Quoine’s Liquid platform is a financial utility that will benefit the entire crypto economy. Quoine, believe the crypto token economy will become the future of the financial world and liquidity lies at the heart of this transformation.

Website: https://liquid.plus/#home

Whitepaper download: https://liquid.plus/quoine-liquid_v1.3.pdf

The Project Overview

The Company

Quoine is a global fintech company that provides trading, exchange, and financial services powered by Blockchain technology. They have offices in Japan, Singapore and Vietnam.

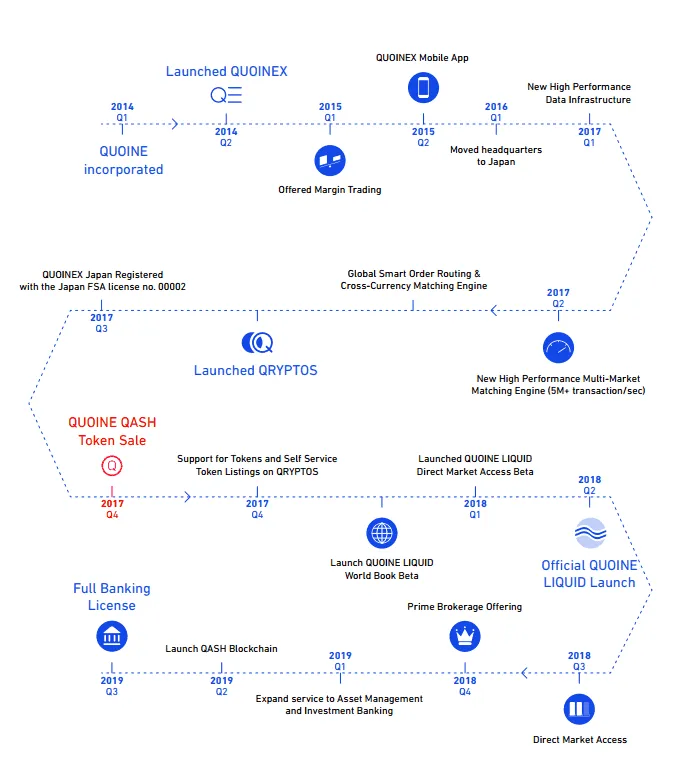

Quoine’s timeline of notable events:

- In 2014, Quoine launched Quoine’s exchange, now known as ‘QUOINEX’. Quoinex provides trading services for bitcoin and fiat currency pairs in numerous currencies. Quoine had raised $2 million from angel investors in December 2014.

- June 2016, Quoine raised $20 million from institutional and angel investors. Funds were earmarked to assist in Quoine’s relocation of its headquarters to Japan and further growing out it’s team. This was for preparation for the steps the Japaense FSA were taking to bring regulation into domestic digital currency exchanges.

- June 2017, Quoine launched a fully digital cryptocurrency exchange and trading platform called QRYPTOS, exclusively for cryptocurrency trading in desktop version at qryptos.com.

- September 2017, Quoine Corporation became the first global cryptocurrency exchange to be officially licensed by the Japanese FSA.

- October 2017, Quoine announced proposals for their platform LIQUID which aims to bring liquidity into the global cryptocurrency marketplace alongside details of it’s planned token generation event/ICO

The Idea

Liquid’s fundamental objective is to provide a “World Book” of orders for any unit of value that exists including all popular cryptocurrencies, national currencies, and blockchain assets allowing for a continuous supply of liquidity capital within its ecosystem. In the process, this will allow anybody to tap into all the opportunities the new Crypto economy has to offer. This means lenders and traders can seamlessly interact without liquidity issues due to supply and demand.

The World Book takes a trader’s order in any unit and draws on a global pool of available trading liquidity. It does this by combining all exchange liquidity sources behind the scenes and matching them on its front-end, the “Prime Brokerage”.

The Liquid platform aims to bring together a network of global cryptocurrency exchanges and making them accessible to everybody. By having access to all the major reputable exchanges worldwide, Liquid’s platform will be able to provide a suite of trading services to individual and institutional investors alike — as well as to token Issuers and token holders.

