It has been ages since I have made a post. Not entirely sure why, but I have just fallen out of the habit of posting regularly. In an attempt to get back to posting, I figured I'd start by looking at the various Hive Engine Income tokens that I am working on accumulating.

Before I start, this post is by no means exhaustive - in fact most tokens will not be in here as I am not overly familiar with what is around. If you have experience or knowledge around tokens I am overlooking, I'd love to here in the comments so I can broaden my options.

THIS POST IS NOT FINANCIAL ADVICE - DYOR.

Image Source: Pixabay

DAB

Image Source: This post by @daildab

The newest entry to the Income token options, DAB is a collaboration between @spinvest and @brofi. The DAB token is currently mintable by holding staked DBONDS, which recently concluded a pre-sale and will become available to buy on Hive Engine soon. DAB will reward holders with a daily HIVE "drip", which should grow over time.

To me it appears DAB is modeled on another similar token called EDS, but with some tweaks to the system. Funds raised from the sale of DBONDS are powered up, then delegated to bring in income. Much of the income is then shared to holders DAB, with a portion used to grow the asset base.

I completely missed the boat early on with EDS, and only recently changed that by starting to accumulate thanks to the second EDS mining token (EDSMM). Fortunately I've learned from that mistake, and got a good sized stack of DBONDs staked, and minting DABs. Here for the long term, to accumulate as much DABS as possible.

Check out @dailydab account for more info.

EDS

Image Source: This post by @eddie-earner

As mentioned above, I completely missed the boat early on with EDS. Saw it come out, from the @spinvest fund that I am a part of, but just didn't really get the token set up. EDS had some very humble beginnings, it took ages to sell the initial token offer (many month if memory serves), to more recent success where the second EDS mining token sold out fast, and if another one gets released it will likely sell out in no time.

Holding EDS tokens provides a weekly HIVE "dividends" and its tokenomics are designed to grow this income over time. The other nice thing about EDS is that there are multiple ways to mine the token. The EDS mining tokens on HIVE Engine are all sold out, and hard to come by at reasonable prices. EDS can also be bought directly on HE, but is also trading well above its nominal 1 HIVE price. There is also a delegation program, where HIVE delegated to @eds-vote will mine EDS - albeit at a fairly low APR.

The nice thing about EDS is that the @eddie-earner account has built a little community of savers, with the "Saturday Savers Club" initiative run by @shanibeer proving very popular. A great initiative coupled with a very well designed income token.

Check out @eddie-earner for more information.

