Markets vote with the certainty of the known. Yields continue to move higher including in Europe. Tariffs should help non-Chinese rare earths producers. Averaging down in diamonds.

Portfolio News

Market Jitters - Tariff Tantrum

Markets like certainty.

I have been writing a lot about the battle between fear and data. I was chatting to a friend yesterday who knows a little about markets. I said I had been watching over the last 3 weeks Italian stocks in my portfolios posting gains almost every day. He says "they are not bothered about tariffs" It has been the bellwether for me. It was a good one. The tariffs came out. China responded. The facts are now known and even better there are dates attached. Markets go back to understanding the data - jobs growth, earnings growth, oil price rising = all good for US stocks. And we see record inflows to US equities. NOW, the timing of this is a little unusual because this does not normally happen before the quarter end - it normal starts when Q4 begins. That alone is a measure of sentiment - a notch down on the fear index.

This article has data on fund inflows to US equities

https://www.ft.com/content/66fc6cb2-bd1c-11e8-8274-55b72926558f

It is not only in stocks that fear is subsiding.

Markets in interest rates are making up their minds. It must be true - Jeff Gundlach says so. I saw that tweet flash by on my screens and I celebrated. He is the King of Bonds to be taken seriously.

https://twitter.com/TruthGundlach/status/1042208291391041536

- TruthGundlach

I have been watching Europe rates continue to move. A chart shared to my Facebook group yesterday.

Note: this is a price chart. Price drops = rates rise.

Cannabis Carnival Cannabis craze. Reefer rally. Pot stocks. The carnival moves on and prices jump up and down daily with big swings.

The article is a compilation of 6 video clips of so-called experts over the last 3 weeks.

I cut and paste this image as the talking head talks about blue sky. He does make sense when he talks about margins getting squeezed in farming of the crop. This happens to all types of farming. Dead right. He does not see the vision - listen on to the others and make up your own mind. Of note is the Bitcoin price tickers that appear in the videos too. $6944 on August 30 clip a bit higher than it is now

https://www.cnbc.com/2018/09/20/cannabis-marijuana-pot-tilray-stocks-investing.html

The part that really gets me about the talking heads is they compare the cannabis craze to the cryptocurrency craze. Crypto is absolutely at the concept stage with very few working business models generating revenues and profits - that will come. Cannabis is a step further along. It is legalized in 35 countries which means there are farmers operating legally in 35 countries. There are entrepreneurs investing in plant and equipment to extract materials and to produce products. There are distributors preparing distribution models. This is a whole lot further along in evolution. Listen carefully to Steve Risso and Jim Cramer - they get it.

You read it here first.

Bought

Arafura Resources (ARU.AX) Australian Rare Earths. Arafura is building a mine and pilot plant to produce NdPr, a rare earth that is used to make permanent magnets. I have been invested in Arafura for a long time. The story goes back to August 2006 to a cycling trip I did from Darwin to Adelaide. I was chatting to a man who was living in the caravan park. "Mark, there are a lot of vehicles driving around in the hills behind us here. They have laid out some really good roads. I do not know what they are doing but they are spending a lot of money - the trucks say Arafura"

Behind that hill, Aileron, Northern Territory, Australia. I did my research in 2008 and bought and sold a few parcels of shares. By 2010, I had made a 32% return on my purchases. Then prices hit the skids. The chart shows exactly what happens in resource investing.

Early investors and speculators buy in. As the news flow grows the price accelerates. As soon as the reality of what the mine and processing is going to cost in capital terms comes along, the price tanks and a new group of shareholders comes along. The Arafura story has a few more wrinkles in it as they have changed the processing strategy a few times along. The initial plant design was very expensive. The next plan idea to do processing at the export port made a lot of sense but got a lot of heat as it did require transporting the raw material a long distance (over 2,000 kms) by rail. That is all well and good but the stuff is radioactive. That required a replan - and a delay. Status is the pilot plant is running.

I have drawn in my investing story on the chart

- The initial discussion in 2006 (green arrow)

- Wave one of purchases from two lows (blue arrows) and sales (red arrows) near one of the highs. Last entry was at about the same price it was in 2006

- Wave 2 on the next lows and the wave 2 run up - one exit on the way up here BUT maybe held on too long

- Wave 3 are responding to share purchase plan calls for capital

The tariff war is a player too. China is currently the dominant supplier of NdPr - a viable alternative supplier becomes a strong selling point. Bingo. Since that 2006 conversation, electric vehicles have become a viable and growing idea - bingo some more. Like all resource investing though, this is a long game. I have position size equivalent of a half standard position invested. The current share price is below the SPP price - I might just double up. TIB33 discusses rare earths in a little more detail

https://www.mining-journal.com/resourcestocks/resourcestocks/1343028/arafura-answers-the-call-for-magnet-metals for more background

Merlin Diamonds (MED.AX): Australian Diamonds. I have had a low ball bid out on Merlin Diamonds. My first purchase was at $0.006 and I put a bid in at 1/10 of cent lower. The beauty of penny stocks is a small unit move is big in percentage terms - 16.7% in this case for 1/10 of a cent - I just averaged down my entry price by 8.4%. See TIB289 for the rationale on the first purchase.

Expiring Options

I have options expiring overnight on steel, aluminium and retail banking. I am not rolling any over.

Income Trades

Covered calls are expiring overnight. Quite a few have passed the sold strike prices. I am not buying any back - I will deliver the stock.

Cryptocurency

Bitcoin (BTCUSD): Price range for the two days was $435 (6.7% of the low). Price action two days ago (September 19) was vigorous with a a low test bar testing almost exactly the short term support (the pink ray now made a bit longer) and then testing above the resistance line above ($6500). The encouraging part is the next day saw price push back up past $6500 and hold there

Disappointing part is price did not make a higher high. Do not be surprised to see struggle around this $6500 zone before it decides which way it wants to go.

