As part of a study I have been doing on public external debt, which is divided into two main components: the central government debt and PDVSA's financial debt, I recently completed the analysis of the second, whose results I present in this article for knowledge of the general public, especially of the Venezuelan people, in our condition as sovereign shareholders of that state corporation so vital to the destiny of all of us and our children.

Several of the company's financial reports, as well as its management results, are published on PDVSA's official website. Taking as a source of data that material and doing a previous preprocessing to make the same items, variables and indicators compatible throughout the different reports, which have different levels of aggregation and disaggregation, making it very difficult to have series of data that allow analysis over time, I could build the tables and graphs that I present in this article, related to the financial debt of the company, as well as other indicators and variables of relevance for the analysis of their current situation.

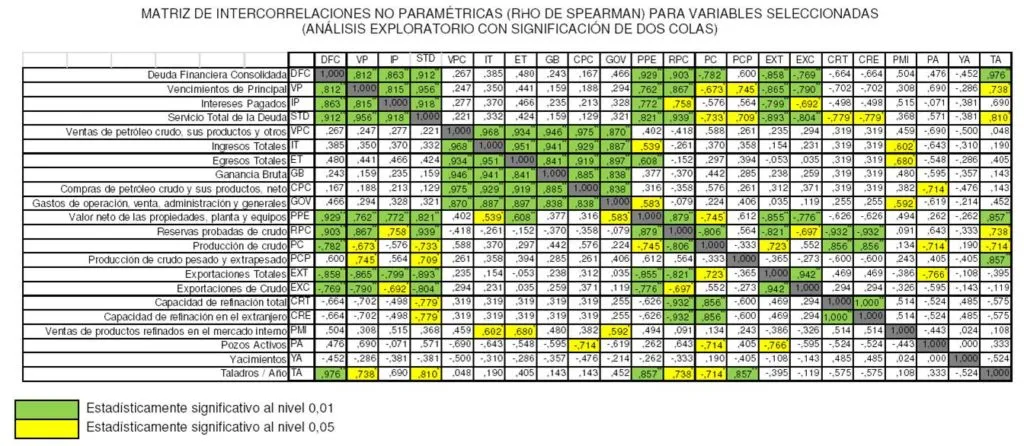

Likewise, I include a nonparametric analysis of intercorrelations for a selected set of variables, in order to explore statistically significant relationships and their implications. I worked with the ordered ordinal correlation coefficient of Spearman, which is a non-parametric analysis technique, thus avoiding having to make assumptions about the shape or size of the data distributions and their statistical errors, in particular about serial dependence or intertemporal autocorrelations.

I also include a couple of scenarios for projection of PDVSA's financial debt and its annual amortization, for the period 2017-2022.

If you prefer, the reader can skip the quantitative and graphical analyzes and go directly to the conclusions of this study; but it is not advisable for the purposes of a better understanding of the current situation and prospects of PDVSA. All figures are reported at the end of each year.

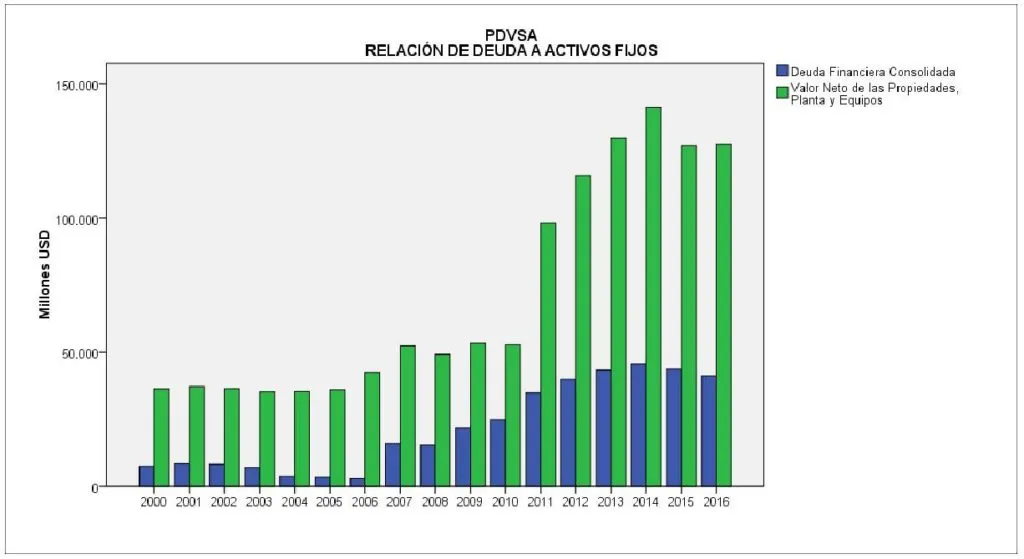

The consolidated financial debt of PDVSA remained under 10,000 million dollars between 2000 and 2006, when it began to increase rapidly until reaching the 50,000 million dollars between 2006 and 2013, beginning to decrease from the year 2014 onwards . This behavior corresponds to the rise and fall of international oil prices and also to the substantial increase in country risk since 2014, which has limited the company's possibilities for new indebtedness.

