Introduction

Since the introduction of crypto-asset through Bitcoin in 2008, a lot has happened in the blockchain world. A number of solutions and hence crypto-currencies have been introduced addressing the pressing needs of society in specific areas. Blockchain was received so well that more and more companies, crypto - fund houses, and even entrepreneurs were looking at blockchain to deliver the next block-buster solution.

While all this was good and encouraging, it did bring forth another aspect of the cryptocurrencies. Let me explain. The success of the blockchain had led to a record number of ICOs in 2017 and that may well continue into 2018 and few more years thereafter. This rush also translated into the first mover lot of investors to put their money into the cryptos. Last two years did see record highs in the rates of Bitcoin and other cryptocurrencies which further led to an increase in investments. Suddenly, cryptos provided themselves as a new avenue for investment and the rest is history, as they say. But what kind of history?

Not a very kind version of history. Near the end of 2017 and the beginning of 2018, the volatility in the rates of the cryptocurrencies had never been wider. The change in some cases was as high as 100%. Once seen as a great avenue for investors, it turned out to be anything but that. Many investors lost tons of money coupled with the fact that many ICOs failed as well. It led to an overall loss-of-faith towards crypto-solutions; more so, it became an undependable avenue for investment, holding of value, and a medium of exchange.

What this did was it deterred the fence – sitters from investing and definitely turned away the institutional investors. It does seem bad but all is not lost, though. After all, the blockchain world is just a decade old while our current financial system is centuries old starting from the barter system. So, what can be done?

The situation can be remedied if the crypto-world delivers a solution that not only presents money as a store of value but also as a medium of exchange. This would then definitely, translate into confidence among investors and would lead to an increased participation resulting in the movement of money.

But do we have such a solution?

Turns out we do.

-----------------------------------------------******-------------------------------------------------

We are talking about Kinesis!

Kinesis intends to handle the challenges that we saw by providing a solution which makes money reliable. In their whitepaper Kinesis’ mission is described as follows:

The mission of the Kinesis monetary system is to deliver an internationally fungible monetary system, designed to give back to those who participate, and thus, create a solution for the global need for sound, reliable money.

One other aspect of the cryptocurrencies is that because of the volatility, users tend to hold or hoard them while spending FIAT for their use. This further adds to the reduction in supply and hence transactions. This is also what Kinesis intends to defeat.

The Kinesis system rewards and hence encourages money velocity. In doing so it ensures that the money is available for commerce and economic activity. New money coming into the system is encouraged by giving the investor a lucrative risk/return ratio. The capital is directly backed by assets at a 1:1 ratio. All-in-all the solution encourages investment, promotes exchange and shares the rewards of the system with all investors depending on participation and exchange velocity created by the investor.

To understand the system better, let’s start by understanding the primary elements of Kinesis. These are:

Asset Class (Gold and Silver)

Kinesis primary currencies are backed by one of the most stable metals - Gold and Silver - in a 1:1 ratio of KAU or KAG coins, respectively. In other words, the KAU or KAG coin owner is allocated the assets and hence is the title holder of those assets. This also moves away from the traditional banking structure where the banks are the legal holders of customers’ deposits and hence open it to risk by their own investment strategies. Also, the asset class itself can be expanded in the future to include other assets, fiat banknotes or other cryptocurrencies, and keep them kinetically charged to stay true to Kinesis’ monetary model.

Yield

The yield generated from the economic activity (velocity) as against debt-based interest in case of fiat money, is the other important parameter of the Kinesis system. This helps in arriving at a value based on the Net Present Value (NPV) computation for use in retail and institutional investment.

Blockchain and Cryptocurrency Technology

The basic tenets of blockchain like decentralization, immutable ledger, no single point of failure, and other known benefits, power the Kinesis solution.

The combination of the above three parameters makes Kinesis (akin to Kinetic Energy) a potent solution in the crypto world. In their own words, Kinesis can be summarized as:

At its core, Kinesis is a monetary system focused on minimizing risk, maximizing return, stimulating velocity, and maximizing the rate of adoption.

