Aave is an open source and non-custodial liquidity protocol for earning interest on deposits and borrowing assets. The Aave ecosystem is powered by the AAVE ERC-20 token and is organized as a decentralized non-custodial money market protocol. The AAVE token registered the all time high on the 10th of February 2021, at $575.15.

Everyone can use the Aave network to provide or borrow assets. The providers will earn passive income while the borrowers will receive crypto assets and will ay a variable interest rate in exchange.

Bityard Contract Trading

Bityard is the world leading cryptocurrency derivatives exchange specialized in cryptocurrency contracts with leverage and derivatives exchange. Bityard is fully regulated and compliant with all the international laws related to cryptocurrency trading.

The contract trading is the method of trading that aims to gain profit from market volatility. This method allows the user to forecast if the price of an asset will go up or down, involving leverage. This method of trading involves a certain level of financial knowledge and skills. I am an ex compulsive gambler but playing with derivatives and crypto is still a bit different, as knowledge can compensate bad luck.

The traders are not buying or selling the asset, only speculating the price and forecasting if the value will go up or down. Contract trading can bring profit quicker than holding assets but the risk involved with this type of trading is higher. Bityard has two different types of Contract Trading: Cryptocurrencies and Derivatives.

The Contract trading is different from spot trading. The trading instrument called contract allows the investor to trade on the price movement of the cryptocurrency, at a future date or and at the desired price.

It involves leverage and therefore the traders are not buying or selling the asset, only speculating on the price movement. With a trading fee set at 0.05%, Bityard has trading fees lower than the industry's average.

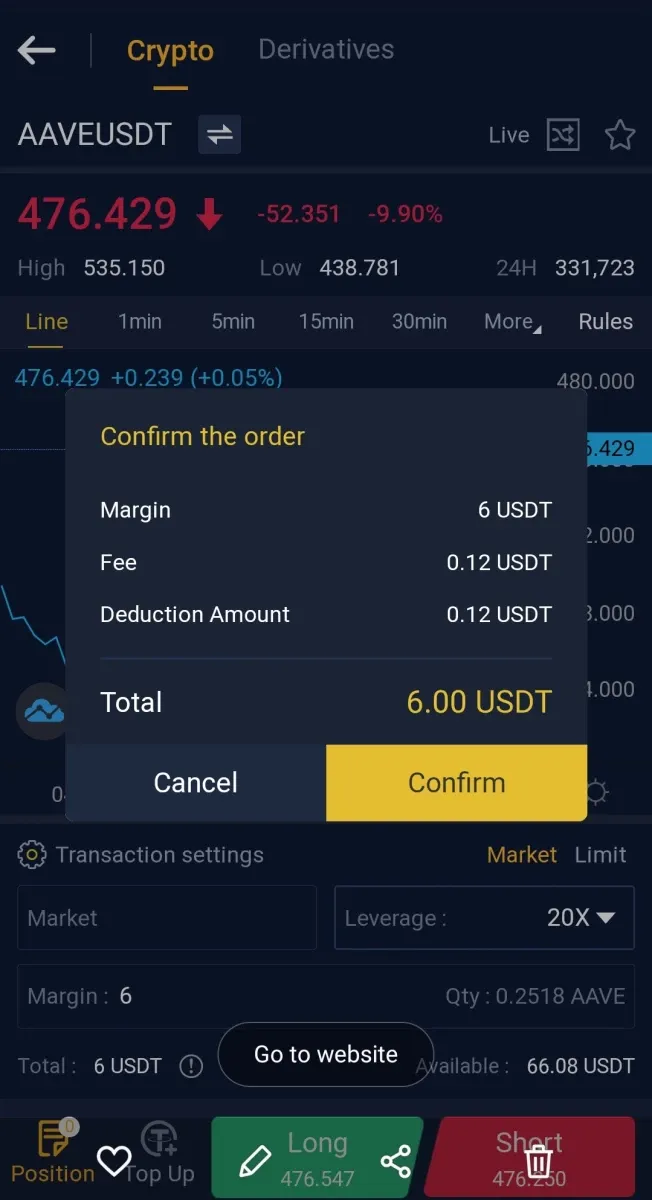

In the below scenario, I am forecasting that the AAVE price will go upwards and I selected the "Long" scenario. Clicking the “Long” button will open the contract, at the current value of $476.249 per AAVE. The value must grow in order to generate profit.

