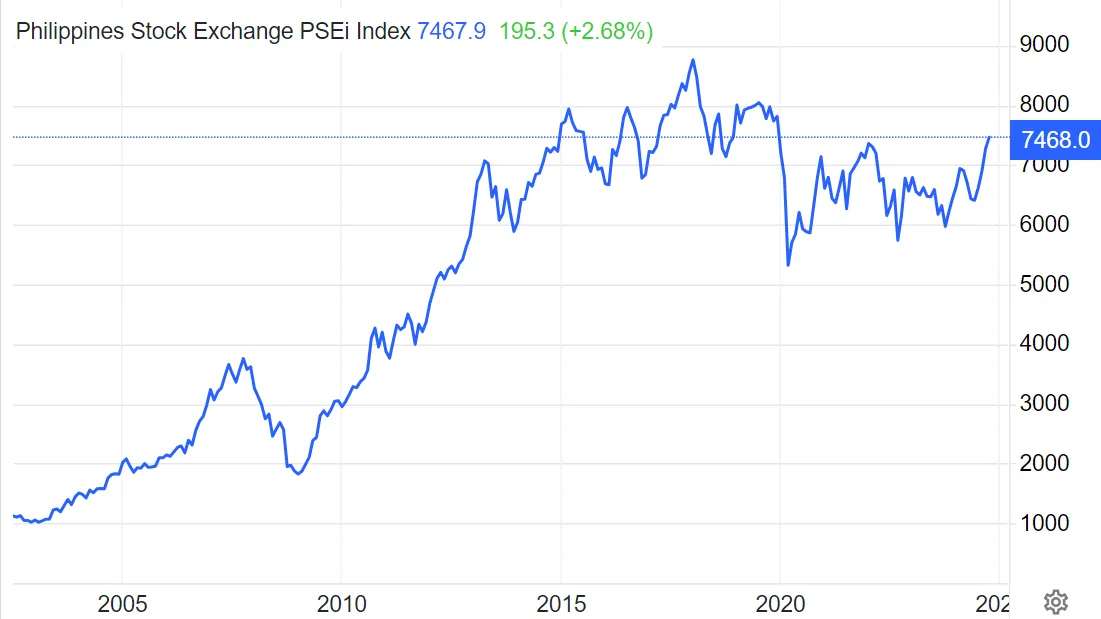

The global markets speak of recession and WW3 news but PH market seems to be cooking for a bull market. I'm still focused on the wealth inequality aspects of the economy but can't help but seeing textbook situations where a possible expansion coming along after a period of long consolidation since 2020

BSP is trying to break free from the FED when it comes to it's decisions on rates. While the global financial crisis of 2008 screwed several economies back then, Philippines also suffered but on selected sectors more focused on export of manufacturing electronic products because it didn't have a lot of exposure to the real estate market.

I get mixed signals from this because liquidity in the PH stock market also relies on foreign money coming in and that's affected by FED interest decisions. At the same time, it gives me more incentive to study the local stocks for value investing since interest rate decisions affect these the most. The recent inflation report for September 2024](https://psa.gov.ph/content/summary-inflation-report-consumer-price-index-2018100-september-2024) shows a 1.9% inflation from 3.3%, August 2024. That gives BSP more reason to reduce the interest rate given that July's data shows a 4.7% unemployment rate.

This sets up the stage for asset prices to rally as those with deeper pockets anticipate the cut in interest rates for mortgages. The plans to reduce the reserve requirements for banks helps bring more liquidity to the market which supports ideas of an upcoming bull market soon. Now the middle class can have more incentives to avail those mortgages. I'm seeing a possible boom in the real estate market so I'm taking my time picking up some Property stocks.

The bullish signs are there but as expected from people not in touch with financial news, it doesn't seem like anything even improved and the quality of life just gets worst. I'm not going to convince myself a short term bull run is going to change the wealth inequality, it likely just increases the gap as it gives more money to the rich while the rest are contented of getting a piece of the pie. But a bull market is better than a bear market if we're just comparing quality of life.

Thanks for your time.