Also, have a look at the Kinesis introductory video:

----------------------------------------------******--------------------------------------------------

What are the benefits of having a currency backed 1:1 by gold or silver?

The first and foremost benefit is the arrest of volatility. The one known issue with the crypto-world is volatility where there seemed to be a lack of correlation between the business reality and cryptocurrency rate. Even those crypto-solutions which seemingly had a strong business basics could not do much about the peaks and troughs in their currency rate.

A currency backed 1:1 by gold or silver arrests such volatility. This is something the Kinesis team has carefully studied and hence arrived at as a solution. The closest example is Tether which is backed by the US Dollar. The velocity of the Tether currency remains high yet stable as the holders of other cryptocurrencies exchange theirs for a stable Tether. Tether’s velocity is one of the highest among cryptocurrencies and also helps investors to consider it as a safe investment avenue. While Tether may provide Price stability, its redemption is what could be questionable as it depends on the traditional banking principles yo-yoing between inflation and velocity. Which means the dollar itself is subject to fluctuations and hence may affect Tether.

So, in effect Kinesis having studied the strengths and pitfalls of such a system, have decided to look at gold and silver, one of the most stable elements in the bullion market, as the elements backing their currency. So, it should provide high levels of price stability and at the time of redemption too, the assurance of a stable asset backing.

Besides, there are other benefits as enumerated below or Kinesis handles the following negatives.

- Decreasing Value – In an inflationary world with deposit interest less than the inflation, FIAT currencies continue to lose value in our banks. Kinesis, on the other hand, increases with use as much as earns money for the holders too.

- Centralized Bank Devaluing Money – To stimulate economic growth, central banks of various countries resort to currency devaluation and create price inflation to spur spending. This is an artificial measure taken at the discretion of the banks devaluing money at our hands further. Kinesis, similar to the first point, grows at the hands of the holder

- Storage Asset – Bullion (Gold/Silver) is held as a storage asset in anticipation of a price increase at the hands of the buyer. This prevents its market availability as much as hardly any benefit to the user in the short run. Kinesis encourages users to circulate and to earn while being circulated

- Bullion Security – Storage of Gold and Silver is always fraught with security concerns. Besides, users pay money to hold the gold and silver in the designated storages. Kinesis solves this by presenting the ABX platform for holding the gold /silver backed currencies. As such it relieves customers of storage worries and they even earn from it

- Physical Bullion Market – Currently, the bullion market disallows global bullion trader from trading globally and even the local trading is made difficult due to lack of technology infusion. Kinesis bring a global platform time-tested under ABX for bullion trading

- High Entry Price Point – Mostly players in the bullion market are heavy investors. As such, small investors hardly find it possible to invest in bullion. Kinesis with its asset-backed currency makes bullion available even to small investors

-----------------------------------------------******-------------------------------------------------

How does Kinesis open the bullion market to regular users? What is the benefit of using Kinesis over OTC alternatives?

While Kinesis’ tokens are backed by Gold and Silver, a world devoid of Kinesis does not deal much with the bullion market. Why is that?

There are many reasons and few of them are enumerated below:

Archaic and Inefficient Market

While the stock market has seen visible technological transformation leading to a settlement in T+2 days, for trillions of transactions every day, the bullion market has largely been untouched by technology. As surprising as it may sound, a large percentage of the trade in the bullion market happens physically over phone, email or in person. What it therefore does is renders the whole system inefficient and dependent on a person to complete the trade rather than a system. This scenario is not inviting enough for an average investor who would see the whole process as cumbersome, in many cases not worth the effort, and also an area open to mafia manipulation.

Siloed Market

From the first point it is obvious that such markets would work in silos and independent of others. This, therefore, makes the siloed market a kind of monopoly dependent on the “bid” price. Also, it denies investors the opportunity of arbitrage, should the price fluctuations present such a scenario.