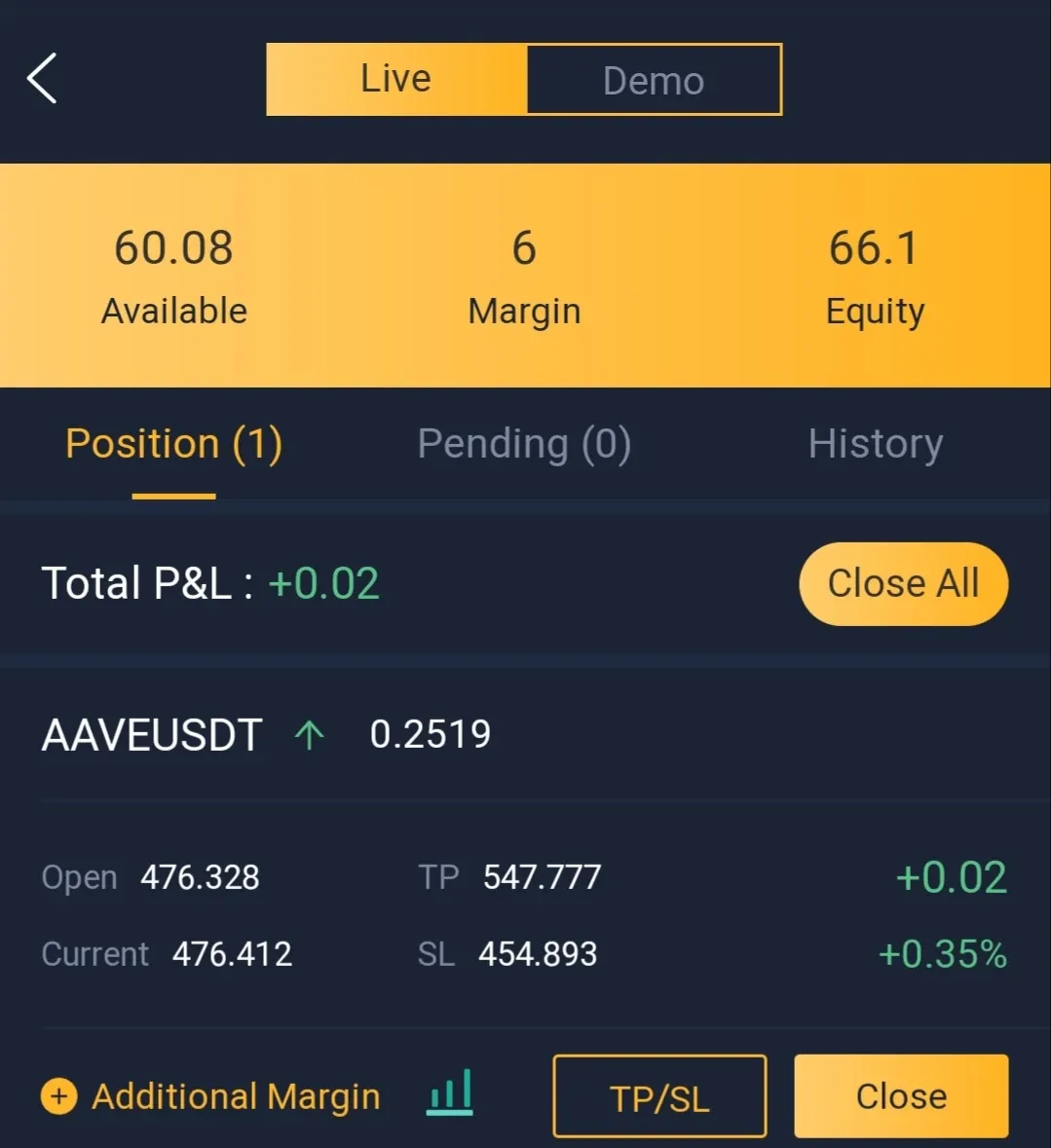

For this transaction I set the leverage at 20x, using 6 USDT to pay for the contract. The 0.05% fee was added to the order. After the confirmation, the AAVE contract will appear in the bottom of the dashboard, under the “Positions” tab. The contract details will include all the useful details, such as the name of the cryptocurrency, the leverage, the chosen margin, opening price and opening time.

The contract will close automatically if the price will raise or drop at the set value, or it can be closed by the user at any time. Closing the contract manually is a method that can bring profit when the value is close to the set value and the price stops moving. Closing the contract will bring a smaller profit but will reduce time wasting and stress due to volatility.

The AAVE price started to grow after I placed the contract and profit was generated. As the price variation was going in my favour, I decided to wait.

