Polycub has done exactly what I said it would.

- Right down to the bottom call of $700k-$1M market cap.

- I sold all my coins between $0.80 & $1.20.

- Easy money.

- Now I'm buying back in and supporting this low level.

Prototype

Polycub is an extremely experimental testnet for the Cub network. All the best parts of Polycub will inevitably be ported to Cub. Many think Cub is down and out because all the attention is on Polycub, but honestly Cub might be the better (and safer buy) at this point. The risk reward ratio of these 'penny stocks' is out of control, but the potential upside is insane.

Truth be told the only reason why I'm involved with any of this is because I know Khal well enough to trust that the grind is going to continue no matter what. Up and coming projects like this are inherently more centralized, but they are also more organized and directed and can develop the product ten times faster than a decentralized network that scatters in every direction. Blah blah blah do you're own research. Not not financial advice.

Getting to the point

The real topic of discussion is the long-term viability of a DEFI network that cuts inflation to zero super aggressively in less than a year's time. Is that sustainable? Is it actually going to work? I think it might.

I've talked a lot of trash about deflationary tokenomics, and nothing has changed. Either the amount of inflation being printed is too much, or not enough. It's very hard to know where that point of maximum estimated value lies, but I can 100% guarantee that trying to guess right in advance is going to be wrong every time. Perhaps this is beside the point though. After all, crypto is not a good solution, only good enough to actually work. Will Polycub work? I realized something very important regarding this just the other day.

More on why decreased inflation equates to a lower token price.

In the above post I rant about how deflation is stupid and the real way to capture the most value in defi is to have elastic yields that constantly change in order to get the highest EV. The goal is simple:

- Provide the lowest yields that create the highest liquidity and volume.

- This is a ratio between cost and value.

We want the highest value for the lowest cost.

- This is a ratio between cost and value.

- Adjust this number dynamically depending on market conditions to stay in the pocket of highest profitability.

- Keep the price of the defi token as stable as possible.

- When price of token gets too low jack up the yields to incentivize hodlers to come in and support the low price with massive yields.

- When price of the token gets too high deflate the network by lowering yield and incentivizing users to dump tokens on the market.

- This is the variable that no one in crypto understands. No one wants to purposefully lower the token price to increase stability and buffer the supply/demand.

- Automated and manual inflation manipulations each have their own pros and cons list.

Can Polycub achieve this?

Within the context of manipulating yields directly, no.

Eventually Polycub will lower inflation to zero.

Only 7.2M tokens will ever exist.

In my opinion, this kind of self-imposed limitation is largely pointless way of gimping the true power of the network. Polycub is not Bitcoin. Bitcoin literally can't increase inflation. Polycub can increase inflation based on one person going beep-boop-beep on the emission contract. These two networks are not remotely comparable in the slightest.

But I get the appeal!

This is a "give the people what they want" scenario. And people are stupid so they wrongfully want a supply cap on maximum tokens printed. It works for Bitcoin, therefore it must work for all cryptos, yeah? So what do we do? We put the cap on the token for the marketing and then work around that limitation. Even though it's not an ideal option, it more than pays for itself if enough users want to participate solely because of the supply cap (which is entirely possible).

But you know what I realized?

Once emissions drop to zero the entire game changes. The exact scenario that I said needs to happen will end up happening (largely by accident). To reiterate, I said that yield needs to drop when price goes up, and yield needs to increase when price goes down. This will happen automatically when no more polycub is being printed.

Think about it...

When Polycub price goes up, yield doesn't go up because yield isn't driven by Polycub being printed out of thin air. Rather, all Polycub yields will be derived from the Vault (Protocol Owned Liquidity). And what is the vault doing? It's farming other DEFI platforms and dumping that farm to buy Polycub and distribute yields without needing to print the token directly. That creates the exact stabilizing forces we are looking for.

For example, if CUB goes 10x, yields go 10x. All yield is printed using CUB emissions, and thus when token price increases yield increases in step. On Polycub it will be the opposite. If the token price spiked 10x the yields would instantly decrease by 90%. The Vault isn't magically farming 10x more farm just because Polycub token price increased. This incentivizes LPs to withdraw and dump tokens on the market, stabilizing the price back to a more reasonable level.

The opposite is also true.

If Polycub dropped in price 90%, the yields would go 10x, assuming the dollar value of that RFV (Risk Free Value) yield was the same before and after that flash-crash. This is possible on Polycub because the dollar value of the yield being farmed has nothing to do with the price of the governance token.

Of course that's a big ask because if the vault is farming crypto assets that are correlated in price, it won't exactly work out like this all the time (unless we are farming a ton of stable coins). But when Polycub is uncorrelated to the market and makes huge moves while the market stands still, this absolutely will be the case.