Quoine believe their services will have a much greater impact when combined with Prime Brokerage, Fiat Management Services, and sophisticated reporting tools. Core product development of the platform has already completed. The focus currently rests on scaling existing operations for the embedding of the Liquid platform into the existing infrastructure in ready for initial launch in Q2 2018. To fund this ambitious project, Quoine are launching an initial coin offering (ICO) in November 2017.

The Roadmap

By Q2 2019, Quoine plan to have their own blockchain (QASH Blockchain) that will have specific financial industry requirements already built in. Currently, none of the existing blockchains (including Ethereum) offer sophisticated tools to build any meaningful or scalable financial services on top of their blockchains (other than basic services such as payments and transfers).

The Team

Quoine have assembled a very strong team with over 250 years of combined experience in Finance and Technology. There is evidence of proven track record in Forex IT, Forex Trading, Algos, Equity Trading Systems, and FICC (Fixed Income, Currencies, and Commodities) — all combined with expertise in Internet and mobile technology.

CEO Mike Kayamori has significant experience in the financial sector having worked for Softbank in the past. Co-founder Mario Lozada resumes include employment at Credit Suisse and Merrill Lynch in Japan (for 13 years). CFO Katsuya Konno was at Softbank for 8 years, CSO Ray Hennessey also worked at Merrill Lynch with almost 30 years experience in financial services. Further employment history can be located via the liquid website with links to the individuals LinkedIn profiles.

Key Team personnel

Mike Kayamori — Co founder and CEO

Mario Gomez Lozada — Co founder & President and CTO

Katsuya Konno — CFO

Ray Hennessey — Chief Strategy Officer

Andre Pemmelaar — Chief Trading Officer

Ken Mazzio — Chief Compliance & Information Security Officer

Seth Melamed — SVP of Operations

Katherine Ng — Head of Marketing

Pavel Pekanov — Creative Director

The Token Generation Event

The QASH token can be used for all services provided by the Quoine Liquid platform, Quoinex, and Qryptos. In addition, Quoine is in discussions with multiple financial services and fintech partners to make QASH their token of choice. Quoine boldly envision QASH to be the preferred payment token for financial services, essentially being the Bitcoin or Ethereum of the financial world.

Initial Coin Offering (ICO)

The QASH Token Sale date begins on 6 November and targeting a contribution of 500,000ETH ($150,000,000) to build liquidity; to fund product development, operations, legal and compliance requirements.

Token code: QASH

Total Token Supply: 1,000,000,000

Token availability: 500,000,000 (50% of supply) = $150,000,000

Minimum capital to Raise: 50,000,000 QASH = $15,000,000

Minimum investment: 500 QASH = 0.5 ETH

Public Presale 6th Nov: Discount: 20%

Public Sale 9th Nov: Discount: 10%

Public Sale 12th-30th Nov: No discount

Registration and KYC: Yes

Exchanges: Bitfinex, Qryptos, Quoinex

Token Release: TBC

Based on the information above, if the project were to raise the maximum target of $150,000,000 (50% of total supply), this would value the company at $300,000,000 (diluted) market capitalisation. This would automatically put Liquid into the 25 of the cryptocurrency market capitalisations.

The Community

Subscribers/followers as of 23rd October 2017…

Twitter: 1310 followers

Telegram: 1158 members

Facebook: 3135 following

Assessment

Positive Factors

Quoine’s proposal of a global liquidity platform (through it’s LIQUID platform) could help bring much needed liquidity in the rapidly growing crypto economy. The project is certainly significant enough in scale to have a huge impact on how crypto currencies are traded. The ambition of this project is certainly exciting and also an example of the disruptive potential of Blockchain technology.

By linking up cryptocurrency trading exchanges under the Liquid platform alongside prime brokerages, the potential to bring much tighter spread and seamless liquidity should provide improved efficiency for traders and counter-parties alike. This will in turn will curb issues such as market manipulation, delayed transactions, high trading spread/transaction costs and even concerns around security such as hacking which is forever a looming issue.

