Let me preface like always that this is not financial advice and that this is for educational and entertainment purposes only. You should definitely do your own research and find out what the best investments are for you.

Why Stable Coins now?

Really, I'm just sick of losing money. Yes, yes, I know I think the smart thing to do when things go low is that you're supposed to buy the dip. Which, I try to do, but to be completely honest, I'm sick of trying to "time the market" and instead I'm trying to be risk adverse with at least part of my holdings and instead park money where I'm constantly earning passive income, and income in the form of stablecoins if possible. So in efforts to utilize my stablecoins as much as possible, I'll be looking at some of the strategies I've been messin' around with lately.

Before I dive any further, I'm not going to be talking about any of the conventional "mainstream" methods of accruing yields, such as getting 8% on GUSD with Gemini, 9% on USDC on Blockfi or even 19% on Anchor with UST because I'm assuming most readers already know about that already. What I'm going to be dissecting today are some lesser known methods that I've been looking at, in order to help build an argument about what the best alternative stablecoin pools/protocols are out there.

MIMS/UST Leveraging on Abracabra:

I'm just going to through this one out there first because you really can't ignore the APY you can generate with leveraging Abracabra. So I was a bit hesitant to even write about this one because I feel like this one is pretty mainstream as well, but the MIMS/UST leveraging can't be ignored, because even if MIMS/UST depegs by 30% (70 cents to the dollar) you can still achieve around 60% APY on your UST, which is pretty awesome. The downsides? This is not something you can easily start and stop whenever you want due to the lack of MIM Replenishes, plus it's on ETH and requires 4 different transactions. You'll be paying so much in gas fees that it's really only worth it if you're willing to put in something 4 figures or greater. That being said, it is a good option if you can plan to park your money there for awhile.

Platypus:

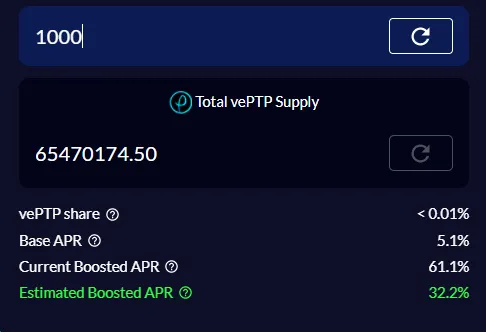

A curve-like protocol on Avalanche, Platypusallows you to "boost" your APR's with their native PTP token. The longer you have your PTP staked, you accrue vePTP which you then claim which in turn boosts your APR in whatever staked stablecoin pools you are a part of. Currently you can stake either USDC.e, USDC, USDT.e, or DAI.e. It probably sounds more complicated than it actually is, but if you're curious to check it out, they have a boosted calculatorto see how much you can actually earn.

In the example above, 1000 dollar deposit + 1000 claimed vePTP will generate an APR of 32.2%, or roughly 37.97% APY. There's a multitude of factors that determines your boosted APR, including your vePTP share out of the total vePTP supply, your amount staked out of the total pool, the base APR for the respective pool, and also the current price of the PTP token itself. If the PTP is more valuable, so will the booster APR. Unlike the MIMS/UST leveraging, you can take your PTP or other stablecoins in and out easily, but at least for your PTP, it's not recommended because your accrued claimed vePTP will immediately drop to 0, and thus, no boosted APR.

I've been investing low 4-figures in Platypus and I'm averaging around 120%APY which I'm pretty stoked about. However one annoying thing I've noticed is how many transactions it takes to do anything. It takes one transaction to deposit stable coin, one to stake your stable coin, one to claim your accrued PTP, one to claim your accrued vePTP and of course another to stake your PTP. This means that you have to constantly keep claiming your vePTP to increase your vePTP share.

Don-key:

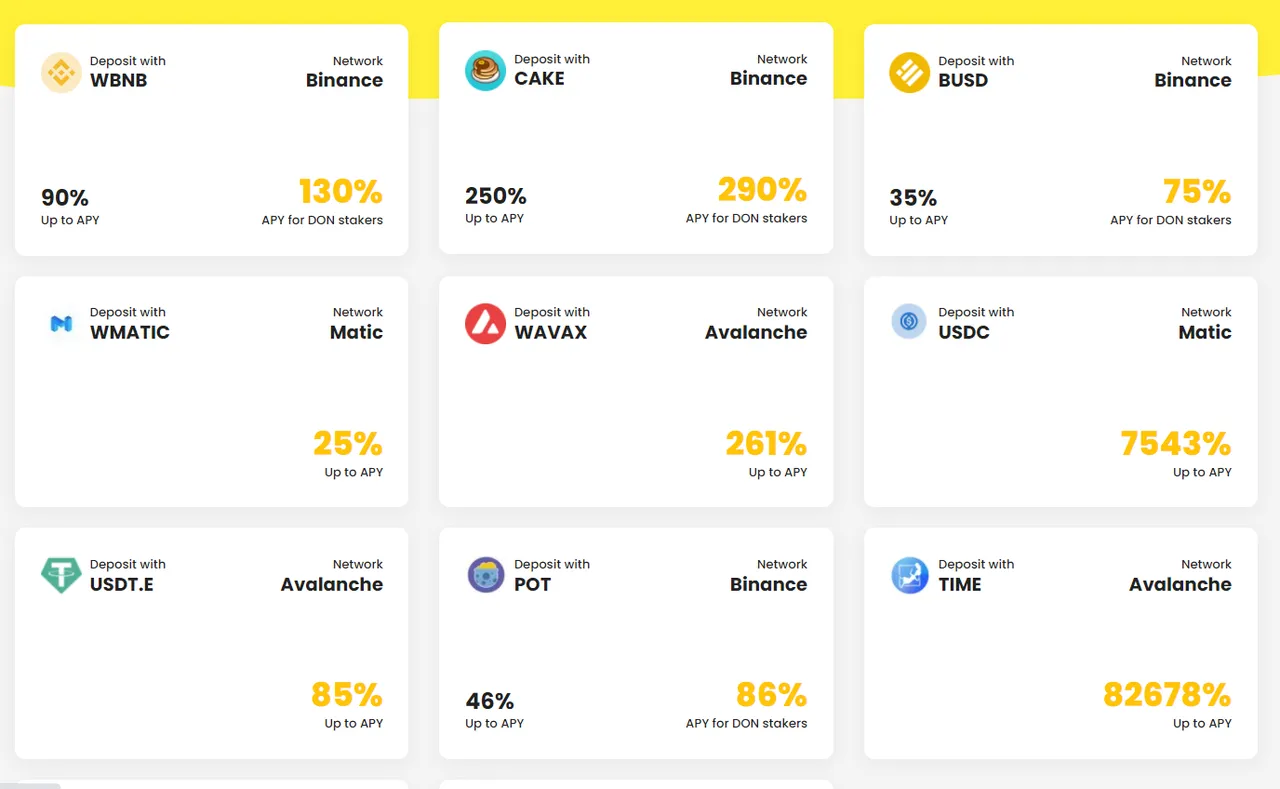

Don-key.finance is an etoro-like platform where people can post their different strategies and essentially you can copy them, exactly like you would copy trades on etoro. What caught my eye in the first place were some of the insane yields on these stablecoin strategies:

7543% APY on USDC for instance? That's insane. Now this is what they have advertised, but it's "Up to 7543% APY" for a reason. Doing a deeper dive into some of them, they actually post all the addresses of people that took part in each respective strategy--including how much they invested, for how long, and how much profit (or loss) they can claim at present. Now I think the concept here of copying and crowdsourcing strategies is pretty different which is a good thing, but doing the math on some of these, the returns are not-at-all consistent and in fact, they're all over the map. For instance, someone who invested on 5FEB is down nearly 20% yet someone who invested on 9FEB is up nearly 40%. Potential for great returns? Sure. But not really an investing strategy I'm looking for with my stablecoins.

Midas Investments:

Lol I guess I'm really not done schilling Midasyet. I've written a couple of posts about them now, but I'm including them in this because they've recently announced that later this month, you can earn 20% APY on all your stablecoin holdings which includes BUSD, USDT, USDC and DAI. These auto-compound daily as interests are paid out natively each and every single day. If you've been following my other posts on Midas, 20% is great and all, but this has come at the cost of them dropping some of their other rates, such as ETH going from 23% to 18% APY.

Another con of some of their stablecoin holdings are their withdrawal fees, more specifically on USDT and USDC, which is around $40, a bit more than some other exchanges. What I've done to circumvent this is to swap them to something else when I need to take money off, such as BUSD, which only has a withdrawal fee of $0.50. 20% with no lockup to worry about? Not too shabby.

And once again, if you haven't signed up for Midas Investments yet, please consider using my referral link to do so:

https://midas.investments/?p=0191

Is there anything I left out? Or are there any passive income strategies with stablecoins that I didn't mention that I should have considered? Feel free to comment below!

Resources

https://app.platypus.finance/stake

https://www.publish0x.com/jaik83/i-just-got-my-first-collateral-update-from-abracadabraand-it-xglgzrg

https://www.publish0x.com/jaik83/why-midas-investments-is-still-king-xlzrxdx

https://don-key.finance/dashboard/

https://midas.investments