Uber and that's what makes this REIT such an interesting company and investment. Regardless of what happens at the end of the funnel, in today's Big Data world, companies will always need cloud storage solutions such as Colocation and DLR has the Real Estate & Data Center Expertise to provide at the base of the funnel.

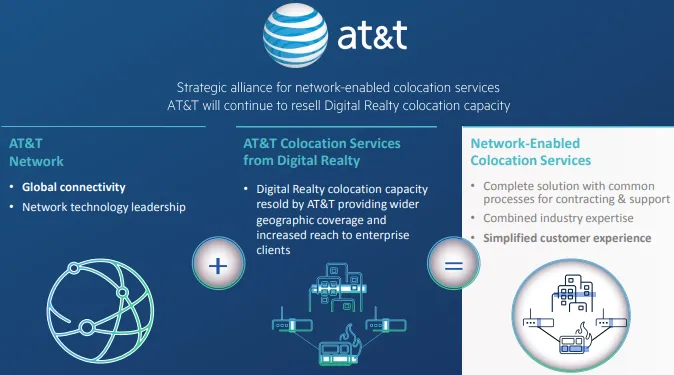

Strategic Partnership with AT&T