Another week for keeping a low profile with a little more work done in uranium holdings. Down markets also allow some averaging down on small initial holdings

Portfolio News

In a week where S&P 500 rose 0.48% and Europe dropped 0.43%, my pension portfolio dropped 2.14%. Big drags in lithium (e.g., Pilbara Minerals (PLS.AX) down 9%, plus Global X Lithium plus Livent (LTHM)), solar, base metals (Eramet (ERA.PA) down 8.3%), US small caps (Clear Secure (YOU) down 10.9% and SunRun (RUN) down 16.8%). AAplus exiting a few positions like ClearSecure, American Waterworks (AWK) and Chargepoint (CHPT) added to the negative sentiment. Even Japan was down.

Big movers of the week were AXP Energy (AXP.AX) (+100%), Bayhorse Silver (BHS.V) (+33.3%), NuScale Power (SMR) (+17.3%), Panther Metals (PNT.AX) (+12.9%), Blue Star Helium (BNL.AX) (+12.5%)

5 stocks on this list tells us all we need to know about he markets = a down week. One glimmer of related moves is the pop in NuScale Power price on the back of a deal with Standard Power to acquire two SMR's to power data centres. NuScale will provide its approved NuScale SMR Technology for these projects, the only SMR technology that has received design approval from the United States Nuclear Regulatory Commission

https://finance.yahoo.com/news/standard-power-chooses-nuscale-approved-105000222.html

Markets are nervous as yields cruise around 16 year highs. This produces spiky responses to any news. The government shutdown was averted (for now) - markets went up and down on that news. The private jobs report came in a little lower - markets celebrated that a little. Non-farm payrolls came in hotter than expected and the rate rise fear surged - for a while - and then the analysts read the report. Wage growth was not strong - time to celebrate with an up day in the end.

Markets have not seen times like these for a very long time - like 60s long time. All the indicators say there should be a recession coming but employment numbers and consumer savings numbers are saying otherwise.

Uranium Supply Deficit

Did watch a good interview with Adam Rozencwajg of @Go_Rozen with a run through of the history of uranium pricing going back to the 1940s. His view is the nuclear power station rollouts in China, India, Saudi Arabia - keeps the market tight to end of the decade. Add in investor sentiment from Western investing markets will underpin pricing. His view on what to invest in: Sprott physical uranium fund (U.UN), Cameco (CCJ), and NexGen (NXE.TO).

Next up are next projects coming on stream NexGen (NXE.TO) - Arrow development, Denison (DML.TO), Kazatomprom (KAP.IL) if they can ramp up production as announced and if you can tolerate the sovereign risk.

Need higher prices after that around $120 level for anything else - all somewhat speculative. His view is deficits in the markets for next 7 years are so severe and there is a chance of a price spike scenario. Beyond the end of the decade, nuclear power is 3 times more efficient than best oil ad gas and 10 times better than wind and solar. Steel carbon output is as great as passenger car fleet. An obvious way to tackle that carbon footprint is to power steel mills with nuclear power.

The uranium bull market is just getting started, but it could get "completely out of hand" before it's over. From a demand perspective, utilities are captive buyers that need to get their hands on the fuel.

Crypto Drifts

Bitcoin price could not sustain the surge from last week and drifted lower ending 1% down on the week with a 5% peak to trough range

Ethereum price was more active going lower ending 4.8% down on the week with peak to trough range of 7.9%

Not a lot of brightness in the alts - a few pump and dumps not worth reporting. One move off the bottom is IoTeX (IOTX) might be worth a nibble with two higher highs off a low tat matches the 2021 lows.

Bought

Heavy Minerals Limited (HVY.AX): Garnet Mining. Newsletter from Next Investors highlighting fund raising event to fund the pre-feasibility study made using a royalty agreement which is non-dilutive to existing shareholders. The potential of a capital raise has been suppressing the price - this might take the pressure off. Added to holding to average down entry price.

iShares 20+ Year Treasury Bond ETF (TLT): US Treasuries. With price opening at $86.31, assigned early on 96 strike sold put in managed portfolio. Position was a leftover from a ratio put spread started in July 2023. Breakeven is $94.27 - going to be a long haul to win this back especailly with a yield of only 3.22%. Step one was to write covered call just below the break even for 0.4% premium with 8.9% price coverage. That premium brings breakeven below 94 strike

IsoEnergy Ltd (ISO.V): Uranium. Uranium stocks have fallen harder than the broader stock market indices in the last few weeks - 6% down for S&P500 vs 19% for this uranium stock. Added to my holding to average down entery price - holdings are still quite small.

Consolidated Uranium (CUR.V): Uranium. IsoEnergy announced in late September a merger with Consolidated Uranium on September 27 to create a diversifeid uranium business. I watced an interview wth the CEO of Consolidated - they are essentialy a projects deal maker rather than a mining development business. The deal adds properties in Athabasca Basin, Canada to their wide geographic spread with the get to market expertise coming from IsoEnergy team.

