Not a Security?

On the heels of an ETH spot ETF being approved people are now saying that ETH is not a security.

Personally I think the logic behind this is a bit thin, but I'm also forced to agree.

The approval of spot Ether exchange-traded funds is “implicit recognition” from the United States Securities and Exchange Commission (SEC) that Ether is not a security, according to industry pundits.

This is a matter of vague precedence. It's not the fact that the SEC approving the ETF makes it not a security, but rather how they approve it. A lot of fuss is being made over this... checks notes... S-1 approval form.

Digital asset lawyer Justin Browder believes if Ether ETFs get S-1 approval — the final piece needed for them to start trading — then the “debate is over: ETH is not a security.”

Apparently this hasn't officially happened yet and we'll have to wait for the official official confirmation, but many seem to think this is a bit of a formality. Maybe it is maybe it isn't, but honestly it doesn't really matter either way. The SEC itself is a formality; a speedbump in the way of crypto. They have no power over the long term.

That doesn’t mean the securities regulator can’t still pursue action against actors in the staking domain, industry analysts and lawyers warn.

The SEC officially approved 19b-4 applications from VanEck, BlackRock, Fidelity, Grayscale, Franklin Templeton, ARK 21Shares, Invesco Galaxy and Bitwise to issue spot Ether ETFs on May 23. Many ETFs issuers notably removed staking in their final amendments.

It's noteworthy to point out that because of the ongoing lawsuits with institutions like Coinbase the ability to stake these shares is off the table, for now. Of course Coinbase is going to absolutely slay the SEC in court eventually, which might actually mark the peak of the 2025 bull market if the timing happens to play out that way. BOLO.

One even suggests this could extend to other tokens as well.

I mean... obviously?

Given my own research of securities law over the years I've concluded that it's actually quite impossible (or very difficult) for any cryptocurrency to be a security. The SEC is simply flexing and abusing their power in this regard. Nothing is a security.

The problem is they LOOK like securities.

Securities laws were invented so that people could not print money/assets out of thin air without following the proper runes and regulations. This makes perfect sense. People shouldn't be allowed to invent completely unregulated assets 100% under their control to do with whatever they please. Allowing such things to happen creates a wholly toxic environment full of scams.

A wholly toxic environment full of scams, you say?

Well that sounds a lot like crypto doesn't it?

So why is crypto definitely not a security?

It all comes down to the matter of ownership and investment contract.

Notice how I said "100% under the founder's control". There are no cryptocurrencies that are 100% under the founder's control. Even if I create a crypto right now and 100% premine all the tokens in a proof-of-stake network: it is still not 100% under my control. Why? Because all the code is open source.

So even in the absolute worst case scenario of 100% of the tokens being premined by one person does securities law still not apply. Clearly this needs more explanation because most don't seem to understand why that would be.

Taking Facebook as an example.

Let's say I leverage the Facebook API to make an app. Let's say my app becomes popular and Facebook just decides they don't like what I built and they're just going to shut me down. That is fully within their legal rights to do. No one can stop them. Why? Because Facebook is a security because Facebook owns Facebook.

Now compare this to crypto.

Let's say I built an app on something that people consider a security, but isn't. Like XRP. XRP (Ripple) was heavily premined so people consider it garbage, which it very well might be, but it's not a security. Why? Because if I build my app on the XRP network and they don't like it... what are they gonna do about it? There's nothing they can do. They can't shut me down because even if they revoke my access to one API I can just go to another API... and even if ALL THE NODES IN THE ENTIRE NETWORK shut me down... who cares? I'll just boot up my own node and set up my own API. And if that doesn't work I can fork the entire network and start my own network using the code that they wrote. They can't stop me.

Imagine trying to do that with Facebook!

Imagine getting shut down by Facebook so you clone Facebook. Even if someone was able to get all the code that makes Facebook (which they can't) once they had that code and cloned the network, guess what happens? Facebook sends them a cease and desist letter and then sues that entity for corporate espionage and the theft of proprietary technology. Why? Because Facebook legally owns everything because that's how securities work. Facebook doesn't just own their stock; they own the entire network and they own all the data in that network.