The QASH token will be pushed as the main form of trading on the Liquid platform and ultimately serves as a utility token of choice for all counter-parties on the liquid platform. With the scale of the liquidity problem, demand for QUOINE’s services could have great potential to increase along with the value of QASH.

Another key factor that helps this project is the Japanese connection. Japan has largely embraced the crypto economy having recently announced the intention to licence Crypto currency exchanges. Quoine’s ‘Quoinex’, is one of the first licensed crypto-currency exchanges in the world, fully compliant to standards set by the Japanese Financial Services Agency (JFSA). Quoine’s QASH token will be recognised as a legal crypto currency much like bitcoin and ethereum is. All this provides again for significant upside potential for the project.

We have seen a barrage of new projects/ICO’s launch which emphasise the rate by which Blockchain and Crypto currency space has grown. However, we have also seen many fall foul and disappear by the wayside. A lot of this is prominently due to only having whitepaper idea(s) without a product/prototype in place. Quoine have a core product in place, established in 2014, with 2 actively trading exchanges across the Asian markets. This is important as this provides confidence that there is a functioning operation in place which has been successful in its past implementation.

For me the biggest factor and key to the future success of this project is the team. On paper, this team is of a high calibre, with great experiences, past successes and one that appears to have great influence within the financial service space. By bringing this talent together and coupled with bright product/backend developers, we certainly can say there is a recipe for success. I believe there should be very little doubt on the ability of delivering a liquidity platform in view of the Quoine team, the advisors and the investors/backers of the project.

There are a number of large investors backing Quoine but none more so than Taizo Son, the elusive billionaire and brother of Softbank CEO Mayayoshi Son, Japans richest man. Quoine’s backers and investors are major advocates of crypto/blockchain technology, fintech and finacial services regulation. many of which had served as senior executives and board members at Asia’s largest firms, such as Yahoo, Paypal and Rakuten.

What is important now leading up to the ICO is for Quoine to build those affiliations and partnerships that will bring wide adoption of the Liquid platform. By making those announcements now (prior to ICO) it will give them the best chance to help raise that ‘huge’ fundraising cap of $150 million which will help the Liquid platform off its feet.

Since my initial review, Quoine had been very (very) active and made a number of key announcements and partnerships.

Quoine announced a partnership with Bitfinex which is one of the largest cryptocurrency exchanges globally. A key feature of the partnership is that Bitfinex will support the QASH Token Sale by listing the QASH on its exchanges.

ANX Pro/ANX international (Hong Kong based technology company) to partner on the Liquid platform.

Partnered with Blockwave (a Canadian Fintech startup) to assist in bringing a cryptocurrency exchange before 2017 to the North American market.

CEO Mike Kayamori recently stated in a Bloomberg report that they are talking to a number of Chinese exchanges and expect make a few further partnership announcements by the end of the year. The ‘peoples republic’ banned ICO’s and required all exchanges to close down. This has had a huge impact in the space and by default shut off one of the biggest economies in the Crypto space until further notice. “We’re talking to almost all of the guys. They’re all desperate now.”

In addition, Quoine have recently announced a number of additional listings on their Quoinex and Qryptos exchanges. Dash, QTUM , Storj, Stox and OAX. It is expected many more are to join the ranks soon. This is very positive and will further draw attention and volume to its exchanges. Traders will likely follow suit and this further means the Liquid concept will become needed to provide liquidity higher trades/volume. This is vey exciting for the potential growth of both the Liquid platform for investors and the overall Crypto Currency market in general.

Apart from the fundraising goal of $150 million, the token metrics seem very favourable. In addition there was no private presale before the public sale which is positive news for all ICO investors as there is unlikely to be immediate price manipulation/suppression once tokens hit exchanges. There are also bonuses of 20% and 10% available to early public sale investors. I believe these metrics are favourable for long term investors. With current Ether price at approx $300, per ether provides 1000 QASH tokens which equates to $0.30 (or £0.22p) excluding bonuses.

Some Concerns

There are a few other concerns, which based on the research I have conducted, tempers the grade scale of the proposed project.

