Recently, I have managed to restart of building up my liquidity pools. I think this have been a less mention feature of Splinterlands and I think it is good to do a refresh briefing on it, especially for those new Splinterlands users who want to look for passive income.

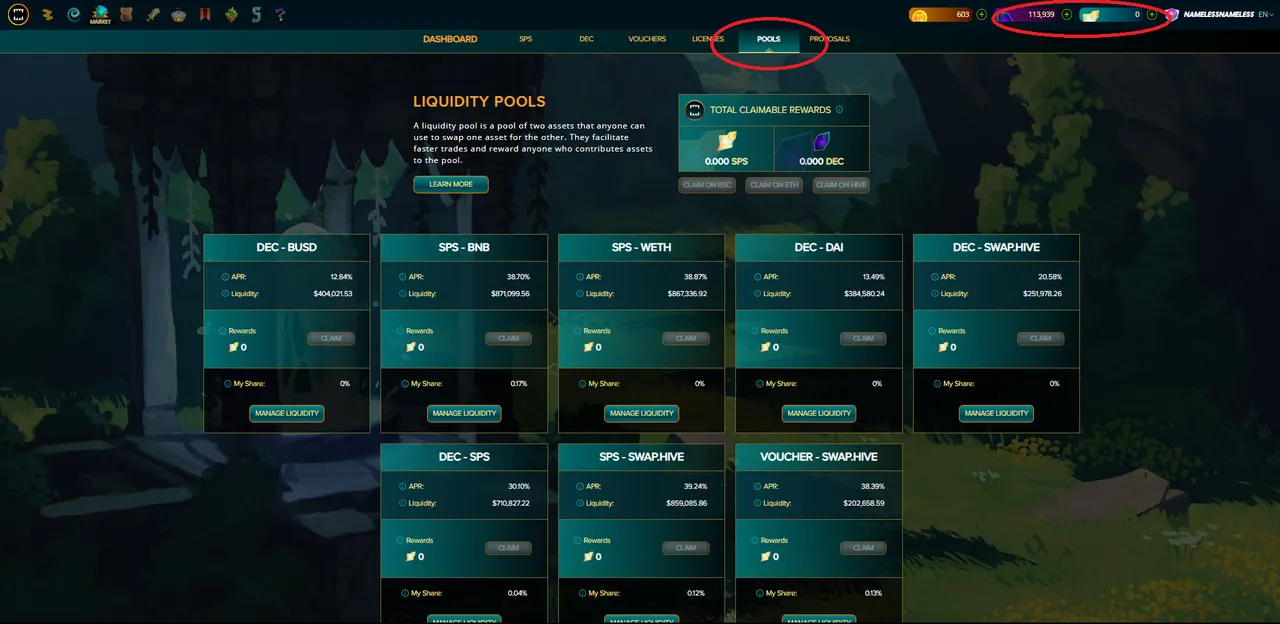

Available liquidity pools(LP)

You can access this function through the Splinterlands tab. By clicking on the top right DEC and SPS tab. You will access to the Dashboard and you can select the "Pools" tab. It will then bring you to the following list liquidity pools.

| Token 1 | Token 2 | APR |

|---|---|---|

| DEC | BUSD | 12.84% |

| SPS | BNB | 38.70% |

| SPS | WETH | 38.87% |

| DEC | DAI | 13.49% |

| DEC | SWAP.HIVE | 20.58% |

| DEC | SPS | 30.1% |

| SPS | SWAP.HIVE | 39.24% |

| VOUCHER | HIVE.SWAP | 38.39% |

Providing Liquidity Pool

Here, I will try my best to guide on how to providing LP so you can get passive SPS income. As you can see, by providing LP, you can get rewards as high as close to 40% ROI! To provide LP, you will need to have both of the tokens.

We will focus on DEC-SPS LP.

For this LP, you will need both DEC and SPS tokens. Do take note that you need to have these tokens on hive engine, and in-game.

Make sure you have both tokens on hive engine

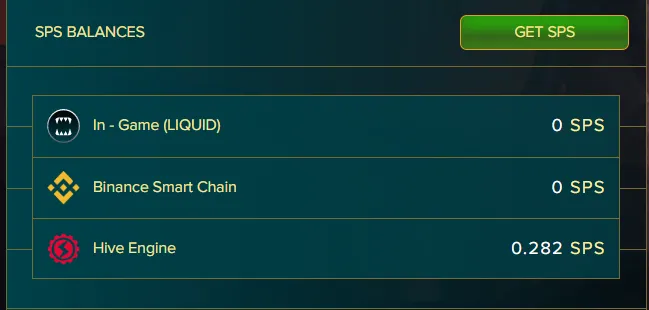

On the SPS dashboard, you will need to make sure the SPS on hive engine.