SPI

Image Source: this post by @spinvest

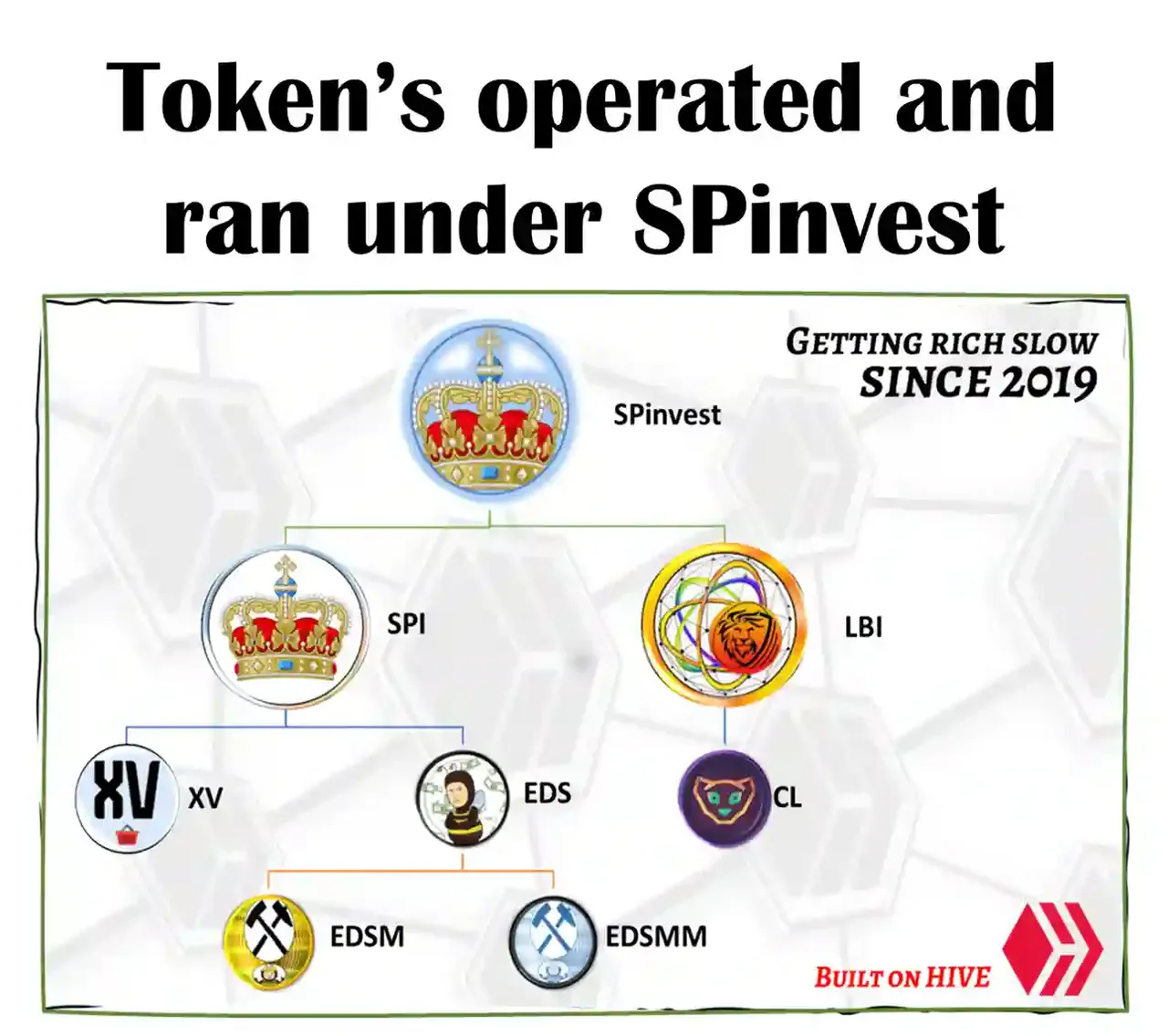

@spinvest is one of the original investment tokens that started before even HIVE existed in its current form. Originally on the chain that shall not be named (ST**M), then moving with the community to HIVE. SPI has been (along with BRO) largely responsible for ushering in a range of other tokens.

There are a number of spin-off projects, but SPI is the original. Paying a weekly dividend to holders, but focused on asset growth for the long term. This is mainly a growth investment, with a mid to long term time preference, and a little yield on the side. With a proven track record as a reliable custodian now in its FIFTH YEAR of operations.

SPI tokens can be hard to come by, and the market has periods of low liquidity as holders tend to cling on to their tokens for life. Personally, due to poor fiat financial situations, I have sold most of my holdings. But I am now in a better position, and can return to growing my stack by working and contributing to the project.

To learn more about the original "get rich slow" project, check @spinvest

BXT

Image sourced from tribaldex

Finally, to a token that is not connected to the Spinvest project, BXT. BXT is the native token for the beeswap platform, a HE front end, with its own HIVE/swap.HIVE conversion facility and a focus on swaps through the diesel pools.

The BXT token, when staked, generated a daily HIVE yield which ranges from 10% to 16% APR roughly depending on the token price and activity levels. The nice part is this is "real yield" from income generated by the platform rather than inflationary token rewards. Having said that, there is some BXT token inflation, which is used to provide some rewards to certain liquidity pools.

My strategy.

My plan is simple, accumulate as many of the above tokens into a seperate account creatively named @jk6276.holdings. As I grow the token balance of this wallet, it will produce a completely passive, liquid HIVE income, which should steadily grow over time. That income will become my "cash-out" funds. One thing I have learned over the last 6 years in crypto is to make a plan during the bear market, and then stick to it during the bull. Having failed to do that effectively over the last cycles, I'm trying again this time around with a more cautious, and long term focused approach.

If you have suggestions of other tokens I may be interested in, feel free to shill them in the comments. I'm looking specifically for HIVE income - daily or weekly, not income in the form of inflationary rewards, things requiring active "work", or curation or whatever, or shitcoinery. There is a place for those things, but for this post I'm looking for "real yield" and liquid HIVE income from sustainable sources.

Thanks for reading, I hope you enjoyed this post.

Cheers,

JK.