Hi guys! Crypto community boasts of decentralization as its central ethos. But as we dig deeper into the operations of some platforms, there's a looming question: are we really moving towards true decentralization or are we subtly reverting to centralization in the guise of innovation and regulatory compliance?

The Bitcoin Way

When you think of decentralization, Bitcoin often comes to mind as the epitome. Its design and structure have ensured that it remains resistant to coercion or any single entity's influence. Despite its dominance and resilience, there are people who still argue that Bitcoin isn't fully decentralized. But the truth remains – no one can bend Bitcoin to their whims.

The Thorswap Dilemma

Enter Thorswap, one of the most popular interfaces on Thorchain, this platform, which has facilitated a staggering volume of trades, has been the talk of the town of recent, not for its impressive performance, but for bending to regulatory pressure. With just a minuscule percentage (4%) of illicit funds being transacted, Thorswap found itself at a crossroads. The outcome? A move to blacklist certain wallets. You can read all about it here.

While at face value, this might seem like a responsible step, one can't help but question the implications. If a platform starts blacklisting based on a small percentage of suspicious activity, where does it draw the line? And more importantly, is this not a move towards centralization? Understanding that the platform is a centralized one, shouldn’t we be moving towards decentralization rather than moving away from it?

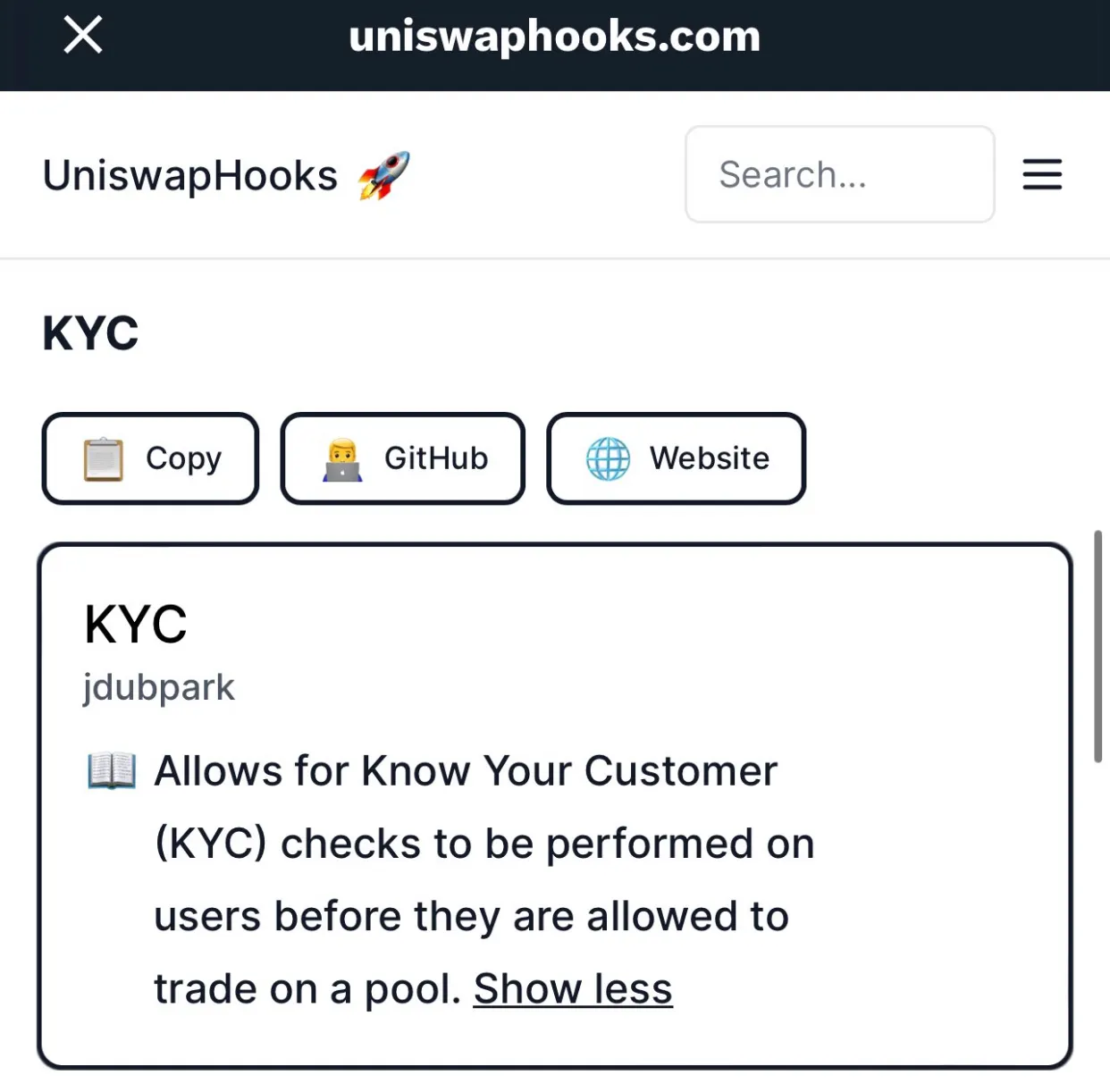

The Uniswap Revelation

Uniswap's recent news about possibly implementing KYC (Know Your Customer) checks further deepens the concern. Such a move would strip Uniswap of its decentralized badge, turning it into just another centralized trading pool. This development reinforces the argument that instead of pushing for decentralization, the industry seems to be subtly shifting towards centralization.

Decentralization vs. Real-world Constraints

It's important to note that achieving true decentralization is complex. Developers are caught between creating a platform that stands its ground on principles and one that complies with the ever-tightening grip of regulators.

While the intention might be to start centralized and gradually decentralize, the journey isn't always straightforward. The challenges of ensuring user safety, preventing illicit activities, and maintaining a robust platform often push developers to make decisions that lean towards centralization.

The Gray Areas of Decentralization

As crypto grows, we encounter gray areas that challenge our understanding of decentralization. Not all platforms that claim decentralization truly embody it in its purest form. Features like governance tokens, staking rewards, and validator nodes, while innovative, often centralize decision-making to a subset of the community. This raises a fundamental question: can we achieve complete decentralization, or will we always operate within these gray areas?

