Welcome back!

Before I begin, I would like to add a story inspired by personal thoughts that may give a little more validity to the themes that will be developed in this post ....

" A Rice Harvester from a small land was to feed more than 20 members with each harvest and store for the winter.... His neighbor built a huge empire using the sale of his products. Unlike his neighbor who humbly was only a gatherer and used only what was necessary for the survival of himself and his family. One night there was a great storm that devastated the cultivated land of both men! One of them went into depression since it was the only thing he possessed.... The other was saving for years a small amount of grain that at the time was insignificant, but the constancy and good management in times of crisis gave a total turn his life .... merging both properties and creating a society they changed their way of managing and safeguarding part of their assets in times of crisis." Moral of the story: No matter how much you drive or how much you earn, do you know what to do when the storm comes?

Perhaps like many! starting from 0 is one of the most difficult tasks and generating a backup to that 0 is almost impossible ... Lately my focus is mainly directed towards the management and risk management of my investments and my total capital. I have read several titles such as "Economics to walk around the house, Rich Dad Poor Dad, Have a worse car than your neighbor" I personally recommend them, they contribute a lot and give a better management of financesSynopsis of the books and some more titles

In summary my management will be handled from today onwards as follows...

Approximately with 62% of my gross income from this platform, trading among others... I can continue to maintain a decent quality of life, pay my taxes and treat myself once in a while...

12% of my gross income goes to my trading fund and what about the 24% that is left over? Previously this figure was not left over because I had a very bad money management and administration Today I identify where my capital was fluctuating and like the great businessman that everyone looked at with great esteem I was not prepared for the storm.

Images created through Canva

Grain by Grain (Pre-savings)

Like the writer Luis pita I think about my economic freedom of which we all long for and the number of years one could live after ceasing to have income without losing quality of life, and to be able to achieve that economic freedom.

If I staked 24% of each post that received votes over the next 15 Years we are talking about 5,200 writings where 24% of their payout goes directly to my "pension fund or voting power" do you think, society will reject cryptocurrencies at some point bringing repercussions to their future quotes and this being a total loss ? (Please respond to comments)

I personally consider that the best option to place my Pre-savings very long term funds are the following:

- Increasing the voting power in leofinance.

( Thanks to its project, its innovations and track record that it has, I think it is a great candidate to be among the first" I personally expect a lot from this tokens).

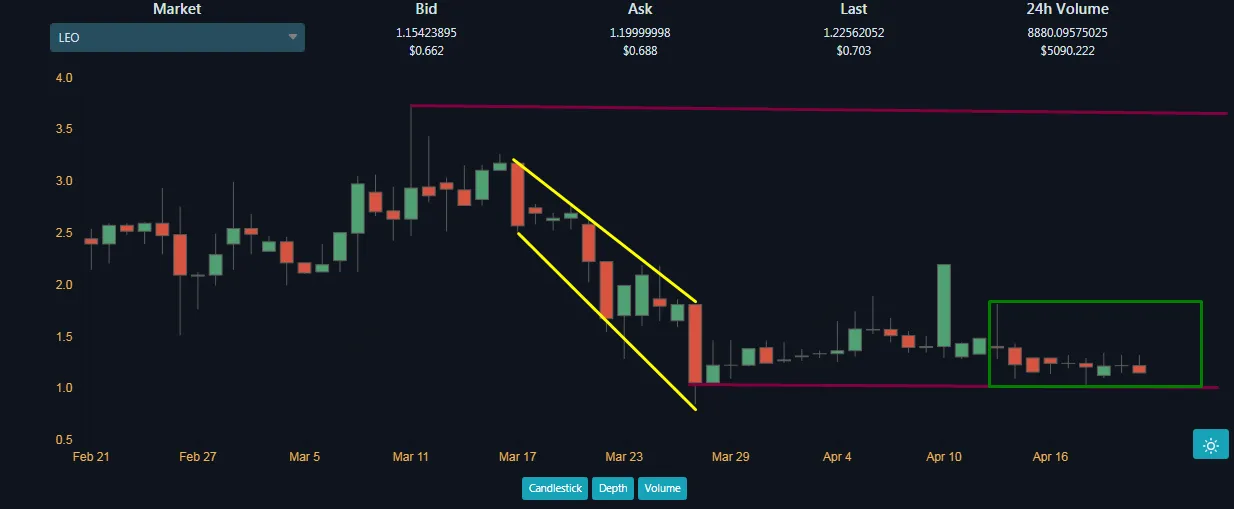

In the chart of leo we can see the indecision and the bearish channel that this presented very long term these quotes become highs that should be broken with the passage of time ...( great time to accumulate ) Chart extracted from LEODEX

Direct accumulation in BNB(BINANCE COINS) or Bitcoins.(We are currently in the basic foundations of the cryptocurrency, that is to say the best stage 'to buy, despite its high prices can multiply even in 30%+ in a few years )On the part of the BNB (Binance Coins) is presented in a range zone where it oscillates as a maximum point 590 and 520 as a minimum according to my Fibo levels if it breaks with a great candle that last ceiling between 587 and vicinity can present a great uptrend (after the break correlation to the line to take strength).

BTC in the same way using the fibonacci tool is at a strong point that fails to give continuity to the sale ie paused its downtrend very long term as I have been mentioning throughout this post I will love to go accumulating satochis until the time of my retirement....

Graphics extracted from TradingView

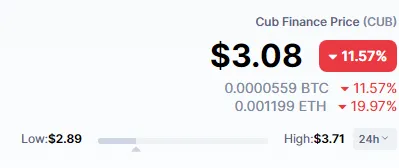

- CubFinance (Staking) I still don't have certain long-term convictions with this token although it has had great acceptance recently by the public and notably is supported by leofinance..... So I'll give it a try !! leofinance has been roaring strong for a couple of weeks now and I feel under obligation to contribute.

Coinmarketcap

Detailed technical analysis authored by @lennonmc21

Consider joining our community at Discord

In this way you will be able to access much more information of the financial type. And, you will be able to train with us in trading, money management and investments.

In addition, you can follow us in our social networks, to provide you with more interesting information about technical analysis, courses, personalized attention, airdrops, crypto coin bots and much more.

Our Social Networks:

Instagram Erarium

Twitter Erarium

Telegram Group