The net value of the properties, plant and equipment (productive fixed assets) took a substantial leap from the year 2011, reaching a historical peak in 2014, to decrease slightly between 2015 and 2016. This process of valorization of the Fixed assets of the company is due to the sustained disbursements for investment, year after year, as follows: 2009: 13,538 MM $, 2010: 13,307 MM $, 2011: 17,534 MM $, 2012: 24,579 MM $, 2013: 22,898 MM $, 2014: 24,418 MM $. These are the only years in which the management reports of the company report investment levels. These figures indicate that in just six years, between 2009 and 2014, within the framework of the strategic oil seeding plan, PDVSA made disbursements for productive investments amounting to 116,274 MM $. During this period, the value of fixed assets increased by 92,020 MM $. If the current portion of the financial debt is taken in each of those six years and it is assumed that it is the capitalizable part of said debt and that it was intended for investment, it is inferred that between 2009 and 2014, PDVSA increased the value net of its property, plant and equipment by 23.98%, at most, through financial debt. Contrary to what one might think, the proportion of financial debt to fixed assets is in fact much lower at the end of 2016 (32.27%) than at the end of 2010 (47.25%), which represents the historical peak of the 2000 period -2016.

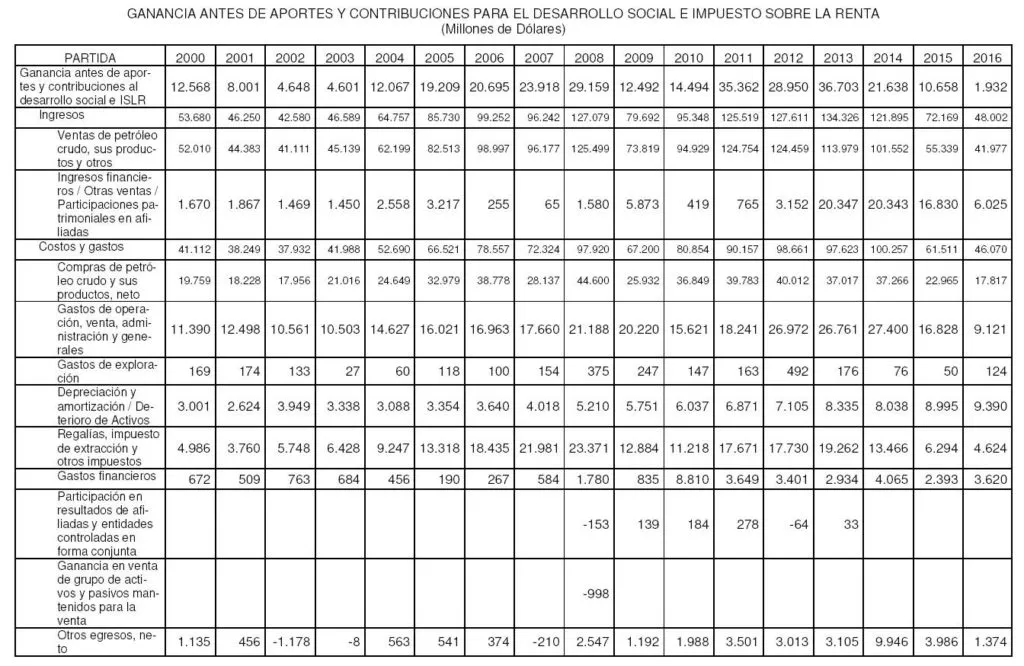

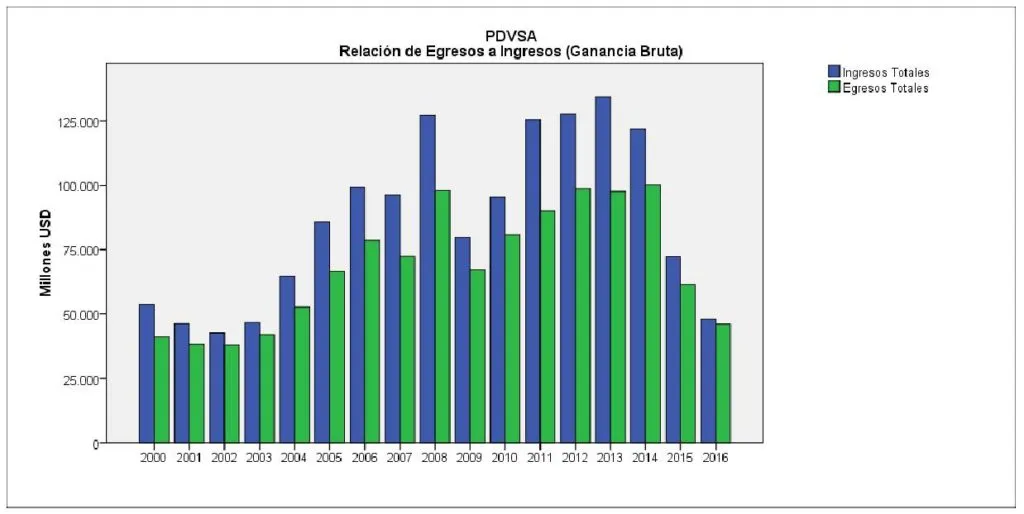

The gross profit of the company has experienced an abrupt and dramatic fall in 2015 and 2016, being in this last year of only 1,932 MM $, the lowest of the entire 2000-2016 series. The next year with the lowest gross profit was 2003, with $ 4,601 million, which was the year of the oil strike, preceded by the 2002 coup d'état. In the 2009-2014 period, the cumulative gross profit was $ 149,639 million. In