This is actually a pretty powerful development that I wasn't really factoring in during all my analysis in the beginning. The communal Vault stabilizes the yields automatically in the exact way that I've already concluded needs to happen. All we have to do now is get as much funds into the vault as possible and slowly ride the price up. I think the chance of a slow grind is high, which is great for stability even in the face of a deflationary network.

Loans and bonding

Being able to take out a loan using xpolycub as collateral is something that could easily 10x the price of polycub. Of course we might have to wait six months before it's available and the risks of such an experimental function are high, but also they aren't THAT high. On other platforms like DAI and UST when bad debt gets created we've already seen what can happen. Token price absolutely can crash to zero in a black swan.

However with polycub when bad debt gets created that bad debt gets outsourced to the users in the form of bonding. Worst case scenario? The vault itself takes some losses. So where did those losses go? Who gained? The users that took out loans and got away with paying back less than they owed (collateral was worth less than the loan). That's not that big of a deal because polycub doesn't have a stable-coin that it needs to peg to $1.

Again, a lot of the risk is outsourced to the bulls using decentralized bonding contracts. Say token price flash-crashes and lots of xpolycub gets liquidated. The Vault owns that xpc now. The Vault then issues bonds to get LP tokens back using a an ingenious tactic. Offer users a good deal on yield over time (paid in XPC) in exchange for LP tokens NOW so the vault can get back to farming other assets as usual. This really is an elegant solution to Black Swan events that will likely be taught in finance books 10 years down the line.

Governance votes.

This is another thing that gives xpolycub a ton of utility. By voting on where yields get allocated this creates a huge demand for the governance token. In combination with loans and bonding this is enough utility to justify lowering yield on xpolycub to zero in the future. You heard me right: zero.

No one will need to earn yield on xpc if xpc has massive utility in other ways like bonding/loans and governance. Also, what happens if even more utility gets built on top of xpc? That's just icing on the cake. Allocating yield to the single-staking pool may become completely irrelevant (maybe just a small amount so that loans remain interest free) and used for providing actual entrance/exit liquidity.

Wut?

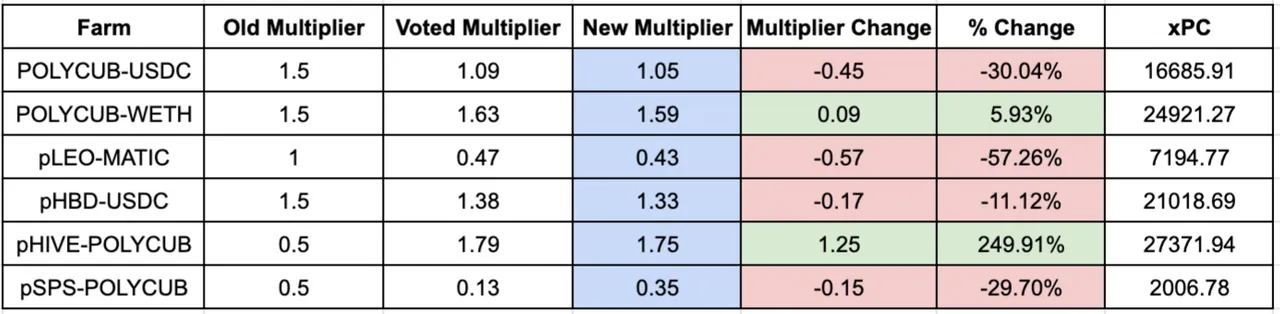

I gotta say I'm a bit floored that the Hive/Polycub LP is about to get an x3 increase in yield. Who knows how long that will last, but still. Impressive. APR could get as high as 150% once the change goes live. Of course I suppose the idea is that competition will enter the pool and that number will drop in response to increased liquidity, but whatever. Let a Hive/Polycub bull dream. This is such a moonbag LP it's not even funny. Even 50% yield on it is a great deal.

Other ways to generate income.

The addition of pHive & pHBD derivative tokens has shown that the Vault can build wealth in multiple ways, not just farming yield across other LPs. The 0.25% wrapping and unwrapping fee is only slightly annoying (cheaper than the trading fees it would take to avoid them). I have no doubt that other strategies for building up the vault's wealth will emerge as we tinker with the protocol. Every little bit counts.

Conclusion

Polycub and Cub are not down and out. There's already a pretty hardcore niche of users around here that are pretty ride or die for these penny cryptos. Gloom and doom for some is an opportunity for others. Remember that going forward. Number one rule of crypto.