The level of capital they wish to raise? $150million is a significant sum of money and is always a concern with investors, particularly with recent bad publicity highlighted with past projects such as Tezos raising such huge sums but projects post ICO falling into turmoil. For this reason it is quite possible that Quoine may fall short of achieving the level of funding they desire in the current climate as investors become more wary of the marketplace. Current markets conditions hugely impacted by investor sentiment and the dramas around Bitcoin (hardforks).

Competition within the space will likely appear sooner than later. Currently Bancor are quite prominent in the space although may not be deemed a direct competitor. A more likely competitor is Omega One which is having it’s ICO not too soon after Quoine. The scale of Liquid project is big but may not be universally appealing/adopted as will be heavily reliant on rapid partnerships to gain first mover traction. However, they could achieve a stranglehold of the Asian marketplace considering its location particularly with its pro-crypto stance.

There has evidently been a lack of ‘hype’ around its ICO in the crypto space. The project has appeared to not received the recognition from prominent crypto enthusiasts which has commonly impacted the success of ICO’s in recent times. This can also be partly attributed to the low key level of marketing that has been conducted by Quoine. However, activity has increased most notably via facebook, twitter, steemit and telegram. The hype on the project from other medium’s (such as youtube) has been low. I believe the value of the project may have been misunderstood and clouded by the judgement of the ICO metrics and most notably the fundraising cap.

As outlined, at this stage it is unlikely they will reach the $150 million desired fundraising. However, Quoine claim to have strong institutional support which could go some way to raising a high level of funding required for the project to really take off.

ICO Rating

The key aspects of an ICO when considering it as a potential investment rests in key areas known as the Key Value Measures (KVM). These measures have proven to be fundamental factors in analysing the potential success of an ICO both in the short term and long term. Refer to ratings criteria explained at end of review.

Key Value Measure (KVM) Grading

• Concept Value: (4.8)

• Development Value: (4.8)

• Blockchain Value: (4.8)

• Management Value: (4.9)

• Marketing Value: (3.5)

• ICO Value: (3.8)

Liquid’s overall score is 88% and a Buy.

ICO Return on Investment (ROI)

• Short term ROI: Low

• Long term ROI: High

• Risk Grading: Low

• Interest/Demand: Low

Rating Summary

Overall, Liquid have a very ambitious yet purposeful project which on paper could dramatically change the financial landscape for crypto currency. Their Liquid platform could scale the value of the crypto/blockchain new heights which would concurrently elevate the adoption of crypto by both traders and investors. In turn this would enhance the value of the Liquid platform and investors into QASH in it during the long term as its grows. Those who look at investments and considering fundamental value for long term growth, then Liquid for me delivers this quite strongly. There is a favourable bonus of 20% from the 6th November during the public presale for this to take advantage of.

However, there has been very little hype around the project which has have been primarily because of the high fundraising goal of $150 million (ICO KVM) which has been a deterrent to many investors coupled with current weak market sentiment towards ICO’s. This suggests the ICO may not deliver at the earlier stages of its birth. Therefore, a small position at ICO could be taken or waiting until the tokens hit the exchanges may be the course of action to take for those unsure of the current market and how ICO’s will perform on exchanges upon availability.

For those considering investing in Liquid’s ICO, there are additional registration requirements which can located on the Liquid website. Individual must open an account with Quoine’s trading platform Qryptos. KYC procedures will be conducted for registration during this process. Quoine outline this is a security measure to prevent cyber attacks and hacks during the ICO which has been somewhat endemic of some recent ICO’s. The ICO will be conducted through the exchange and QASH will be available to purchase from funds deposited prior to sale from the individuals QRYPTOS account.

END

If you have reached the end then thank you for getting through this review. I will be posting further ICO reviews on projects that interest me for the time being.

These include:

Wabi

LeverJ

Omega One

Blockstack

I will have a website launching soon with invaluable info on all things cryptocurrency and ICO’s.

You can follow me on twitter (@mycryptoworks) where I try to be regularly active.

Constructive feedback would be much appreciated.

Regards,

This was an independant review and I received no incentives for my work from Quoine or any any other associated parties involved in their ICO.