that same period, the accumulated net profit after spending for social development and the payment of taxes was 42,668 MM $ (cumulative net integral gain). Assuming that the totality of this amount has been retained as retained earnings (not distributed) and has been used to finance the investment, this represents, at most, 36.70% of the disbursements for productive investments made by the company in that investment. same period 2009-2014. If that figure is added to the 23.98% that at the most was financed with indebtedness, it would subtract 39.32%, which probably was financed through strategic associations (capital contributions from associates). Up to this point, the analysis reveals a reasonable management picture of financial indebtedness and strategic capital expansions, which is far from the biased view of PDVSA's "excessive" indebtedness and its supposed "imminent bankruptcy". Of course, since the baseline level of fixed costs of the company seems to be around $ 40,000 million per year, any level of income that approaches that limit represents a risk of operational loss for the company. Without access to sources of funds that exceed this cash flow limit, the company is certainly at serious risk of halting production.

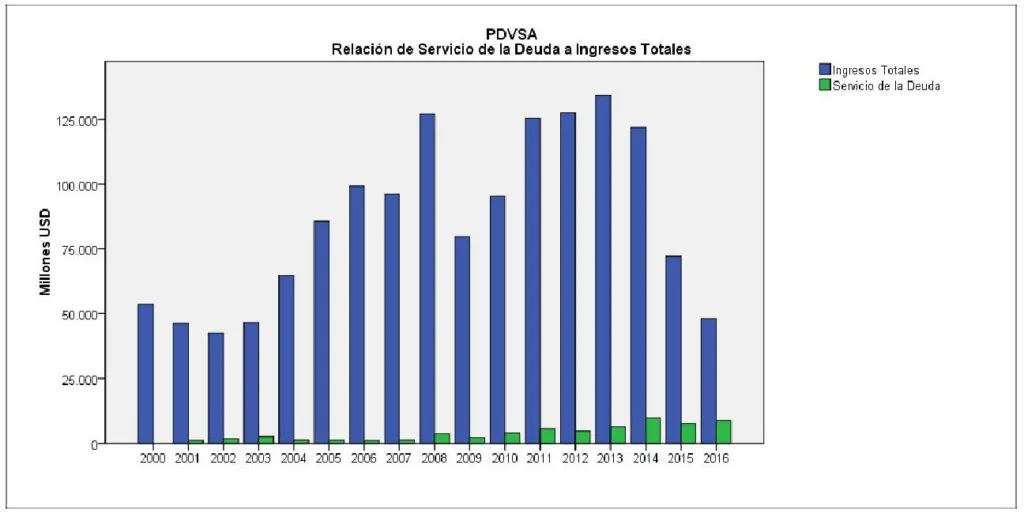

Coinciding with the results already analyzed, regarding a reasonable management of the financial indebtedness by PDVSA, it should be noted that in the period 2000-2016, the average proportion of the service of the annual debt (principal plus interest) with respect to total income, it is 4.79%. However, all the years of the series are below that average, with the exception of 2003 (5.37%), 2014 (7.92%), 2015 (10.36%) and 2016 (18.44%). ). Therefore, the abrupt fall in revenues in the last two years makes the debt service an important burden that compromises the short-term solvency of the company.

