This is a value for value post: see the explanation in the footer.

Last Week

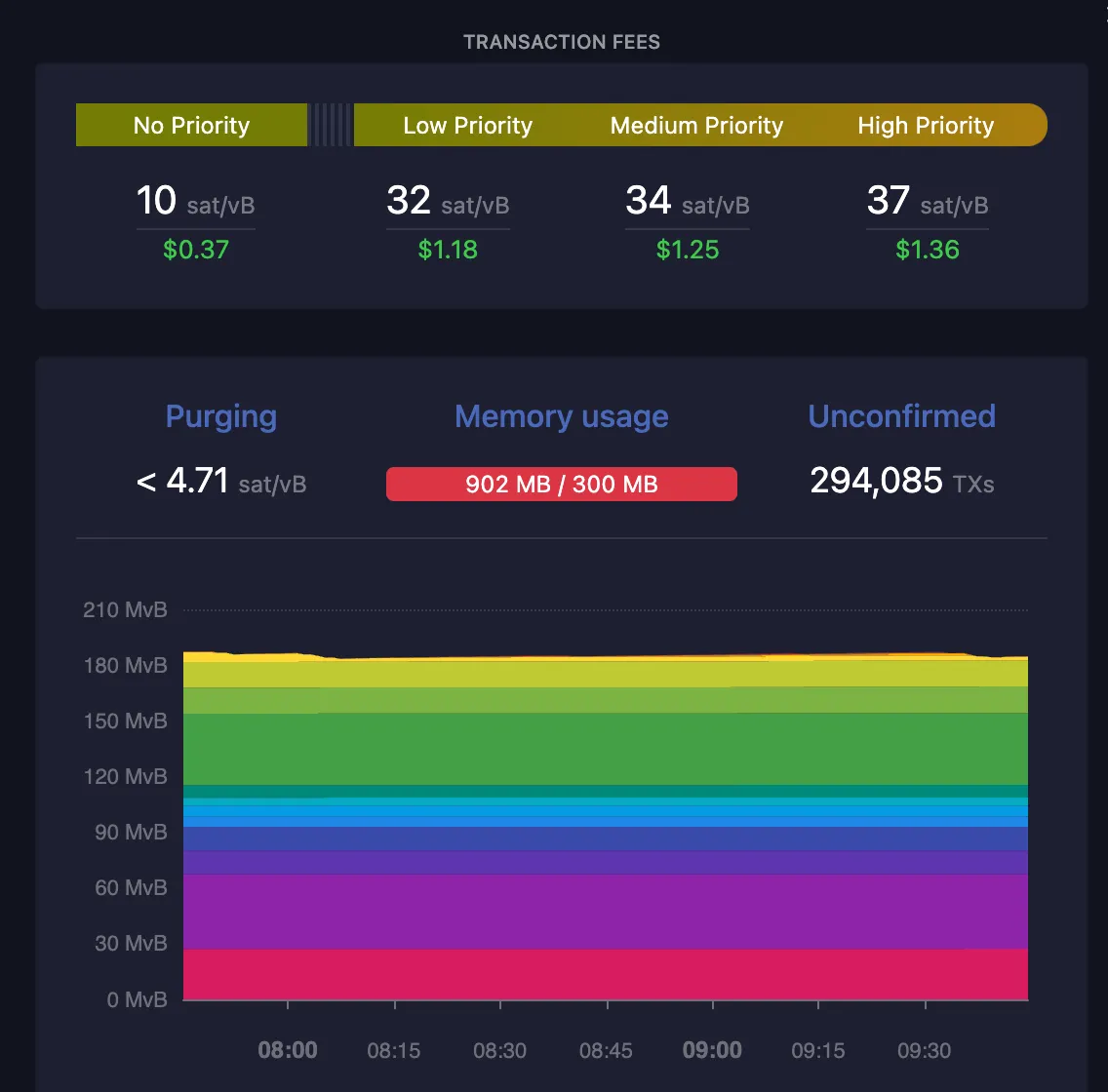

Last week at the height of the Mempool's insane climb to some of the highest fees we've ever seen and a backlog of 400,000+ transactions, I wrote the following:

I’ve been reluctantly building on Lightning because I saw big VC money going in and to ride those coat tails and pick up on what they built.

The current fiasco with Ordinals has me doubting Lightning’s future entirely.

I don’t see any ROI for VCs when channel openings and random closures will eat all possible profits and cost reductions. Without centralised services and huge nodes investing big BTC bucks, I don’t see any way this works.

I don’t see what incentive Miners have to do anything different, they make bank on these fees. They don’t want stupid 1 sat/vb channel openings and at 100+ sat/vb I don’t see how Lightning is viable.

Perhaps at some point this destroys Bitcoin completely, I don’t see how the original “best money ever” continues when moving it even via Lightning requires either a huge upfront investment or huge fees.

Where is the incentive for Miners to even want to change the code and discourage arbitrary data storage?

Unfortunately Bitcoin’s ridiculous governance model (i.e. shouting on Twitter and some email lists with no actual ability to force a change in the code) looks increasingly like its biggest vulnerability.

Why am I wrong?

But The Mempool is Recovering? Right?

As I write this on Friday, the Mempool is back to costing 35 to 60 sats/vB to get Bitcoin transactions confirmed quickish (as quick as BTC ever is with its 10 minute blocks). This is still 50x more than I've been paying for most of the time I've been using Lightning.

This matters critically to Lightning because channel opening and closing is the ONLY way Bitcoin moves INTO or OUT OF the Lightning Network. Somewhere, someone has to open or close a channel for the amount of Bitcoin within the Lightning network to change.

What does this spike do?

If you can open and close a Lightning channel for pennies and then move a few hundreds or thousands of dollars back and forth, Lightning makes sense.

I've had one channel which whilst only being 5m Sats ($1,300) managed to transfer 2.1 BTC ($55,000) backwards and forwards over its 9 month life. That channel cost me peanuts to set up. The problem is, for no readily discernible reason, it was closed automatically just before this current blow up. I did nothing wrong but somewhere something happened and the channel close.

I actually have a reason for running a Lightning node. I provide a service which many people use. The dream of the Bitcoin Maxis however, is that "ordinary" people will run these nodes. Well that works when channels cost 30c to open, but not when they cost $10. That's what the spike in fees does.

The result of driving out the hobbyists is exactly what @theycallmedan @starkerz and I go on about every week on @cttpodcast : centralisation and capture.

Thanks for reading this far, I'll be back posting about the new @v4vapp website build after the weekend and if you haven't heard, we're under steady rocket attack here in Israel. Stay safe everyone, see you next week.

Value for Value

For the last few months while building @v4vapp I was generously supported by the DHF. Going forward I have a much more modest support which covers direct server costs and a little of my time.

If you appreciate the work I do on and around Hive, you can express this directly: upvoting posts on Hive is great. Also consider a direct donation (there's a Tip button on Hive or a Lightning Address) on all my posts.

Support Proposal 244 on PeakD

Support Proposal 244 with Hivesigner

Support Proposal 244 on Ecency

Vote for Brianoflondon's Witness KeyChain or HiveSigner