I thought Sydney real estate was overpriced back in 2013, when the median house price was 8 times the average annual income. Now the house price to income ratio is above 12 to one in Sydney, and nearly as high in Melbourne. With more cracks appearing in the housing market, 2018 may shape up to be a less than stellar year for Aussie property investors.

Key Property Market Highlights:

- Sydney home prices are expected to decline by 10 percent in 2018.

- Banks are starting to force some investors to pay back principal sooner than expected.

- Politicians are arguing again over investor tax concessions, reminding us that negative gearing and the capital gains tax discount may soon be on the chopping block.

The Latest Auction Activity

The property market in Australia grinds to a halt for about three or four weeks each year, from Christmas until around the third week of January. Expect no auction market data until the end of this month.

Recent Changes in House Prices

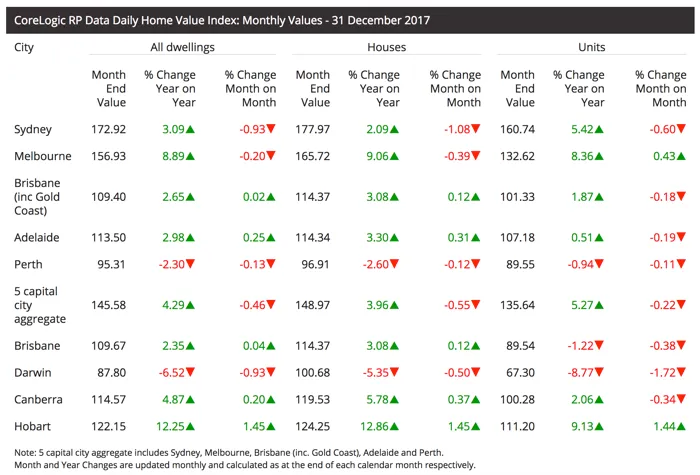

Sydney home prices have fallen for a fourth consecutive month. Over December, the median house price dropped nearly 1 percent. That brings annual growth for the 2017 calendar year to a measly 3 percent, barely higher than inflation.

Even in Melbourne, where demand has until recently remained relatively strong, the median house price moved backwards.

Unit prices declined over the month of December in every capital city except Melbourne and Hobart. Sydney saw the greatest decline.

source

Recent Property Market News

Sydney home prices are expected to fall 10 percent in 2018.

After double-digit growth for each of the past four years, even the traditionally bullish analysts expect home prices to fall in Sydney over the next year.

From my perspective, if all we see is a 10 percent pullback in 20187, I’d say it was a good year. I’ve encouraged my clients holding investment properties in Sydney to sell. Some have listened, others are afraid that prices will continue to rise, then they would be “locked out of the market.”

20,000 property club members just got shafted by the banks.

As I’ve written about before, most Australian property investors take out interest-only home loans when they buy a property. They expect the value of the property to perpetually increase, so why bother paying back any principal. Besides, on an interest-only loan, the payments are lower, so you can afford to buy a more expensive property.

The problem is not only that sometimes real estate goes down in value (a fact that many Aussie investors fail to acknowledge), but sometimes the banks change the rules in the middle of the game.

Members of the largest property investing club in the country recently learned this the hard way. The banks have switched them over from interest-only loans to principal-and-interest mortgages earlier than they had expected. Some of them have seen their loan repayments increase by as much as 45 percent.

That will sure put a dent in your cash flow!

Start waving goodbye to one of the primary drivers of demand for property investors.

The Labor Party is the predominant left-wing political party here in Australia. They like to come across as if they are identifying with the little people – the “hard working Australians.” They talk a lot about the unaffordability of housing, and have promised in the past to tinker with investor tax concessions if/when they come into power. Their aim is to even the playing field; to tip the scales of power a little more from the have’s to the have-not’s.

If the Labor party can convince voters to give them a shot, we’ll see a large segment of demand leave the housing market as tax benefits are a primary justification for cash flow losses in real estate.

What do you think? Where do you see Aussie home prices going in 2018?

Jason Staggers