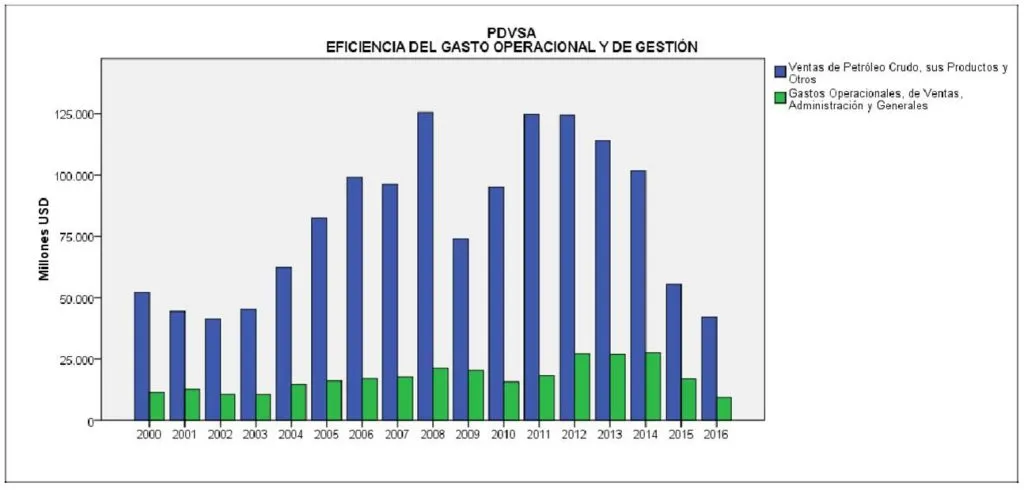

Much has been said about PDVSA's "inefficient spending". However, the figures do not corroborate this assessment. In the period 2000-2016, the average annual proportion of operating, sales, administrative and general expenses, with respect to sales of crude oil, its products and others, is 22.21%. Half (8 years) are located above that average and the other half (9 years), are located below. It is not the increase in spending that is the most determining factor in this proportional relationship, but the decrease in sales (revenues). In the last two years of the series (2015 and 2016), the ratio of expense to sales was, respectively, 26.98% and 30.41%. This is not due to an increase in the "inefficiency of spending", but to an evident fall in income, determined by two factors: the fall in the price of oil in international markets and the decrease in the volume of production.

