Hi, community friends. Today we talk about the One Saving Grace we were waiting for: Liquidity Network

This is a contest organized by @originalworks and funded by Liquidity Network

What is the Liquidity Network?

It is a super easy to use, scalable and very secure private network, which is at the top of the Etheruem blockchain and has the purpose of offering a good viable option when sending cryptocurrencies. This network has an advantage over other technologies, and is that it supports millions of users and is quite affordable.

Source

On June 14, 2018, this off-the-shelf architecture was completely launched, integrating itself into the domain and placing itself above compelling rivals known as the NYSE Marketplace.

How does the system work?

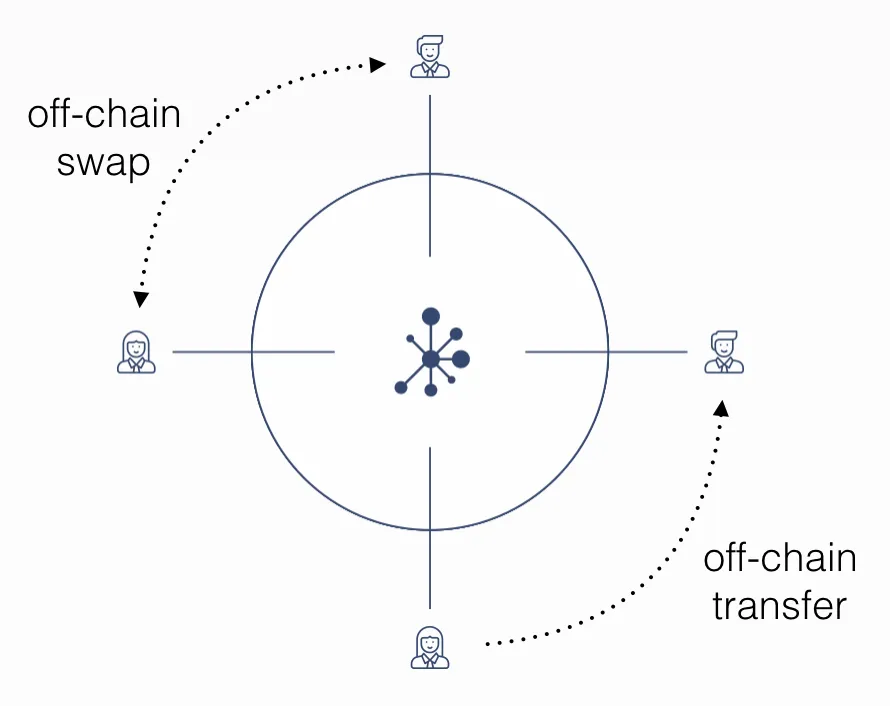

Essentially, the network uses a central approach, thus increasing the speed of transactions, while with a decentralized approach it preserves the security of the block chain.

The power of computation is centralized by the network, through central centers which are called The Liquidity Hub NO-CUST. Where the users of the same have the possibility to make transfers of their valuables, that is to say cryptocurrencies, among them in the intranet. As a result, this causes the transactions to be low cost and snapshots.

NO-CUST is derived from the word "No custody"

The network guarantees each user that they have access to other users at the time of a transaction. It also ensures at the same time, that the asset is safe, which considerably reduces the risk. This combines the purpose of a chain of blocks but where assets are transferred out of it.

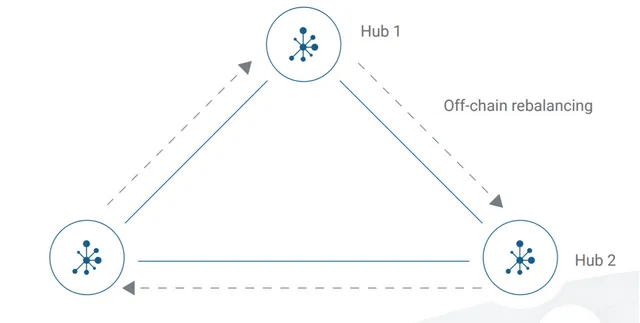

The network also has another component called REVIVE. This is an algorithm which guarantees the balance in all the hubs and since it is out of the chain, it makes it easy to scale.

Liquidity Network: WhitePaper, Page 12

Transaction cycle

Transactions can be made between 2-part channels or payment channels of N numbers.

• "A directional: the asset travels in an address in which a party sends a guarantee to the recipient."

• "Two directions: the asset moves between two parties in both directions. Its limitation occurs when a party invalidates the transaction and steals the funds. "

• "Linked payments: when the two parties are not directly connected in the network."

• "Bipartite payment centers: involves two parties that send funds directly to each other."

Source

In many places this happens. The amount of computational power needed is reduced, compared to other bipartisan channels, which makes transfers faster, more efficient, more affordable and also allows more users to be in the hub.

The private keys come with the control in each concentrator, where the owners of these keys have control. Whoever can start a payment center and host millions of users!

The portfolio of the Liquidity Network:

The application of the wallet is executed in different devices. Both desks and cell phones. The application of the network is available both Google Play Store for Android smartphones and Apple App Store for iOS users. And there is also a web application that is in its Beta phase executed in all browsers. Call Billfold wallet.

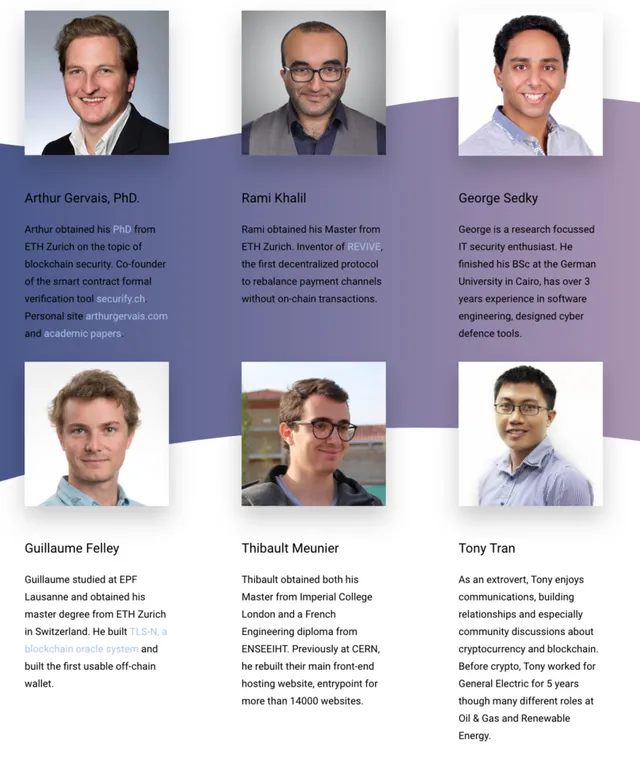

Meet the Team

More Information & Resources:

Liquidity Network Wallet

Liquidity Network WhitePaper

Liquidity Network NOCUST Paper

Liquidity Network REVIVE Paper

Liquidity Network Apple App Store (IOS)

Liquidity Network Google Play Store (Android)

Liquidity Network Telegram Group

Liquidity Network Telegram Announcement

Liquidity Network Twitter

Liquidity Network Github

Liquidity Network Blog

Twitter Bonus

lqdtwitter2019

If you liked my post you would help me a lot by commenting and voting, I invite you to follow me as much as Steemit and Instagram! Thanks for your support.