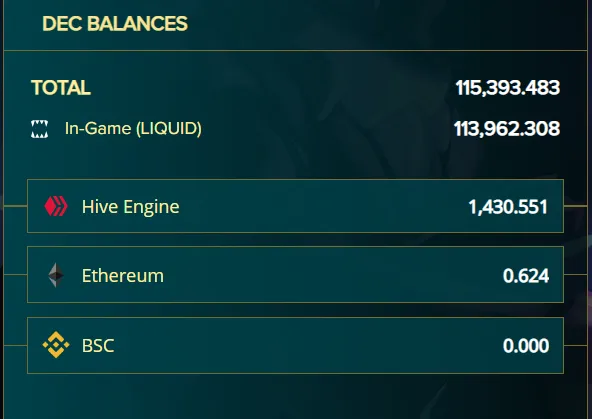

On the DEC dashboard, you will also need to make sure the DEC on hive engine.

Accessing the liquidity pool platform

Then, after we have made we have both the tokens at hive engine, we can go back to the pool tab at the dashboard. Locate the DEC - SPS pool and click on the "Manage Liquidity".

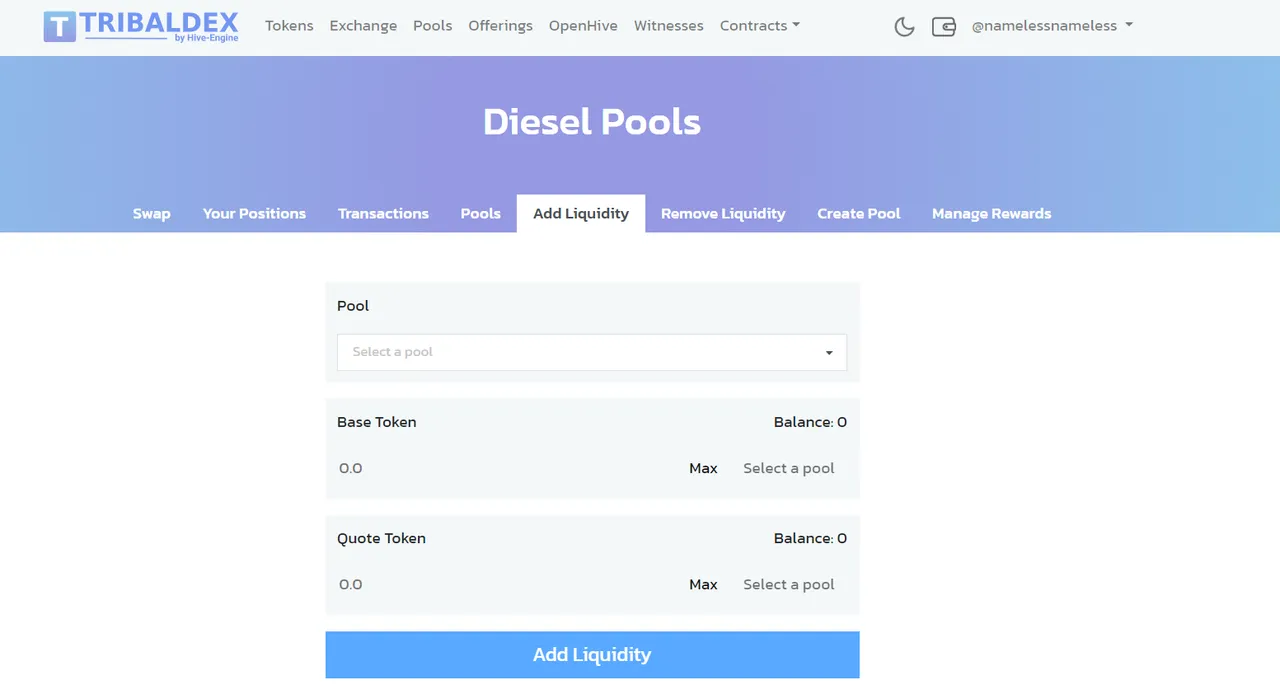

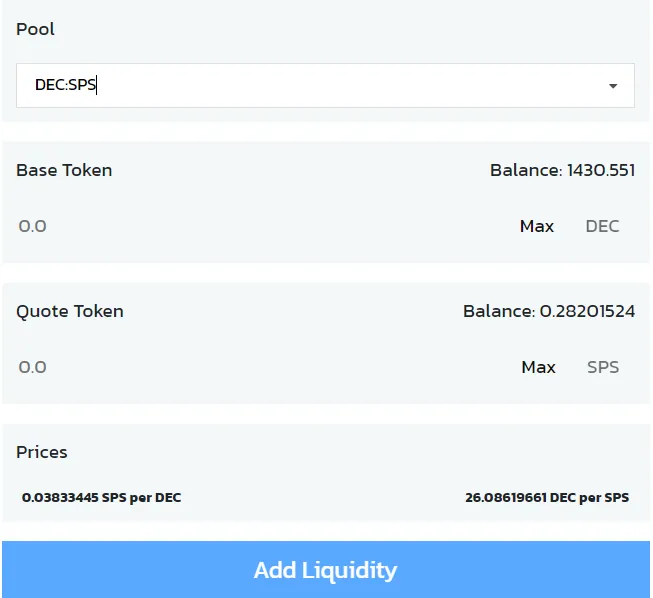

Splinterlands make it super friendly user where it will bring you directly to the website where it will track the LP. For DEC - SPS LP, it will bring us to Tribaldex, exactly to the add liquidity pool tab some more. This is what you will see.

Note: Make sure you are login on the platform.

You just need to choose DEC : SPS and it will immediate show you the amount of DEC and SPS in your hive engine wallet.

All you need to do is to select one of the token and input how many SPS or DEC you want to provide to the LP.

Note: You have to provide equal value of DEC and SPS. So for example, you have $100 worth of SPS and $50 worth of DEC. You can only provide $50 SPS and $50 DEC into a liquidity pool worth of $100. You can always consider to swap the half of the remaining $50 of SPS into DEC so you can further add another liquidity pool of $25 + $25 = $50.

Collecting Liquidity Pool Rewards

After providing the liquidity Pool, you can start to get passive SPS income.

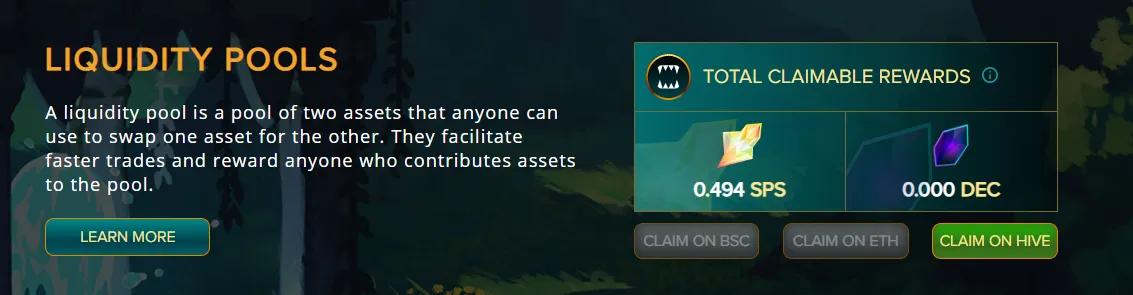

You can just go back to the Splinterlands ingame pool tab,

You can see that in my case, I have accumulate 0.494 SPS. You just need to click on the "claim on hive" and the SPS will go to your wallet. You can use the reward to further compound on the pool, so that means you can get way higher ROI than 40%.

Danger of Providing Liquidity Pool

There is a reason why I did not provide liquidity pool for a long period of time. In fact, previously I am providing LP but I withdrew all of them after a while. The risk about providing liquidity pool is impairment loss!

Explaining Impairment Loss

When you provide the tokens for the pool, you deposit 50% in token 1 and 50% in token 2. However, the pool will not have 50% in token 1 and 50% in token 2 when people may use the service to transfer from one token to another. So what happen when there was an increase in price for token 1, people will tend to swap their token 2 for token 1. So when that happen, the pool will support the the swap and it will hold more token 2 and lesser token 1. So when you withdraw, you will receive the tokens based on the pool proportion and not 50% for each token 1 and 2. In this case, you will receive more token 2 and less token 1, meaning if you have kept these 2 tokens, you may have more token 1 which can enjoy the appreciation of price more. Similarly when one token decrease in value, you will hold more of that token so you may face the drop in value more.