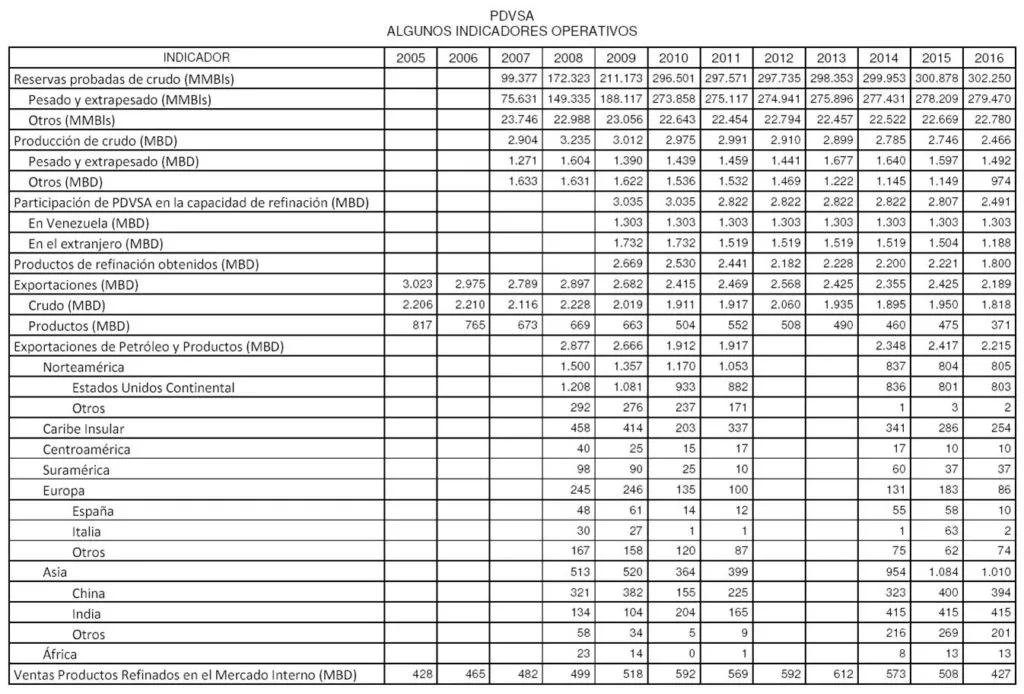

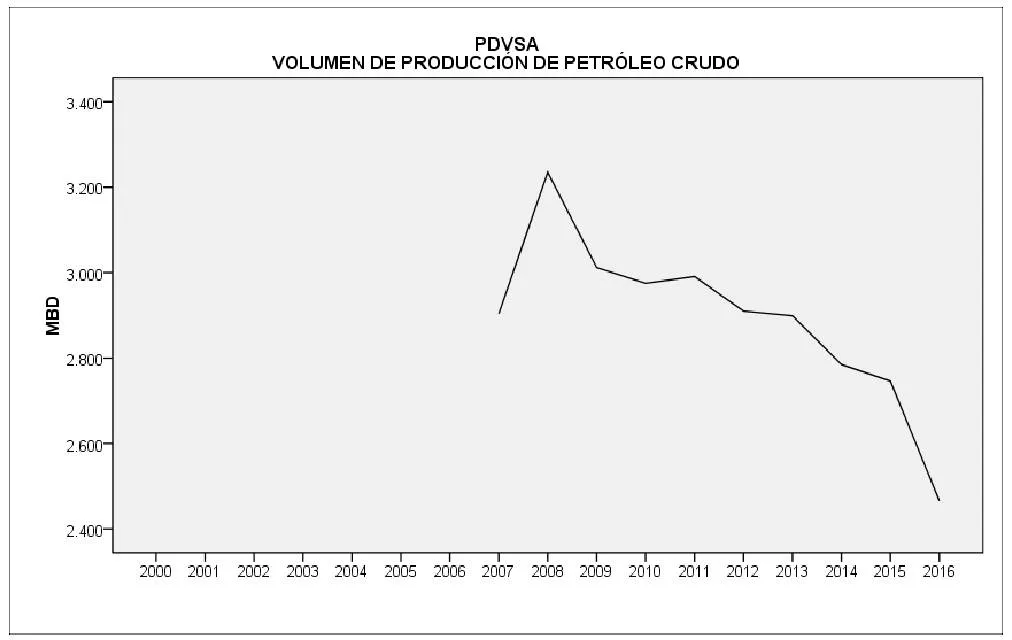

This indicator reveals a worrisome situation. Between 2008 and 2016, the company exhibits a sustained and uninterrupted decrease in the volume of crude oil production. It is an uninterrupted fall over eight consecutive years, with 2016 being the year of greatest seasonal decline. But what draws attention is not that there has been a fall in the accumulated production volume of 23.77% compared to the peak volume of 2008, but that it occurred precisely in a period where the levels of productive investment of the company they were gigantic, as explained above, also financed in large part by indebtedness and capital contributions from associates; that is to say, by means of an important patrimonial load for the company. It is inferred, therefore, either that the investments were actually made and were misguided and / or that there was a good part of the investments reported in the management reports of the company that were not actually carried out, which would lead us to consider a possible situation of embezzlement or fraud. According to the annual management reports, the investment in exploration and production was: 2009: 4.360 billion, 2010: 7112 million, 2011: 8.49 billion, 2012: 12.475 billion, 2013: 12.750 billion and 2014: 13.385 billion. , for a total in that period of 58,576 MM $, which represents 50.38% of all the investments made in that period. It does not seem reasonable that such an amount of investment has translated into such poor results in the volume of production of crude oil, which decreased in that same period by 13.91%. Therefore, the hypothesis of embezzlement or fraud acquires force.

