I don’t know about you, but I was glued to the markets this week. I found myself obsessively opening the Voyager app, staring at the prices of Bitcoin, Ethereum, XRP, and other top assets as they flashed red. I flipped back and forth to the stock market, which was spooked into a sell-off by an inverted yield curve.

I don’t know about you, but I was glued to the markets this week. I found myself obsessively opening the Voyager app, staring at the prices of Bitcoin, Ethereum, XRP, and other top assets as they flashed red. I flipped back and forth to the stock market, which was spooked into a sell-off by an inverted yield curve.

crypto-678x381.png

A summer full of regulatory scrutiny and a flip-flopping trade war between the U.S. and China kicked volatility into high gear this week.

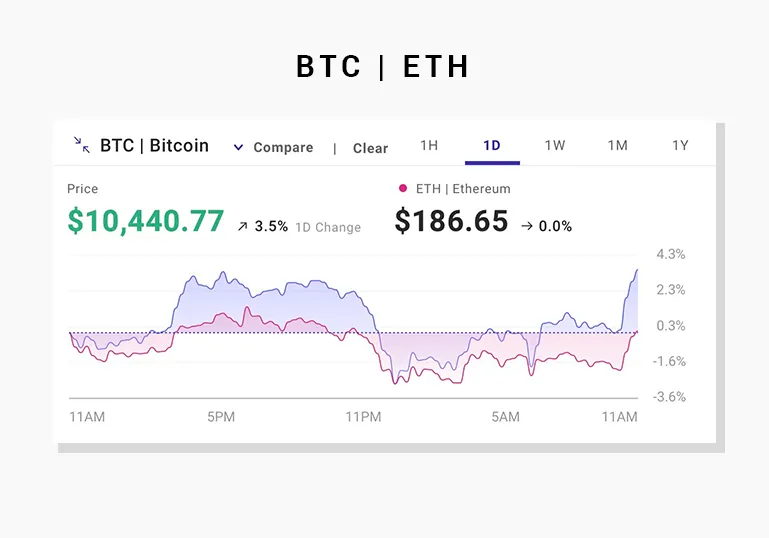

On Thursday, Bitcoin fell below the $10,000 threshold, Ethereum dropped under $200 for the first time since May 2019, and XRP touched $0.25, its lowest price in more than a year. All this happened as the interest rates on short-term bonds went higher than the interest rates paid by long-term bonds – a key recession indicator in the equities market.

With no clear signal to blame, some pointed to the Yuan’s recovery as the reason for crypto market's sell-off, while others to the uncertainty in global financial markets.

Image source: cryptonews.com.au

What do you think?

Keep your comments coming in......

Source: https://main.weku.io/community-deals/@holifield/5vojj1-crypto-talks