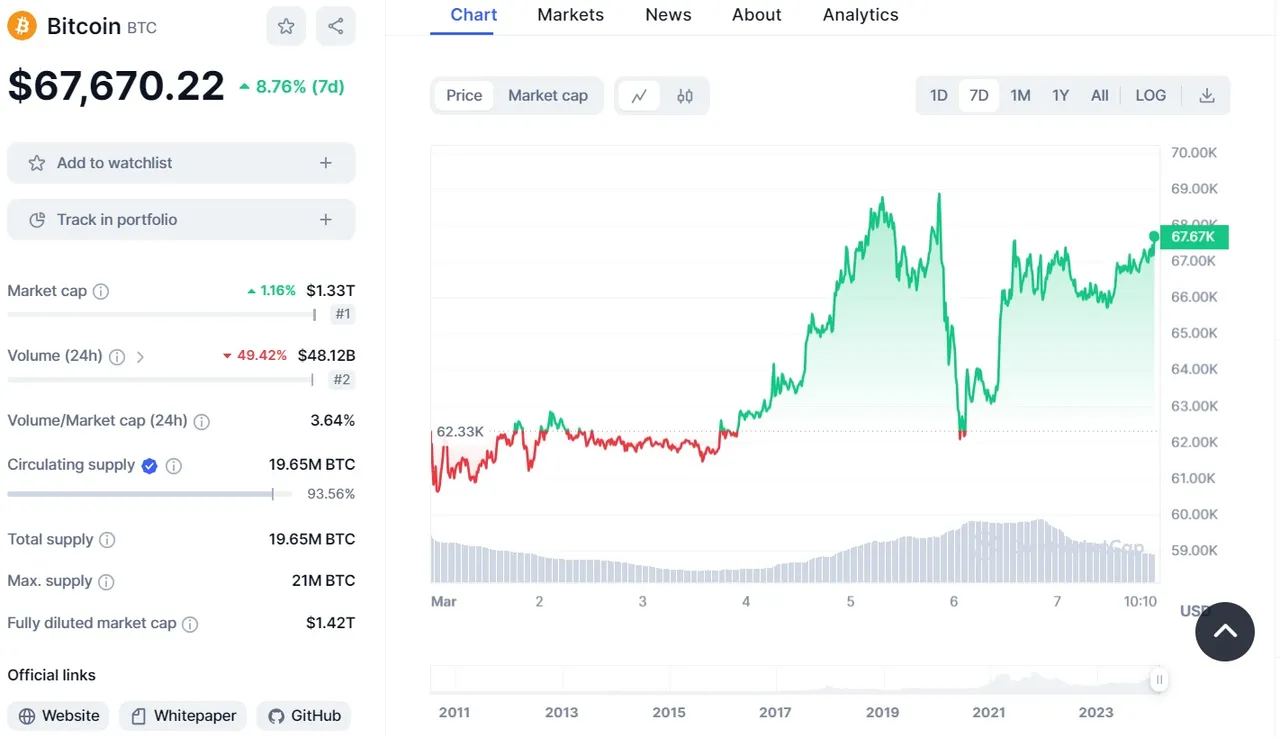

The large flow of money into the institution controlled BTC ETF fund means Bitcoin hitting all time high this is quite evident from the ETF money flow numbers.

This has lead to a couple of interesting outcomes.

On one side we see significant price swings

Take for instance the events following the bitcoin claiming its All time high. Soon after there was some serious profit taking by the big players.

This saw the price dip from $69K to $60K and back to $ 67K in a span of 48-72 hours.

This kind of price swing in an asset that is priced in the $60K-70K range clearly makes it a very volatile asset that can be played well with large institutions and big players that are backed by big money.

Bitcoin trading is getting difficult for the common Joe

For the above mentioned reasons both owing an entire Bitcoin and trading it is becoming and continue to become very difficult for the common person.

This means that those looking to grow their crypto portfolios in limited budgets would have to look towards the alt coins.

Why is the altcoin season eluding us?

A good yardstick of what is happening in the crypto market can be see from the Bitcoin dominance numbers and the Bitcoin volatility and pace of growth.

Currently the Dominance of the top two crypto currencies stands at : BTC: 52.0% ETH: 18.1%

source

With the ever growing Bitcoin dominance the focus stays on Bitcoin and so does the money flow.

