Week 35 - Aug 29 Investment Moves

- Current US market condition

- Aug 29 Options Trades @ 2:45 pm (EST)

- Late posting (more trades)

Current US market condition

The US market as of 2:56 pm (EST).

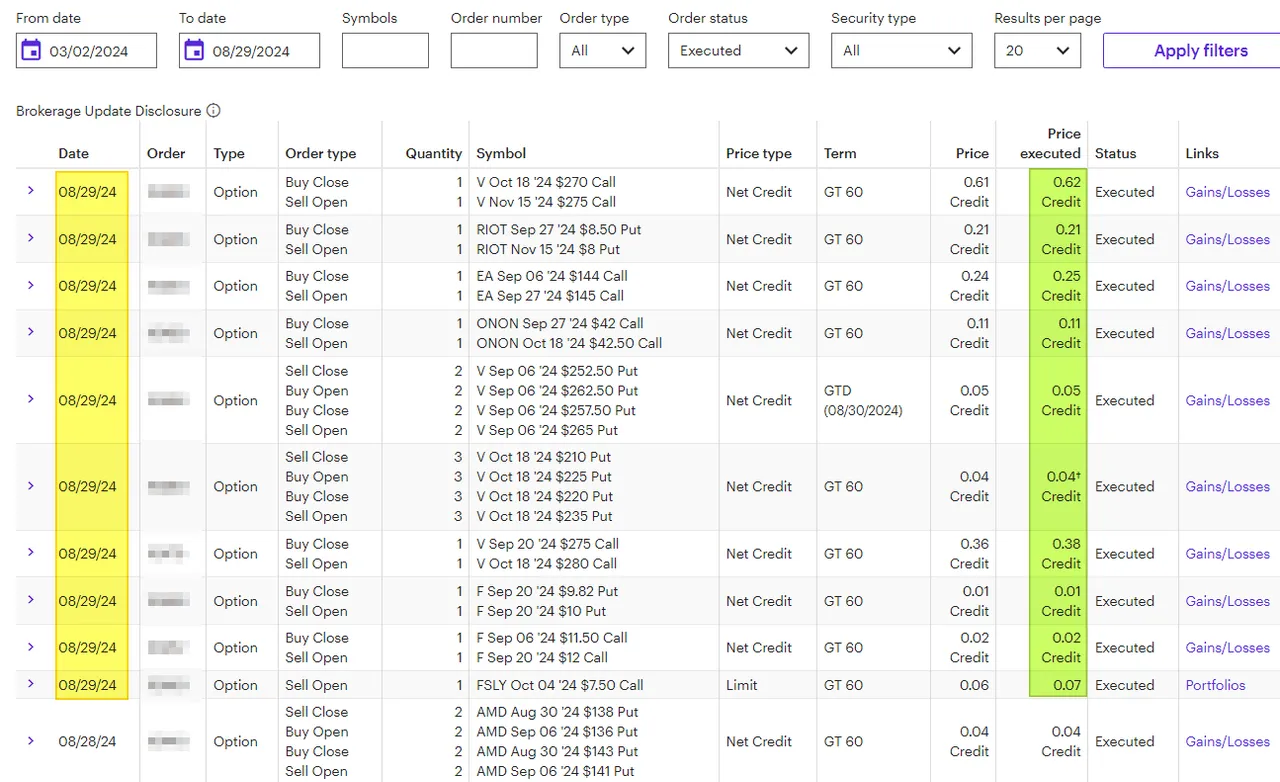

Aug 29 Options Trades @ 2:45pm (EST)

Here are the option trades for today:

Today was a good day to adjust some of my option positions. I got credit (premium) for changing my position.

Summary:

- Rolled V Covered call out one month and up $5 in strike price. Got 62 dollar in premium.

- Rolled RIOT covered call out two month and got $21 in premium.

- Rolled EA covered call out 3 weeks and up $1 in strike price. Got $25 today.

- Rolled ONON covered call out 2 months and up $0.50 in strike price. Got $11 today.

- Rolled V put credit card up and got $5 premium each.

- Rolled V put side of the IRON Condor and got $4 premium each.

- Rolled V covered call and got $38 in premium.

- Rolled F CSP (cash secured put) for $1 in premium (less when you factor in the commission).

- Rolled F covered call up and out for 3 weeks for $2 each.

- Added new covered call on FSLY.

Late posting (more trades)

Normally I post between 10 am -12 noon (EST). Right now is almost 3 pm (EST). Therefore you will see more trades than normal.

Nvidia is a big position, in my SP500 ETF holding. Therefore I don't focus on owning more of it directly. I'm looking to hold and own small/mid-caps that will grow into larger businesses. This is why I love to talk about companies that are sometimes smaller or unknown.

Here are some of my holdings that I'm excited about:

PLTR, AXON, LFUS, NEE

I do own large caps like Visa (V), Bank of America (BAC), Ford (F), and Exxon Mobil (XOM). What I have been doing is selling off some of my boring or "safe dividend" holdings and buying things that I believe will be growing faster in the next 10 or 20 years.

Have a profitable day!