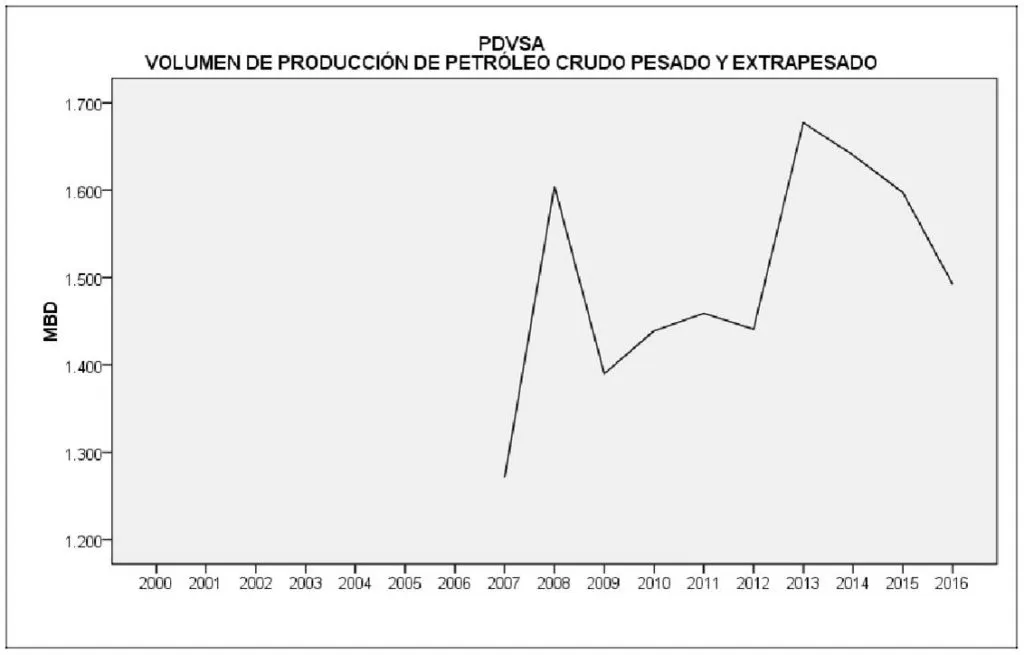

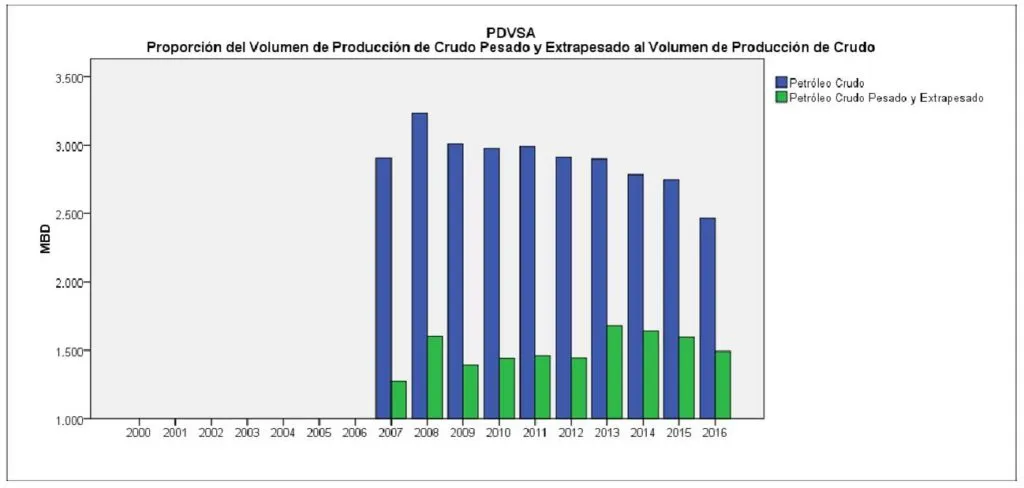

Notwithstanding what was said in the previous analysis, it is significant that the production volume of heavy and extra-heavy crude oil grew significantly between 2008 and 2016, as well as in the period 2009-2014. The cumulative growth as of 2008 was 17.39%. This supports the hypothesis of "misguided investments", that is, large investments that managed to increase the production of heavy and extra heavy crude in a modest proportion, and divestment in segments that could have represented much better operating results, such as the recovery of wells inactive light and medium crude, much higher profitability. The investments in expansion of the volume of heavy and extra-heavy crude production are strategic, because they represent the segment with the greatest future for the national oil industry; but they do not pay enough in the short term.

This graph corroborates the above, since it shows that the production of heavy and extra heavy crude has increased, while the production of light and medium crude has declined steadily in recent years.