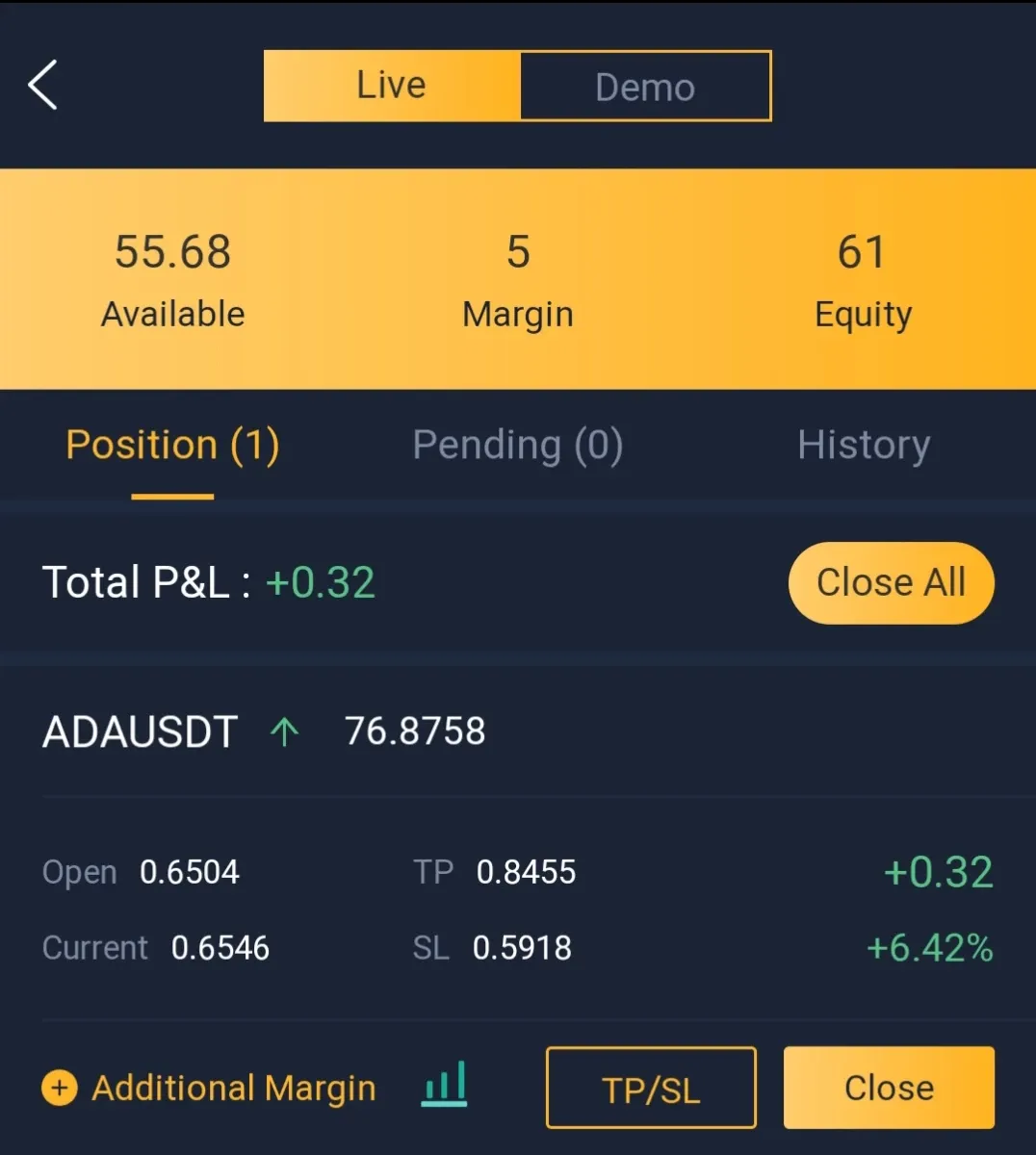

I closed the contract manually, for 6.42% profit. This provided $0.32 above the amount used to open the contract, which was added in the wallet automatically.

Why Bityard is different?

Bityard operates with licenses from USA, Australia, Singapore and Estonia. All the accreditations and licenses are a guarantee of Bityards high standards and enhanced level of security. The following licenses are regulating the exchange activity: the Singapore’s ACRA (Accounting and Corporate Regulatory Authority), The American Money Services Businesses (MSBs), Estonia’s MTR (Register of Economic Activity) for the European Union, and the Australian Transaction Reports and Analysis Centre (AUSTRAC).

I am using Bityard for educational training and to test how contract trading works. I like it because the whole platform is user-friendly and easy to use. I can print-screen or record my work easily while on the mobile app.

Resources:

The fountains: PipeFlare ZCash, GlobalHive ZCash & Get.ZEN

Publishing bundle: Publish0x, ReadCash, LBRY & Presearch

- This article may have been published on ReadCash or Publish0X