Thursday 02/08/2018, 11:20CET

The importance of basic economic education

Every person, every business, every government, association, club or group that make economic decisions, even those ast trivial as buying stationary, are all actors playing a role in the economy.

That is why economics is such an elusive ephemeral topic. Though, because we all participate, shifts in economic climate should be very high on our list of things to watch and take into account.

We spend a huge part of waking lives chasing tokens in the economy so we can survive and enjoy our lives. The pursuit to accumulate, and the guarding against loss of these tokens (i.e. money) is something that occupies us so much that we have stopped talking about it.

I am getting all esoterically philosophical suddenly, but each time I think of the paradoxical attitude we have to these tokens, I get pissed off with the way our society has tabooed the open discussion on them, except when we simply do not have enough of them. Not the "why".

My experience with the schooling system in Australia in the 70's is no different in this regard from that which my kids have experienced in Switzerland in the 00's. The true nature of money, how it really works, what is it, and some rather basic axioms about it that require reanalysis or updating for today's economy, are subjects I feel are deliberately avoided in the traditional schooling system.

As a trader, investor, and fellow pursuer of these tokens, I am becoming more and more awake to the macro forces that swirl right under our feet. Forces that can lay the most carefully laid strategies for our financial well being, to waste.

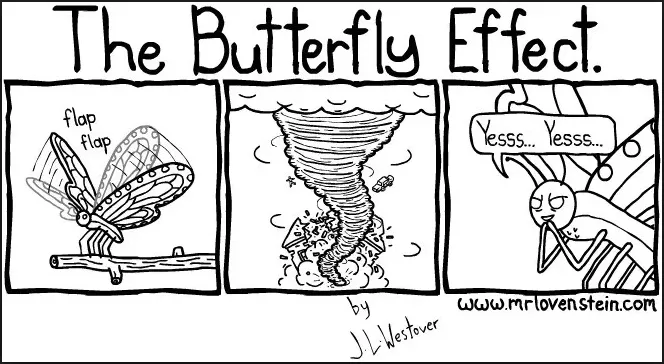

Butterfly effects abound in our economy as actors shift their strategies according to their interpretation of current and future conditions.

Bubble, bubble, toil and trouble

To get down to it, I want to share a link to a great update from an economic analyst I have been following for some years and who I think is one of the brave geniuses who deserve far greater recognition that they do today. Wolf Richter.

He has been covering the Australian housing market for some time and his piece here is something that will cause a lot of ripples soon. In my opinion because the conditions underlying these events are replicated in other cities and countries.

I grew up in Sydney. I have many friends and some family there too, and I also participated in the speculative housing market many moons ago, so I have particular connection to this.

And as a final note: I am not one to seek out the pleasures of schadenfreude, on the contrary,

If you want avoid getting financially smashed by its ever swirling forces, you need to understand it and watch it like your favourite football team.

Realise as well that you can profit from its peaks and troughs as well. Major shifts in sentiment, usually market downturns and crashes signal events in our economic world when strategies can be executed which can potentially yield future financial returns that no 9 to 5 job can match.

If you liked this post, please give me an upvote. Better yet, leave me a comment, they are a great psychological boost.