So today I bought some silver. I don't mean silver derivatives, but actual physical coins.

Of course I love crypto, but my portfolio is at 100% in that allocation, and I need to diversify further. So yeah, precious metals. And specifically silver because of its industrial uses. Even the military uses it, so sadly it's usage isn't going anywhere anytime soon.

Why make that particular diversification play?

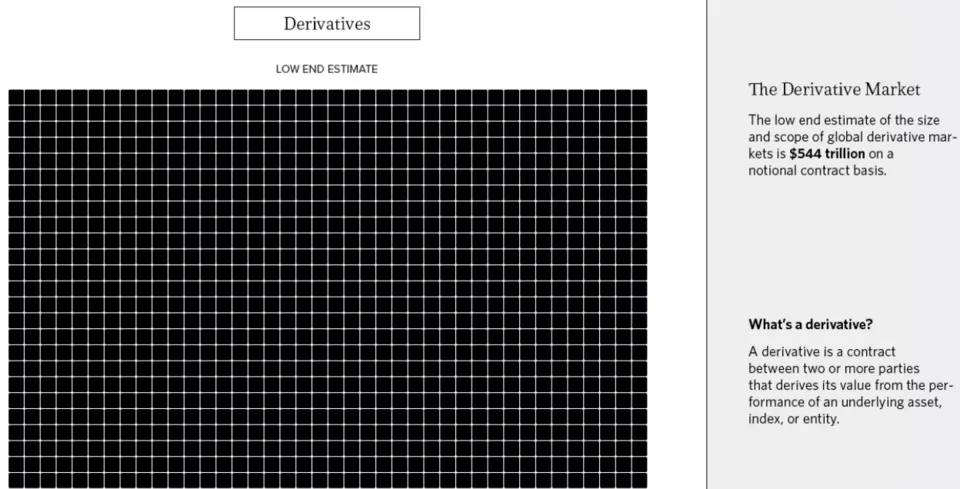

Well take a look at the charts on this page: Global money supply

Notice how much of the "money" is actually derivatives. That's another word for "pretend money."

I'm not going to go on and on about the stock market bubble the fed has been driving us into by buying up bonds.

(It's counter intuitive, but buying bonds reduces yields which makes people not want them and prefer stocks. IMHO, as NOT an investment advisor, about now would probably be a good time to lock in stock market gains by moving money into bonds or other instruments available in your 401k, even money markets, no matter how low the yield. Preservation of capital is sound policy, particularly after a bull run like the one we're at the height of right now. You got your gains already! Now keep them. But not financial advise, cause I'm just a retired business consultant.)

Anyway, I'm also not going to go on and on about the student loan bubble, the real estate bubble in all major cities globally, the debt crises looming for emerging markets that will probably take out Spain first then come for the rest of the "developed" world, or the fracking bubble.

Did you know there was a fracking bubble? The US fracking industry falls into debt by $9 Billion every quarter. That's $36 Billion a year. As soon as the government stops subsidizing them they're all going to go bust. But I digress, because I'm not going to talk about that.

The Bottom Line

All I want to say is, this is a time that each person needs to be tuning into their inner guidance system and figuring out what they are being guided to. I feel good about my overall picture in terms of weathering what I foresee coming these next few years, although I do wish I had a greenhouse and more gardening skills. I will probably look to see if I can find a community greenhouse to become a part of, and learn better gardening skills than I had from the tiny garden I had in CA.

Your inner guidance system might lead you to completely different decisions than the ones I've made, though I think we can all agree that crypto is something to accumulate. But we may not agree on which coins to accumulate, the importance of using decentralized exchanges (which can't run off derivatives of crypto the way the centralized ones absolutely do), or what other forms to hold "money" in.

That's why I don't need to be an investment advisor. I want to be a heart advisor. I want to inspire you to feel into your heart space as you think about what the most loving way to prepare to take care of yourself and your family might be if they shut down the banks.

Are any of you in Venezuela? Someone told me recently that in Venezuela they are now going to the zoos and eating the animals there. I couldn't believe it and won't believe it until someone living there confirms it for me.

Did you know that people with money in their pockets had a hard time buying food during the Great Depression back in the '30s? At that time 50% of Americans lived in rural areas and only 50% in cities. Now only 2% of our land is agricultural and most people live in cities. And much of that farm land is used to raise livestock feed, no human food. How will we feed the people if we lose the ability to import food at low prices because the dollar is falling?

But maybe the dollar will be fine. I mean, currency is a global thing. It's all relative. It's not about how much your currency is "worth," but rather how much more or less it is worth than the currencies of other nations you wish to import from. Since this is a global smack down/correction coming, maybe the dollar will fair okay simply because all the other currencies are fairing so poorly. Who knows.

Well a part of you knows, for you at least.

There really is an inner guidance system we have available to us. Ultimately it is your inner guidance system that must lead you. But before you know to interpret that sense of "all is not actually well" as an urge to action, you may need to frame some of these ideas in a way your intellectual mind will accept. Otherwise you'll dismiss those urges as paranoia or just general dis-ease in the state of the world.

That's why I share this with you. So that you'll start taking seriously those urges you get to start making different sorts of financial decisions than you may have considered before, but which Spirit is in fact whispering to you.

Can you hear it?

If you hear something, do something. Now!