Primexbt covesting essential tips for you !

One of the most important steps that every Follower takes is choosing which Strategies to Follow. Here are some essential tips, which when considered and applied together, may assist Followers with choosing Strategies that best suit their risk tolerance, profit goals and more

Look for time-proven Strategies with the help of the ‘Active Days’ indicator

‘Active days’ reflects the amount of days a Strategy has been active for:

While the activity duration of a Strategy does not necessarily reflect its level of success, a Strategy that has stood the test of time will reflect more extensive information about its profitability trends and profitability history. A good indicator to take into account when searching for reliable Strategies.

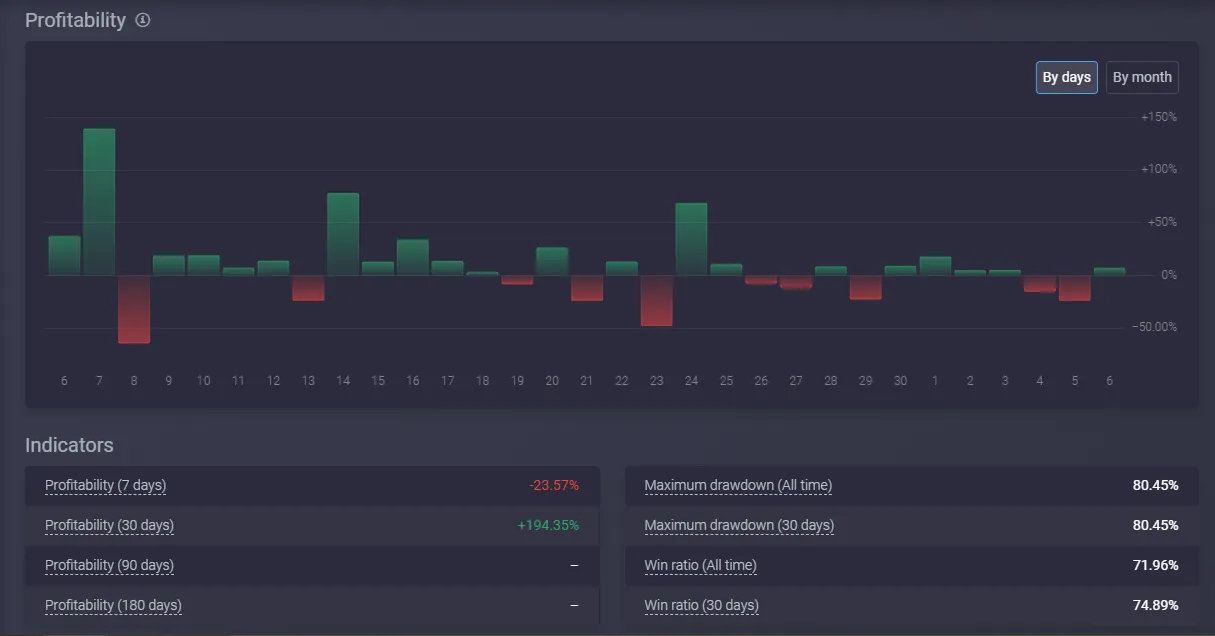

Take into account a Strategy’s profit charts, profitability, Equity stats to determine its profitability trends, growth and ROI potential

Profit charts and profit statistics of a Strategy reflect its profitability trends and the overall trading success of the Strategy:

It is important to keep in mind that newly created Strategies (i.e with a low ‘Active days’ indicator) with high profitability may often employ high-risk/high-reward trading techniques. While this may quickly bring these traders to the top of the leaderboards in the case of their success, such Strategies may not be suited for Followers looking for a more steady and stable ROI with low risk.

On the other hand, a consistent and steady growth of a Strategy’s return on investment over a long period of time, can be a strong indicator of a Strategy with viable trading techniques and effective risk management. Definitely something to consider for those looking for a stable ROI.

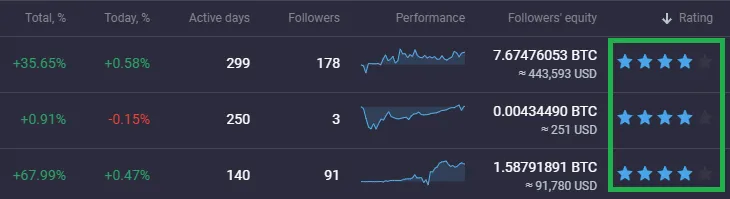

A manager’s personal Equity as an indicator of their commitment to the success of their Strategy

Another key factor worth considering is a Strategy manager’s personal Equity. Strategies in which the manager holds a minimum of 0.5 BTC in equity are awarded one star (see 5-star rating description below). This indicator ensures that such Strategies are more seriously committed to the capital at stake. In other words – the more personal Equity a manager has allocated toward their Strategy, the more committed they will be to utilizing low risk trading techniques and proper risk management to ensure that their Strategy is successful.

Monitor margin chart metrics for risk aversion and capital protection

When choosing a Strategy from a margin risk point of view, one should always consider a Strategy’s margin metrics chart:

The ‘Margin’ chart reflects a manager’s Margin usage statistics at any given point in time. Something worth taking into account when reviewing a Strategy’s margin metrics:

Green values on the chart mean margin usage was less than 40%

Yellow values designate periods of more aggressive margin usage between 40% to 70%

Red values alert about a very risky trading style with more than 70% or more of margin used

Utilizing a large share of a trader’s margin implies the use of very-high risk trading techniques which may lead to large losses sooner or later. When positions go against a trader any available margin is utilized until the unrealized loss exceeds available margin, after which all positions are automatically liquidated. The more margin is allocated towards opening a trade, the more risk the trader takes that liquidation will occur should the market move against them.

For those with a low risk appetite or those who just want to protect their capital by minimizing margin risk, reviewing margin metrics is a crucial step when considering which Strategies to follow.

Considering additional Strategy activity indicators with the 5-star rating system

Each Strategy can receive up to 5 stars in the rating system. Each star corresponds with certain conditions and is awarded if these conditions are maintained by the trader:

Stars are additional indicators of a Strategy’s overall activity and will provide additional information worth considering when choosing a Strategy.

Patience is Key

When unable to make a decision on which Strategies to follow, sometimes the best option is to simple exercise patience and wait for any changes in Strategies that may gain your favor before Following. This will give you additional time and opportunity to consider which Strategies to Follow.

Trading success is based on a large number of factors which are not possible to predict with absolute accuracy thus it is important to remember that even the best traders are also human and can make mistakes. That being said, the tips provided here are guidelines which may assist Followers with finding Strategies that best suit their risk tolerance and profit goals and may greatly assist with making an informed decision when choosing a Strategy to Follow.

Read More : Primexbt Reviews