Limited Resources

Many organizations currently do not have the regulatory know-how nor the resources required to open up to the global market. This further accentuates the siloed operation and presents a limited opportunity for a potential investor.

Barriers to Entry

Barring the big bullion banks or the international trading houses, there is a lack of a global aggregator platform which brings the "buy" and "sell" side of bullion market, globally, at one place. This limits a local player from tapping into the international market and vice-versa.

Market Access

The consumers of bullion (jewelers, manufacturers, etc.) have to depend on intermediaries to access the bullion market which therefore restricts the market for users as much as escalates the price discovery. Such a market will always operate at a certain level of inefficient price which cascades through the value chain.

So, these are the limiting points of the bullion market. These are also the points that Kinesis takes head-on. This is explained below:

Kinesis opens the Bullion Market to regular users. How?

Kinesis is a well-thought-out and engineered solution leveraging the strengths of Allocated Bullion Exchange (ABX), which is a world leading institutional exchange for allocated precious metals. This well-stitched solution is what opens up the market to regular investors or users.

Dependable and Integrated System

ABX allows Kinesis to utilize the inherent system strengths like operationally segregated wholesale contracts offering serial number and bar hallmark, easily operated over the blockchain. The network of institutional players coupled with ABX’s experience of running the system since 2013, allows regular users an easy and efficient access to the market. No longer will there be physical or person dependent market but a system enabled one.

Global Platform: Handling Inefficiencies, Intermediaries and Price Distortion

As there is no barrier for users and sellers to participate in the Kinesis ecosystem, all global players can participate and have access to different markets. What this allows is to carry liquidity where it is available in excess and move it to a market where there is restricted availability. On the other hand, it allows excess supply in one market to be made available to another market with lack of supply. The platform, therefore, will result in a new price discovery for the metal being traded (gold or silver in this case.). The proposition makes it easier for a user to log in and trade efficiently.

The other not so apparent benefit is the removal of intermediaries for users to interact directly with suppliers. The suppliers too can present an “offer” price as against “bid” price to intermediaries in the traditional market. In the traditional market, the cost would continue to escalate as it changes hand while the participants (those adding actual value) make less money. But the Kinesis based solution helps participant make more money, yet lead to an overall reduction in the final price.

-----------------------------------------------******------------------------------------------------

How will the know-how from ABX translate into a successful execution for Kinesis?

The Kinesis solution being based on their currency being backed by precious metals like gold and silver, requires a strong know-how of bullion management and trading. Besides, the blockchain part of the solution intends to make Kinesis decentralized as much as accessible across the globe. This means a strong platform would also be required to be backing such a solution. Incidentally, ABX ticks both the boxes of bullion trading know-how and a strong platform to enable the Kinesis solution. Hence it forms a natural cog in the solution wheel for the successful execution of Kinesis.

ABX is a global spot bullion exchange which has been in operation since 2013 and has an impeccable record. It’s credibility is further bolstered by partnerships such as the one with Deutsche Borse Group, one of the largest exchange groups in the world, PT Pos Indonesia, state-owned postal systems, and large established mobile banking and vaulting partners. Such a strong ecosystem has led to ABX having a verifiable audit trail backed by multilayered third-party audit and verification process in place. All this will help the Kinesis solution.

As such ABX makes the Kinesis Monetary System a credible and strong solution. Let’s look at the Kinesis Monetary System in its entirety.

-----------------------------------------------******--------------------------------------------------

Kinesis Monetary System

Kinesis is a full-circle system made up of all elements and functions required for a successful and effective monetary system.

Kinesis Currency Exchange (KCX)

KCX functions as the wholesale market where the currency is created and minted through Allocated Bullion Exchange (ABX).

Kinesis Blockchain Network (KBN)

KBN is where the Kinesis suite of cryptocurrencies are built. Coins purchased at KCX finds its way to the KBN with incentives based on money velocity.