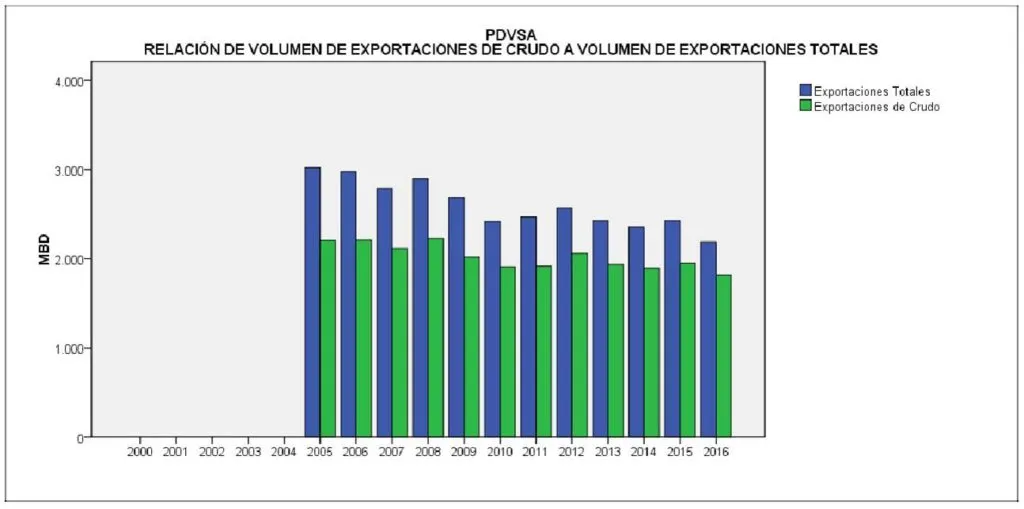

Likewise, the volume of exports of higher value-added products (refining products) has been decreasing in relation to exports of crude oil. This is in line with the fact that PDVSA's refining capacity requires high levels of investment for its conversion to the processing of heavy and extra-heavy crude, which is the one that is increasingly being produced. It is evident that the decline in the productivity of the light and medium crude oil wells, and the orientation of the investment effort towards the production of heavy and extra heavy crude oil, have determined a decrease in the production volumes of higher added value and profitability. . This, together with the fall in international oil prices, has led to a fall in PDVSA's productivity and the deterioration of the terms of trade of the national economy.

The significant drop in PDVSA's refining capacity abroad, observed in 2011, indicates that it may have been one of the sources of funds used by the company to finance its ambitious investment plan in that period. The fall in 2016 could mean a way to obtain liquid resources to improve the cash flow situation of the company, precisely in that year where total revenues suffered a substantial fall, bringing the gross profit obtained to a historical minimum. These decisions could also have influenced the lower possibility of feeding light and medium crude to the refining capacity abroad specifically adapted to these types of crude. It is possible that PDVSA has opted to maintain its refining capacity abroad mainly of heavy and extra-heavy crude, based on the strategic reorientation of its production towards the future use of the huge reserves of the Orinoco Oil Belt, thus releasing funds dammed in refining assets that could be idle due to lack of supply of raw material.