Looking at evidence one can see that only when the price of Bitcoin stabilises in a narrow range and becomes optically stagnant and stable for a day or two does the alts make a move.

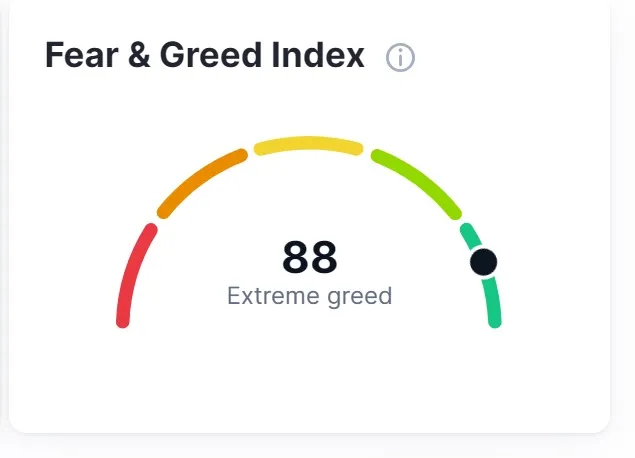

The Fear and Greed index is taking it toll

Looking at the fear and greed index chart for today speaks a lot about what may be happening in the minds and hearts of the crypto investors.

With the numbers so high people start thinking ahead of things and people begin to work on hypothesis like what if they shorted BTC at 69K and entered again at 60K. For most people with limited budgets this would be possible only with a leveraged trade.

However if you do not have strict stop losses then there can be serious damage to your investment capital.

Those who understand it would like to spot some other opportunities.

This makes people look for other investment within the crypto space.

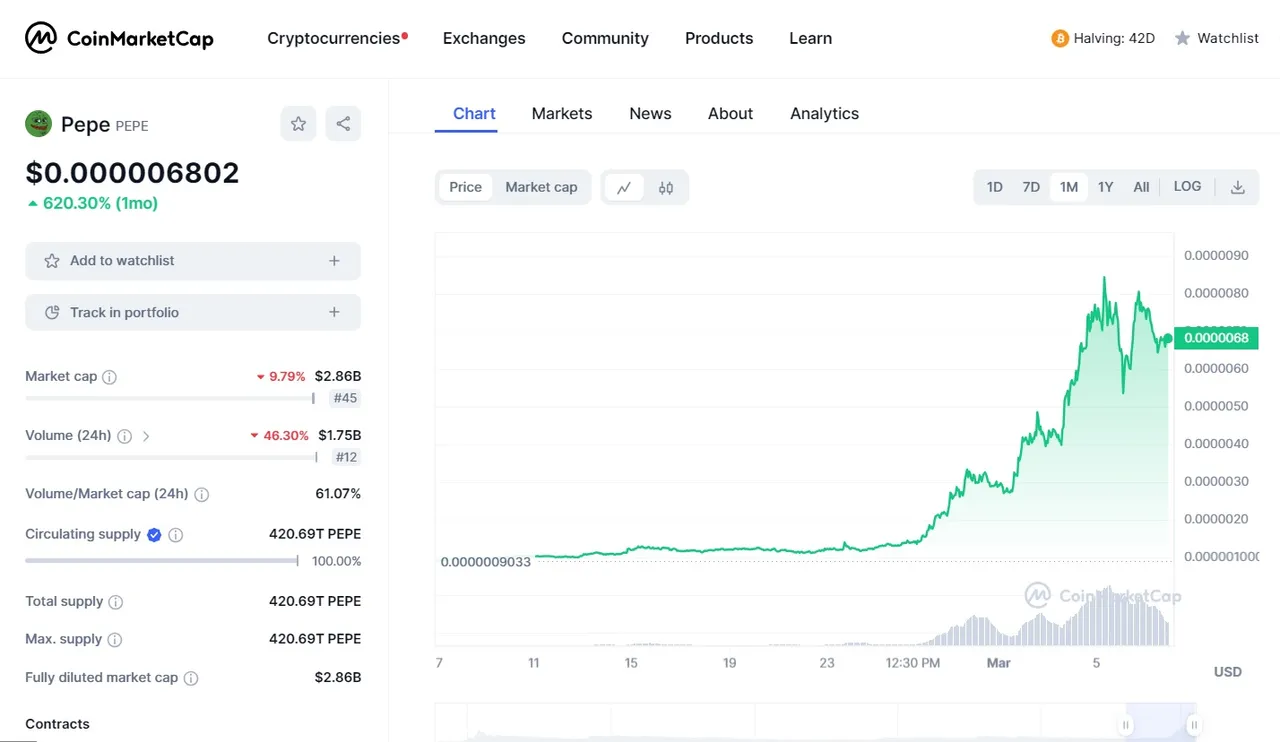

The meme coins are doing their thing

Another set of coins that are in a zone of their own are the meme coins.

