Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI has just recently come under new management, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

Here is the link to last weeks report for those that want to compare:

@lbi-token/lbi-weekly-holdings-and-income-report-week-6-8-sep-2024-ij

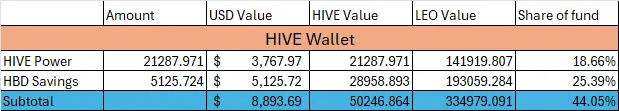

Hive Wallet

Much smaller growth this week with 92 Hive power gain. This is entirely down to me putting less content out. The relaunch has been a source of plenty of content, but now as things settle down and our wallets and plans are pretty much set in place, there is less to post about and make meaningful content. I will try to keep finding interesting things to write about, but I'm not good at forcing content just for the sake of post payouts. My goal is to make post payouts largely irrelevant for this fund, so it grows and grows its income without being dependent on post payouts. That is why I set it up and don't count post payouts (except the LEO part) as income. When we do post, the rewards will go into asset growth.

HBD grew at it s steady, predictable rate. I'm likely to pull 500 or 600 HBD out of savings this week, to buy some more HIVE based assets, as there are a few decent options around. Adding more DBONDS and buying extra PWR is high on my priority list.

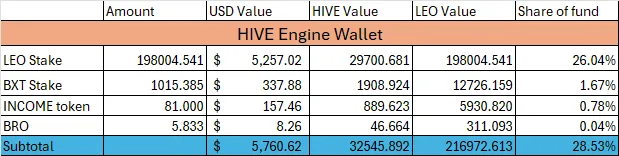

Hive Engine Wallet

Steady week here also. Added a couple of INCOME tokens, and a little more BXT and BRO. LEO grew from the leo.voter delegation, However we did only get 4 days of payouts so we gained 170 LEO instead of the 290 it should have been. Thinking to drop the leo.voter delegation back, and increase the PWR delegation instead. The advertised yield is lower - 8% for PWR instead of the 16% for LEO, but two things. PWR holds its value, whereas LEO has been in a steady decline for a while now, and PWR payouts are more reliable. If we look back to the very first post I made after taking over LBI, LEO was almost 36% of our assets. Now it is 26%, without having sold any. That highlights how much LEO has drifted in value. Each LBI just 8 weeks ago was worth 2.783 LEO - now it is 3.855.

Will LEO recover? Time will tell I guess. Being a "LEO Backed Investment" token where our biggest asset is in steady decline is an interesting challenge to face. I have hope, but I have also diversified to have other sources of growth to stem the losses. I think the overall value of LBI has held up quite well in the face of a

significant fall in value of our biggest asset.

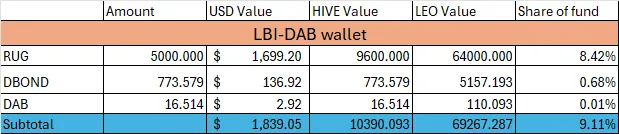

@lbi-dab wallet

DBOND mintage from RUG was a little better this week, and we are up to 773 DBOND's. I'm looking at a big supply sitting in the market at peg value, and thinking they would look good in our wallet. There is over 2500 DBONDS available, and picking them up would speed up our rate of minting DAB significantly. Is it time to use some of our HBD savings to boost this wallet up a bit. Last week we enhanced the EDS wallet by picking up a bunch of miner tokens, this week boosting our DAB wallet may be in order. At least it would give me something to post about. 😉

Income from our small amount of DAB is still small, and I am still supplementing it by unstaking some of the DBOND earned from RUG each week.

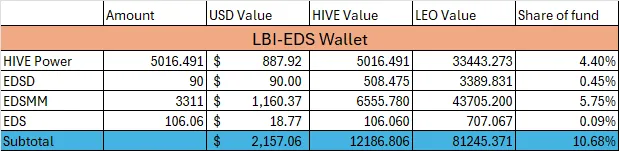

@lbi-eds wallet.

Here we can see the effects of the move to buy EDSMM starting to kick in this week. We gained a total of 20 EDS for the week. If we go back a few weeks, we were minting around 13 EDS per week, so we have definitely boosted the growth of this wallet. The income being generated at the end of this process is still small in the scheme of things, but will grow steadily every week. Happy with the move, and still eyeing off the remaining EDSMM that are available for sale.