Charts are showing that market has not reacted to the deal in exactly the same way - added a small holding to be on both sides of the deal. Sometiems these deals do not develop in the way planned especially when there are courts involved. The details of the deal are Consolidated shareholders will get 0.5 Iso shares for each share they own - this means that the Consolidated share price shuld be exactly half the Iso price (less trading costs). Buying this parcel gets access to Iso shares at a 5.6% discount. There are no dividends to distort the ratios.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Only scale ins and sales this week. Scale ins are stocks moving between 5 and 10%. Scale in lot size is half of new buys at $150

Ran out of trading costs credits in the week - will hold off on new trades until the now month begins - October 7

Scale Ins

Fortescue Metals Group (FMG.AX): Base Metals. Dividend yield 10.10%

Yancoal Australia (YAL.AX): Coal Mining. Dividend yield 10.40%

Ampol Ltd (ALD.AX): Petrol Retailing. Dividend yield 6.70%

Sold

Pointsbet Holdings Ltd (PBH.AX): Gaming. Pointsbet sold the US gaming business and returned capital. This changes the dynamic of the holding - closed out the rump holding for an overall 3.5% profit since June 2023.

DDH1 Limited (DDH.AX): Mining Services. Acquired by Perenti (PRN.AX) in a stock and cash merger. On a mark to market basis would be a 12% loss at the price Perenti trading at the day stock was delivered.

Hedging Trades

iShares MSCI France ETF (EWQ): France Index. With price opening at $34.87, December expiry 38/36 ratio put spread is in-the-money leaving me exposed to 36 strike sold puts. Rolled the naked portion out to March 2024 for 26% loss but in a cash positive trade.

Quick update of the chart shows that price had four tests of the sold put (36) level since trade time before finally pushing lower. Normally, these hedge trades are done with a shorter options expiry time reducing the time value of the ratio sold put. Options market is not liquid enough to do that. Plan will be to close out the remaining bear put spread as theoretical maximum profit has been made. With low liquidity, prices are not following the options pricing models. Might have to go to assignment and exercise on expiry

Cryptocurrency

Thorchain (RUNEETH): Launch of ShapeShift decentralised exchange propelled RUNE price with pending order hit for 50% profit since April 2023. has been a patient hold.

Seems that the pending order was not the only thing watching the price

A pressing and persistent concern has recently come to light: the potential movement of illicit funds through THORChain and, specifically, THORSwap,” THORSwap posted on X (formerly Twitter). “Such activities have no place on the THORSwap platform, and THORSwap stands firmly against any and all criminal actions.

It seems that the folk who hacked the FTX wallets are cleaning their funds through ThorSwap

https://coinjournal.net/news/thorchains-thorswap-dex-now-in-maintenance-mode-amid-illicit-activity/

Income Trades

Quiet week for income trades wih only two covered calls written in 3 portfolios (US 2). Continuing the process of writing only for profiable exists while markets are down.

Naked Puts

iShares 20+ Year Treasury Bond ETF (TLT): US Treasuries. With price opening at $85.77 (Oct 4), rolled out 94 strike sold put. Buyback was at 415% loss but was slightly cash positive. Will keep the rolling going a bit until yields start to flatten again and then go to exercise. 1.4% rise in price on the day was a good start on the back of private jobs report coming in a little low.

Commerzbank AG (CBK.DE): German Bank. With price opening at €10.12 (Oct 4), rolled down and out 10.4 strike sold put. Buyback was at 147% loss but was moderately cash positive. Last week Commerzbank announced a massive capital return via dividends and buybacks and price surged past covered call strike. This week the nerves got the better of all of that and gave away most of those gains.

UBS Group AG (UBSG.SW): Swiss Bank. Went back to the plan to sell naked puts at strike stock was assigned at in July. Premium as a tiny 0.35% with wide 12% price coverage for 2 weeks exposure.

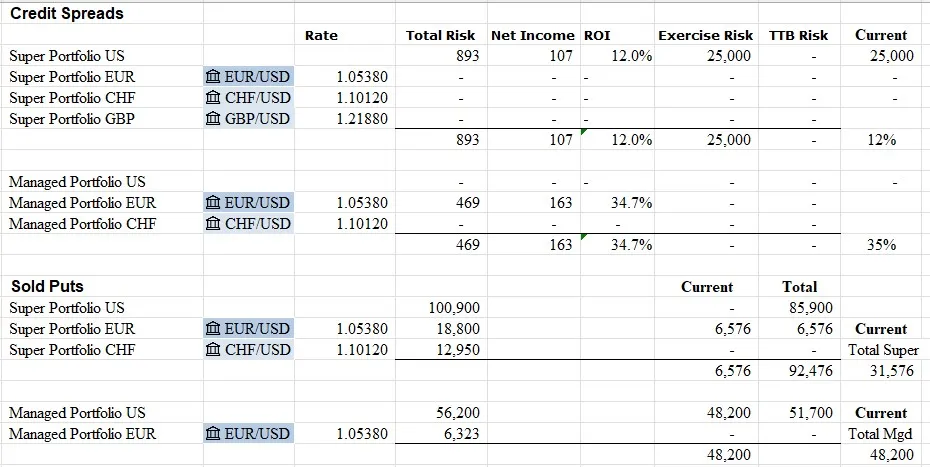

Credit Spreads

McDonald's Corporation (MCD): Restaurants. 12% ROI 2.3% price coverage. AAPlus idea.

Exercise risk is withing margin lines provided there are no really early exercises. US Treasury shorts in two portfolios are under observation.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

October 2-6, 2023