Here we see that when the altcoin are looking for a direction and a trigger from the Bitcoin price stabilization the meme coins are exhibiting significant volatility as well as growth.

One of the top meme coin on the watch list of many is Pepe which is on the ETH blockchain.

If we see its chart over a period of 30 days then it has shown a healthy growth of 620%

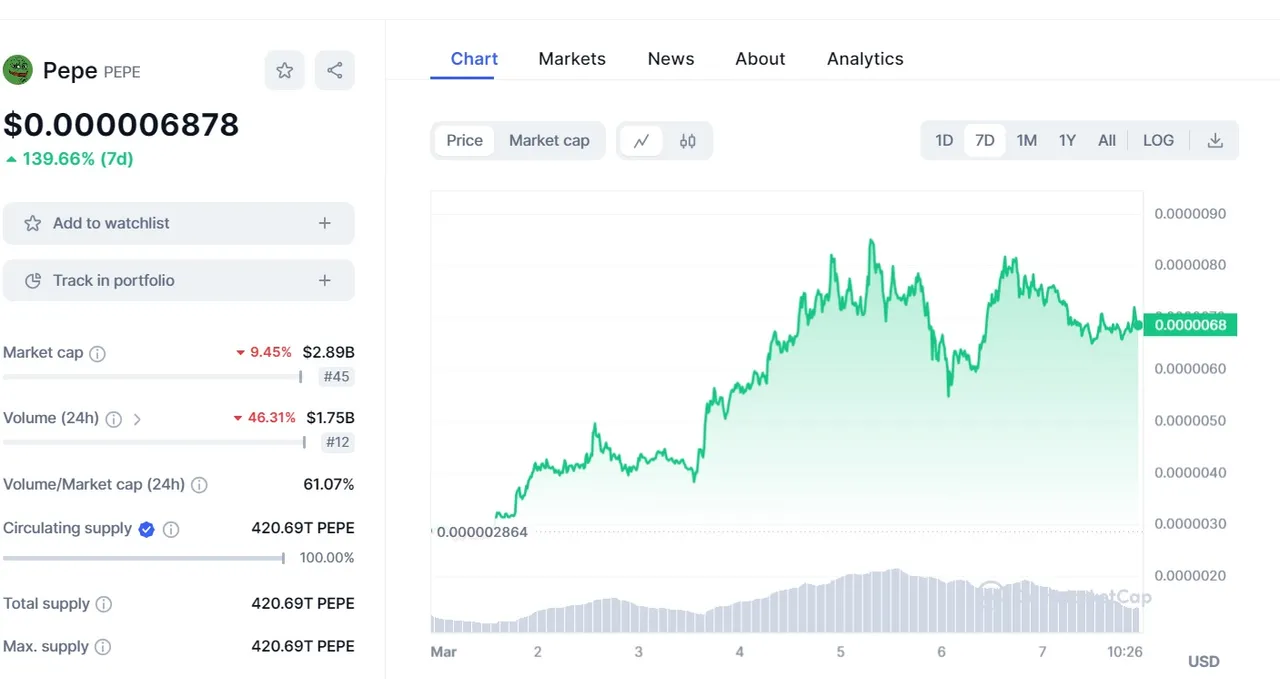

Even a 7 day chart of PEPE looks pretty decent

Even here it has gained a healthy 139%

The theme of the season is diversification with safety

No doubt that BTC & ETH rule the markets so they would be in the portfolio of most long term investors.

However the alts would surely see very decent growth.

From BTC to alts and meme coins there are plenty of opportunities. However there is no one solution that would fit everyone's investment style.

Based on ones capital, risk appetite and investment style one needs to be watchful for the next opportunity that emerges on the crypto horizon.

Stay safe folks. Preserve your peace of mind and capital and grow with the trend.