Common Enterprise means the opposite of common.

Common Enterprise is one of the legal terms used to test if an asset is a security or not.

- An investment of money

- in a common enterprise

- with the expectation of profit

- to be derived by others

This is the Howey Test, which is a metric used to determine if an asset is a security or not. Crypto networks fail every one of these bullet points. A "common enterprise" is one of those ironic legal terms that means exactly the opposite of what it sounds like. It means that the thing is 100% unilaterally controlled by a single centralized agent and that agent can sue anyone who takes their thing and tries to copy it. This ties directly into "to be derived by others". Why is the profit derived by others? Because the entity that controls everything legally won't allow anyone else to get in on the action without permission. Absolutely none of this applies to crypto. Not even a little bit.

The SALES of crypto are a different matter.

While a crypto network itself can never be a security, the sales of premined tokens can be an investment contract. This is why Ripple lost the small part of their case where they sold XRP to institutional investors. These sales of XRP only partially pass the Howey Test but that was enough to win in court. Obviously this makes sense on a logical level: if you sell an asset to literal institutional investors then "clearly" that's an investment contract. There are arguments to be made about why this is actually false but I'm not going to split those hairs. All I will say is that if an institution buys gold from someone it's not an investment contract; people who sell gold are not responsible for the price of gold going up.

So I can 100% premine an asset and my network won't be a security, but if I sell those assets to others under the guise of number-go-up I could get into trouble. However, if I sold those assets to people saying something like: "It's going to be fun while it lasts but I'm going to rugpull you eventually," there is no way this could be interpreted as an investment contract. Another way to get around the investment contract laws is with "utility". If you need my token to play a game I created you're not buying the token as an investment you're doing it to play the game. As long as I never market the token as an investment the sales of my token are not infringing on securities law (in theory). However, as we can all see the SEC just makes up the rules as they go so none of this accounts for them breaking their own laws, which they seem to be doing on the regular these days.

Conclusion

The happening is happening. The thing that I've been talking about happening, is happening. ETH is not a security. In fact nothing in crypto is a security no matter how premined or terrible it is. The foundation of this conclusion is that it is not feasible for open-source technology to qualify as a "common enterprise" legally. This is a big detail that most seem to not understand because the concept of a "common enterprise" seems to be intentionally vague. Go look it up yourself.

I personally had to read five different websites and definitions of "common enterprise" before even understanding what it meant. Long story short it means unilaterally controlled intellectual property. None of this applies to any cryptocurrency because no open-source network can send a cease-and-desist letter to anyone on their network or another network that cloned them. We don't own the things we build in crypto. It's all out in the open for anyone else to copy freely. The only real asset of value is the network itself and the people that choose to participate, all of which have a legal right to help make the asset better, nullifying the "to be derived by others" clause of the Howey Test.

A network like Hive takes it even one step further. We are one of the only networks out there to nullify the "investment of money" clause of the Howey Test, as anyone here can earn money with their labor. Impressive. The last "expectation of profit" clause is only valid if the person selling the asset can control the asset's price (meaning the other clauses must be true). Secondary sales on exchanges already have legal precedence here because the exchanges can't control the price or mint/premine the underlying assets they are selling.

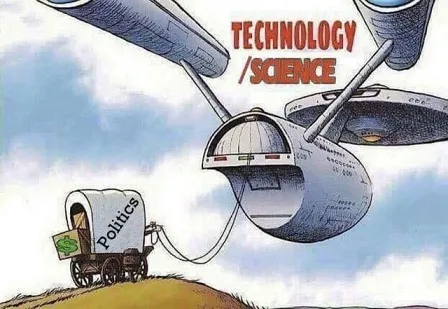

Ultimately the SEC doesn't care about any of this. They are a 3-letter government agency that wants as much power as they can grab. Their battles with crypto have ended the careers of multiple lawyers at this point from sheer embarrassing and unprofessional behavior. They are getting their asses handed to them, but they are slowing down the acceleration of mainstream adoption, if that happens to be the goal. The next couple of years are going to be riddled with more embarrassing losses for the SEC. It will be entertaining to watch. Remember to grab some popcorn.