I recommend first checking this index of related posts, before giving this one a read.

What is risk management?

It is about controlling the amount of money you are willing to lose if your trade goes wrong. Responsible risk per trade is usually about 1% max of your trading capital, but it can be as low as you want especially if you are learning, or simply doing paper trades can be even better while learning. So, if your trading capital is for example 100 dollars, you should be risking only 1 dollar per trade.

Following that example with basic numbers, would that mean having position sizes of only 1$ per trade?

No, position size is calculated based on the entry price and the stop loss (SL) price. The stop-loss price is determined based on the subjective technical ability of each trader. It is the level of price at which you admit your trade idea is wrong, and you need to exit at a loss. This is why it is important to set the SL price before entering the trade, otherwise, if the trade begins to go wrong, and you don't have a limit order as your SL and you need to apply a manual exit, your psychological state can prevent you from doing so and accepting the loss, which can result in an even bigger loss as the price continues to move against you without you exiting your losing position. Using limit orders, which are executed automatically, is a MUST in my opinion for SL.

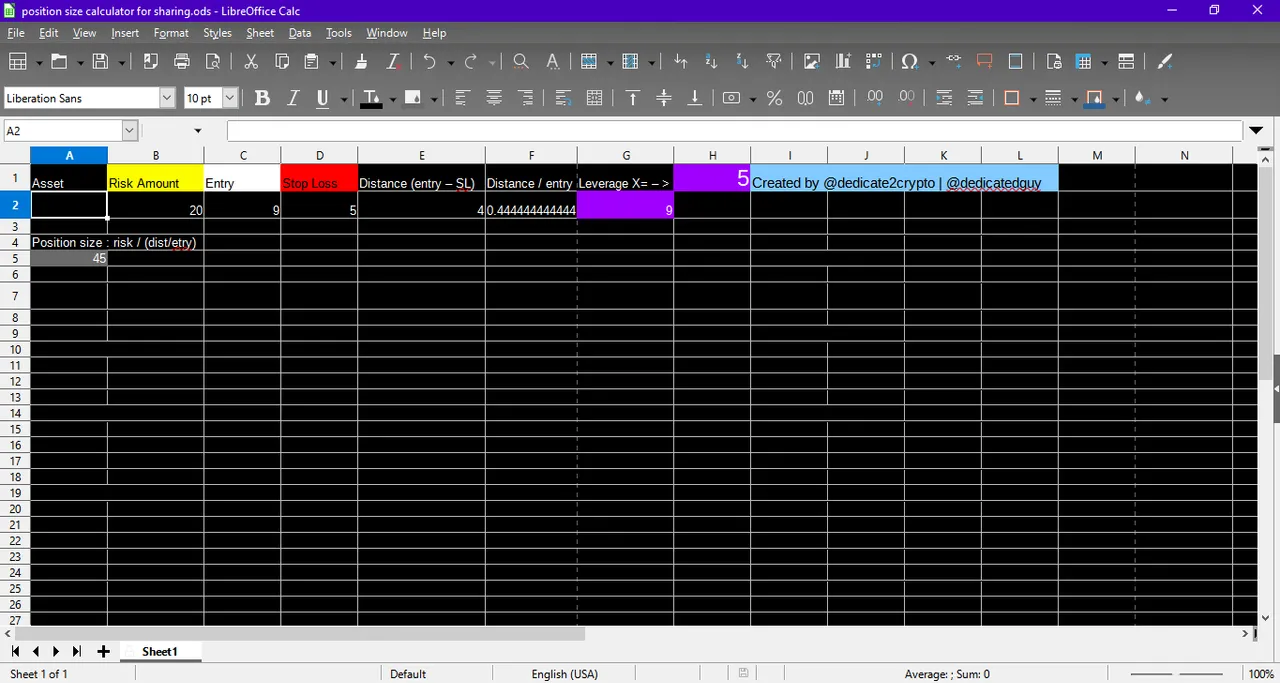

With those 2 price levels, entry and stop loss, and having determined your risk in fiat money (such as dollars) based on how much do you have in total for trading, then you can properly calculate your position size. This is done with a formula, but I personally use an Excel spreadsheet with the formula already integrated in some cells so I only need to enter my risk in dollars, entry price, and stop-loss, and the spreadsheet gives me the position size. I uploaded the spreadsheet to google docs here so feel free to download it.

Below you can see a screenshot with some random numbers so you can see how it looks with the black background I use:

Under the yellow cell, you input your risk in your preferred fiat money.

Under the white cell, you input your entry price. If you use a white background then feel free to change it for another color.

Under the red cell, you input your SL price.

The grey cell shows you the position size in total in your fiat money. So, if you enter that amount and your trade goes wrong and your SL order gets activated, you will lose you predefined risk (the number under the yellow cell).

The purples cells show you the money you will need to enter the position size if you use leverage. In the example above, the leverage is the big number 5 but you can edit this number freely.

The other 2 cells with no color are simply calculations for the position size, and their only use is being part of the formula.

If you use leverage to place your trades in futures, have in mind the added cost of funding fees. The journal template I will share soon in another post has a small reminder for them.

I believe there are websites, and even telegram bots that also make calculating position sizes very easy, but in my case, I like using the spreadsheet I shared a few paragraphs above.

One thing to take into account is that it isn't possible to measure the risk in fiat money if you are trading BTC pairs. In those pairs, you can only measure the risk in BTC.

Something to think about risk management.

It is my honest opinion that any strategy without proper risk management will eventually liquidate the trader no matter how good the strategy is. Without proper risk management, there are no defenses when the market goes in your opposite direction, and this can happen at any time. Black swan events are impossible to predict, and in crypto, they are much more common than in other markets. Just a few days ago, for example, there was a harsh collapse in the FTM ecosystem because one of the main devs suddenly decided to stop working in crypto/defi.

On the other hand, entering based on coin flips with proper risk management could, in theory, end up being profitable because you would be limiting your losses which would be 50% of all the trades, and depending on your active management, you would be letting the winners run which would be the other 50% of your trades.

Understanding this can really cement the importance of risk management in one's mind. By the way, the above example isn't my own but I hear it while watching a video from mentfx and I realized how deep this realization could be.

I hope you found this information useful, and in the next post, I will share a much more complex Excel template that I use for my journaling. I would also be explaining the importance of measuring and registering our trades results using the risk to reward ratio.

Thanks for reading!