Kinesis Blockchain Exchange (KBE)

As the name suggests this is where the Kinesis currencies will be traded with other cryptocurrencies.

Kinesis Financial Network (KFN)

KFN is the point where Kinesis currencies can be interfaced with the real world. This also allows Kinesis to be used as a mode of payment across the world. This also has a Mastercard and Visa debit card and accompanying companion card facility.

To enable KFN an e-commerce suite will be built in to allow real-time movement of Kinesis. Additional functions like savings (with interest earning), payments, remittances and money movement can be achieved in this module.

Kinesis Commercial Center (KCC)

This module is Merchant centric and allows seamless use of Kinesis currency for payment.

-----------------------------------------------******--------------------------------------------------

Use Cases

Case 1: New Age ESOP

One of the basis of giving high performing employees with ESOPs is to encourage their participation in the company. The basic assumption is that the company’s stock is valuable and it is growing. However, the latter can sometimes be tricky, depending on when the employee wants to liquidate.

The owner of the company XYZ comes to know of Kinesis and immediately realizes that Kinesis forms a good alternative mode of ESOP. The currency benefits the holder too and its value grows over time. Since it is backed 1:1 by a precious metal, the chances of it being stable and growing is plausible.

Besides, from a value perspective each employee would feel that he or she has been gifted with gold or silver. A potential win-win for the organization and its employees.

-----------------------------------------------******--------------------------------------------------

Case 2: Institutional Investors Promoting Bullion Trade

Institutional investor ABC sees bullion trading to have a lot of potential, however, his customers once invested do not divest and invest again, nor do they trade them as there seems to be no apparent benefit in the short run.

ABC comes to know about Kinesis and finds the solution at once promising. They inform their customers of the same and invest their money in Kinesis. This proves to be beneficial to both ABC and its investors. Even if they hold and not circulate, they earn some amount and the very fact that circulation helps them earn more makes them actively look at trading.

ABC is quite happy with the Kinesis solution and sees his Kinesis portfolio swell as more and more investors wish to participate in the Kinesis backed ecosystem of investment.

-----------------------------------------------******--------------------------------------------------