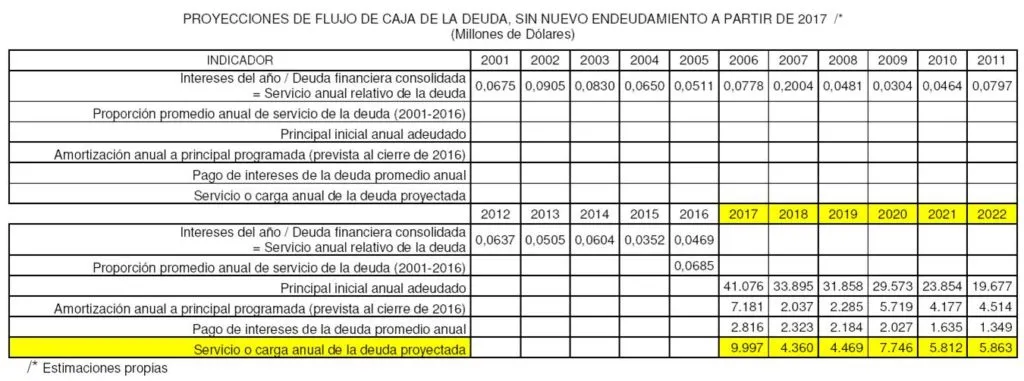

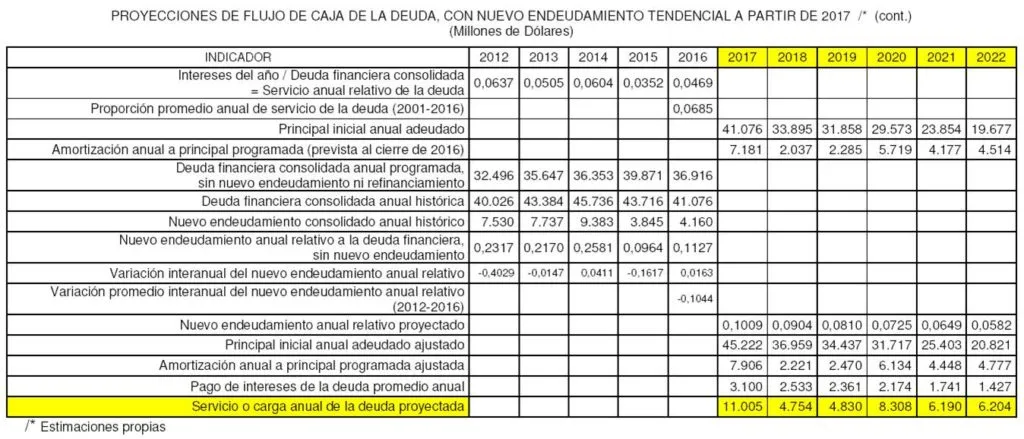

Taking as input information the principal maturities of the financial debt programmed for the period 2017-2022, reported in the financial reports of PDVSA at the end of 2016, and taking into account the historical proportion of the debt service for interest payments with respect to At the level of indebtedness, the flow of annual disbursements that PDVSA would have to incur to amortize its accumulated financial debt until the end of 2016 was projected using the simulation model presented in this table, assuming that the company will not acquire new financial debt to from that moment. The simulation indicates that the payments of principal and interest for financial debt in 2017 could reach around 10,000 M $, representing the current year the highest total service of the financial debt since 2000, preceded by the year 2016, in which debt service amounted to $ 8,851 million. Now, after the peak of 2017, the annual service of the debt decreases substantially from 2018, with an increase in 2020, but always below the peak peaks of 2016 and 2017. Despite the favorable forecast that this scenario paints , everything will depend on the level of gross income of the company that will allow it to cover its annual financial expenses, which in turn will depend on international oil prices and the annual production volume of crude oil and refined products for export. If these last levels are compromised by embezzlement or investment fraud, the company will have no other way than to seek capital raising through strategic partnerships, joint ventures and even financial leasing of its production plants. Hence, the leasing rumor of the country's main refineries to strategic partners (Russia, China), is not unreasonable, given the current circumstances that the company is going through.

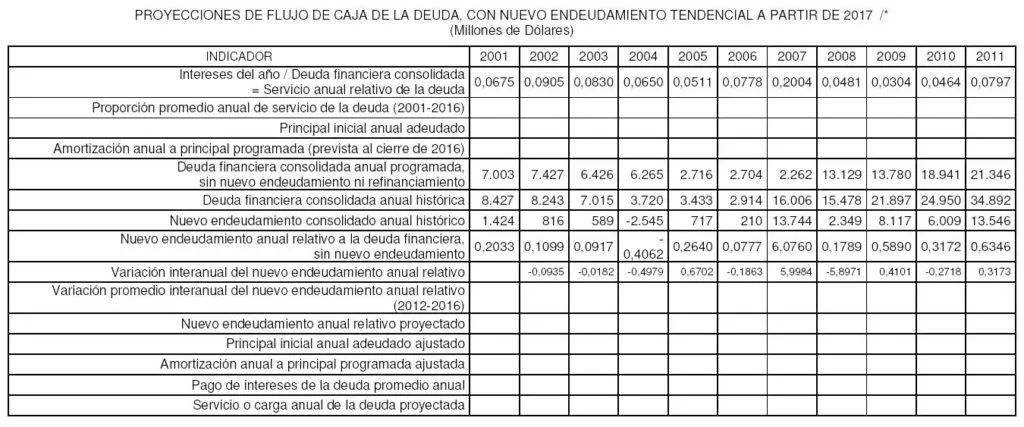

Despite the severe restriction on access to new indebtedness by PDVSA, given the disappointing prospects of its operating cash flows, mainly due to the decrease in the volume of annual production of crude oil, it is advisable to project the possible annual service of the company's financial debt between 2017 and 2022, under the assumption that it will be able to receive new financing, at the same rate as that received in recent years. Taking specifically the 2012-2016 period, the simulation model presented in this table was constructed, assuming, unlike the previous model, that PDVSA will access new indebtedness in the future maintaining the same trend observed in the 2012-2016 period, where the access to new indebtedness has already been quite restricted. This simulation indicates that the payments of principal and interest for financial debt in 2017 could be close to $ 11,000 million. What is discussed in the first scenario is also valid for this, but the annual total debt service amounts increase slightly. Noteworthy is the relief in the annual disbursements that the company will have in 2018 and 2019, which are two critical years where a significant recovery in international oil prices is not expected and where the inertial tendency of the crude oil production crisis in PDVSA could translate into even greater decreases in the volume of annual production, with the consequent risk of operational loss, that is, that total outflows exceed total revenues. In the latter case, the possibilities for the company to remain in operation will depend on its financing possibilities through commercial credit, inventory management, management of accounts payable and receivable, financial leasing, the lifting of share capital and, finally, the decapitalization of fixed assets, first abroad and then in the country.

By: Luis Enrique Gavazut