The community plays a pivotal role in this narrative. As users and stakeholders, the power to shape the direction of platforms lies with the community. By actively participating in governance decisions, voicing concerns, and demanding transparency, the community can steer platforms towards a more decentralized future. However, it requires constant vigilance, a deep understanding of the underlying technology, and a commitment to the foundational principles of decentralization.

In the case of Thorswap, while they might want to play fair with regulation, the danger is where the line will be drawn. Today it might be enforcing wallet blacklists, tomorrow it might be enforcing kyc, who knows what will be enforced by the next day, nation states black lists? How long till the regulators begin to weaponize this “understanding” for personal good? What about innocent wallets that get caught up in the web of the blacklists?

Economic Implications

It's not just about technology. Decentralization also carries economic implications. The global financial system, as it stands, thrives on centralization. The movement towards decentralized finance (DeFi) challenges traditional banking and financial models.

As platforms like Thorswap lean towards centralized actions, it raises questions about the economic motivations behind such decisions. Are there economic pressures, perhaps from institutional investors or traditional financial entities, that influence these platforms' decisions?

Beyond Finance

Decentralization has started to influence sectors beyond finance. From decentralized social media platforms to supply chains, the ethos of decentralization is penetrating various industries.

The challenges faced by platforms like Thorswap and Uniswap will likely be faced by other industries as they adopt blockchain and decentralized models. How they address these challenges will provide valuable lessons for these sectors.

The debate about decentralization is a never ending one. It's a clash between two worldviews just as we see on Thorswap: one that values absolute freedom and autonomy, and another that sees the need for some structures and controls for the greater good. This philosophical debate will continue to rage on as technology evolves.

Bitcoin, often heralded as the epitome of decentralization, has managed to stay true to its principles, resisting external pressures and influences. It stands as a testament to what can be achieved when a community remains committed to a shared vision of autonomy and freedom. As we reflect on the challenges faced by platforms like Thorswap, we should look to Bitcoin as a beacon, reminding us of the true essence of decentralization.

Thanks for reading. Kindly share your thoughts below.

images were generated with ai