Ethereum (ETHUSD): Price range for the two days was $33 (16.7% of the low). Price did hold above the $200 mark for two days and made a higher high. There is quite a bit of price congestion around the $275 mark - that will be the next target for a move up.

CryptoBots

Outsourced Bot No closed trades. (221 closed trades). Problem children stayed at 18 coins. (>10% down) - ETH (-67%), ZEC (-66%), DASH (-58%), LTC (-48%), BTS (-41%), ICX (-79%), ADA (-68%), PPT (-82%), DGD (-83%), GAS (-84%), SNT (-60%), STRAT (-76%), NEO (-79%), ETC (-52%), QTUM (-79%), BTG (-72%), XMR (-34%), OMG (-68%).

All but PPT went up 1 or 2 points. ICX (-79%), ADA (-68%), QTUM (-79%), and NEO (-79%) moved up a level. ADA was the best improver at 5 points up. GAS (-84%) remains the worst.

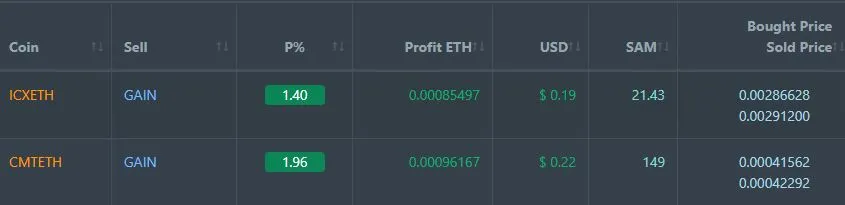

Profit Trailer Bot Two closed trades (1.68% profit) bringing the position on the account to 2.71% profit (was 2.68%) (not accounting for open trades). Both these trades were PT Defender trades. I have pushed up the exit target to 1.35% which is less than half the daily volatility we see on Bitcoin prices.

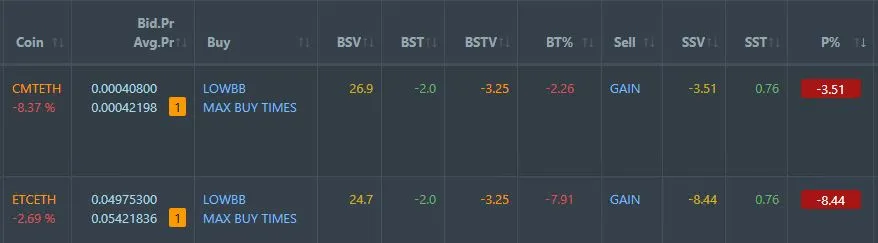

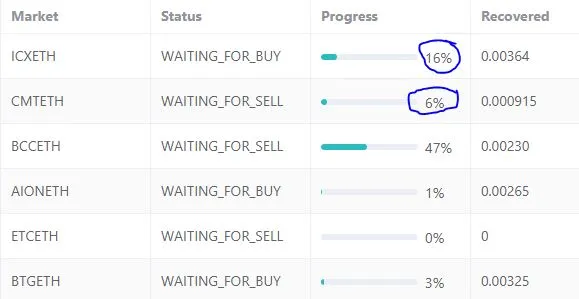

Dollar Cost Average (DCA) list remained at 2 coins with CMT going off and back and completing one level of DCA

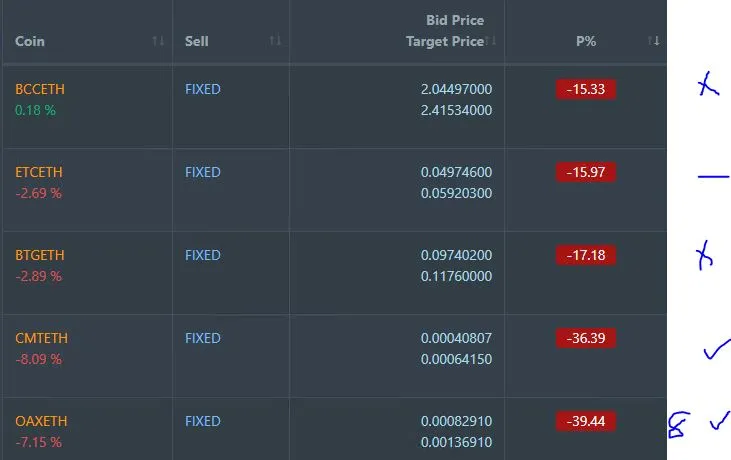

Pending list remains at 10 coins with 4 coins improving, 3 coins trading flat and 3 worse. OAX was the best improver at 8 points.

PT Defender continues defending 6 coins and did make progress on defence of ICX and CMT.

New Trading Bot Trading out using Crypto Prophecy. Trade on SNT from September 9 closed for 1.4% profit. Chart shows exit coming with a pump and dump.

I did open one new POE trade on a Bollinger Band signal

Trade closed for 1.44% profit directly after entry. There is scope for more. A bot would have picked up 2 or 3 entries.

That leaves trades open on DGD and TRX. TRX is racing ahead and I am hoping to hit the target soon.

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 17.8% (lower than prior 19.9%).

Outsourced MAM account Actions to Wealth closed out 1 trade for 0.04% loss for the day.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search and CNBC.com. Gundlach tweet is from Twitter.com. Aileron photograph is mine. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

Crypto Prophecy provides a useful tool to identify oversold and overbought coins - https://mymark.mx/CryptoProphecy

September 20, 2018