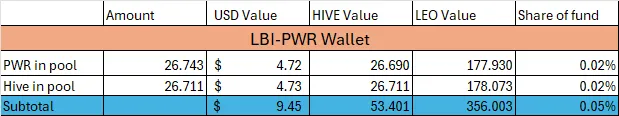

@lbi-pwr wallet

Small growth here this week. Earned a little PWR and bought a little. Likely to give the delegation a significant boost in the coming week, as I think this wallet is one I'd like to grow significantly. Hive dividends have begun for PWR in the liquidity pool, and I'm keen to boost our share of the pool. It's still tiny at the moment, but this is definitely a project I want us to have a much bigger position in.

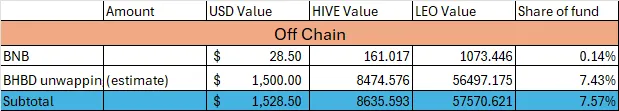

Off chain

Still no change here. Have not had any progress with our support ticket for the BHBD unwrap and recovery process. We shall keep waiting patiently.

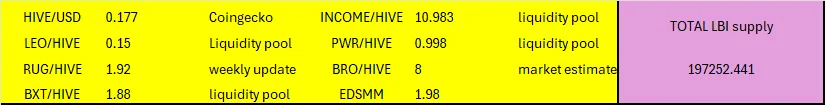

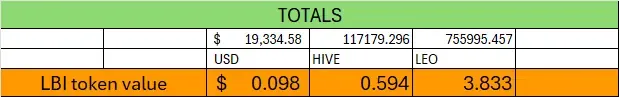

Totals

Last week, here is what the LBI total value looked like:

Here is how it looks this week:

The good news is that we regained the $20,000 Total value in USD. HIVE has performed a little better this week, so our value drops a bit against HIVE. LEO value is slightly up, and trending towards 1 LBI being worth 4 LEO.

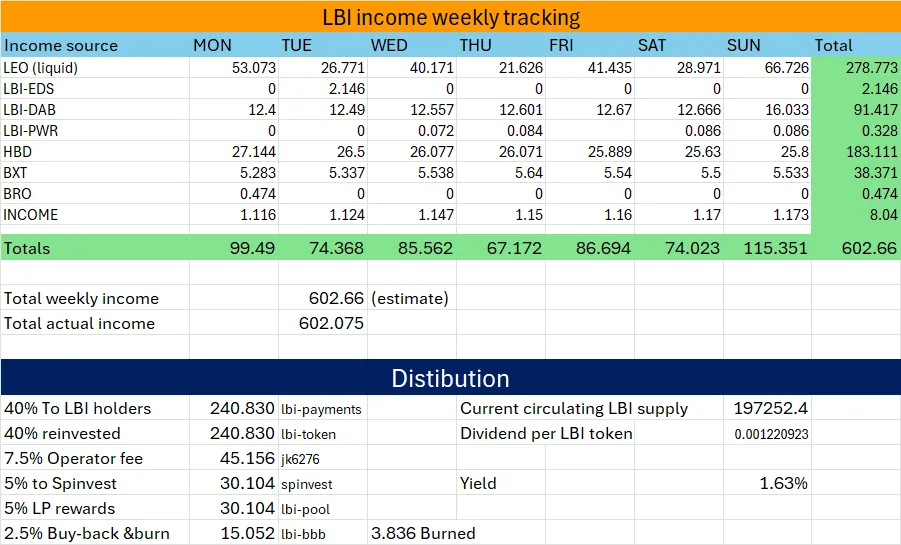

Income.

Overall income is down a bit on last week. This is entirely due to a lower output of content. Dividends went out last night, and some funds were added to the LP rewards. The yield is still small, for both dividends and LP, but as I've mentioned in the past it should steadily trend higher in the long run. 3.836 LBI tokens burned this week. Th "flywheel" effect is slow to begin with, but will grow over time.

This week I note that the LP price currently is above the asset backed price. I like seeing this, as it means there is support for the project, and people are buying tokens out of the pool.

That's it for this weeks update - I hope you all have an awesome week.

Cheers,

JK.

To read more about LBI, here are some more posts for you:

@lbi-token/major-change-for-our-eds-wallet-9ba