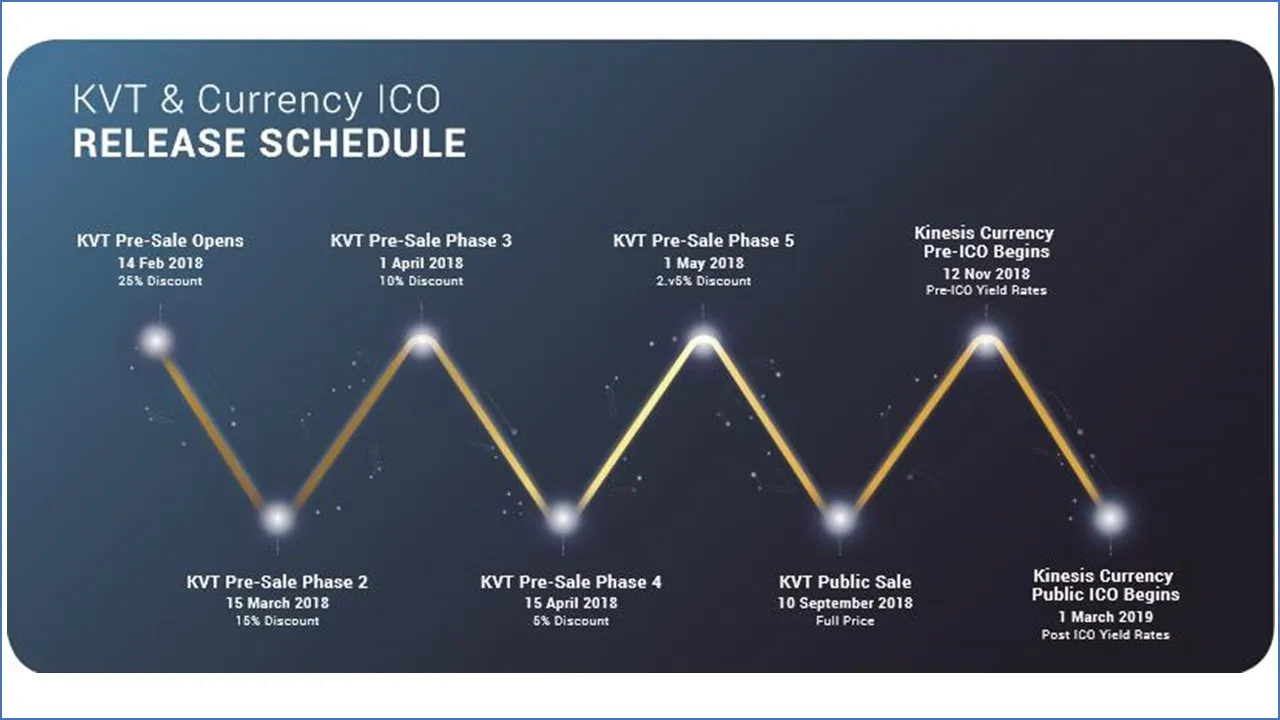

Kinesis Token Release Schedule

It is worth spending a few minutes understanding the Kinesis tokens. Unlike other crypto-solutions, there are two types of tokens here.

The Kinesis Velocity Token (KVT)

KVT tokens are the fund raising vehicle for launching the Kinesis Monetary System. It is an ERC20 compatible utility token. Holders of KVT stand to earn a percentage of the transaction fees collected through the Kinesis Monetary System.

Kinesis Currency Tokens

These are the actual currency tokens backed by an asset in 1:1 ratio. The Gold and Silver backed tokens will be referred to as KAU and KAG, respectively. These tokens are based on the Kinesis Blockchain Network, a fork of the Stellar Network. Obviously, the idea is to leverage the benefits of faster transaction speeds and other benefits of the Stellar Network over the Ethereum Network. KAU and KAG will be the tokens enabling transactions across the Kinesis Monetary System.

So, how does the token release schedule look like?

At the moment the Initial Token Offer is in progress and readers interested in buying them can do so over here:

-----------------------------------------------******--------------------------------------------------

And the team behind Kinesis?

-----------------------------------------------******--------------------------------------------------

-----------------------------------------------******--------------------------------------------------

Summary

At a time when the relevance of blockchain solution was fading because of the volatility and lack of basics in pricing, Kinesis comes as a breath of fresh air. Not only does it make blockchain as a viable concept but also makes bullion lucrative. The asset-backed currency makes it dependable and less volatile. What’s more, the concept of incentivizing money flow works well to keep the currency in circulation.

Over a period of time, there is a chance that all that we call as risky capital, like other cryptocurrencies, fiat with less interest, bullion market investments and other investments will soon find its way into the Kinesis ecosystem. There is hardly anything which appears amiss from here.

So, we look set poised for a Kinesis based credible blockchain world.

-----------------------------------------------******--------------------------------------------------

It is also recommended that readers understand more about Kinesis through any of the following informative resources.

- Kinesis.Money Website

- Kinesis.Money WhitePaper

- Kinesis.Money OnePager

- Kinesis.Money YouTube

- Kinesis.Money Telegram

- Kinesis.Money Linkedin

- Kinesis.Money Github

- Kinesis.Money Steemit

- Kinesis.Money Bitcointalk

- Kinesis.Money Medium

- Kinesis.Money Twitter

-----------------------------------------------******--------------------------------------------------

Here is my twitter link:

https://twitter.com/DawsonSavio/status/1036637388200665094

-----------------------------------------------******--------------------------------------------------

This article is written in response to originalworks’ call on authors’ thoughts on Kinesis. It can be read here.

Image Courtesy: Kinesis Resources

kinesistwitter

kinesis2018