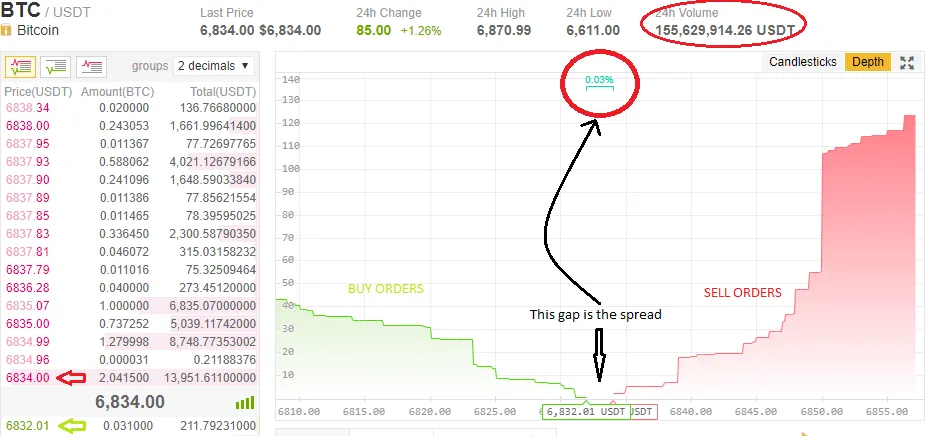

It’s due to the lack of liquidity* in crypto. And the real reason, I believe, is the large spreads* caused by lack of liquidity. Large spreads mean buyers often have to pay more than they might be willing to execute a buy order. In a bull market* buyers are more willing to pay more. This is why, in crypto, you see price movements that are greatly exaggerated during a bull market. On the other hand, in a bear market*, buyers feel less pressured to jump the spread and succumb to the lowest sell price. Buyers say “I don’t want to pay any more than X” and sellers say “well I won’t sell for any less than Y”. In this case, price movements become very restricted and reach an equilibrium. As a result, in cryptos, bear markets/corrections can become very extended. Take Reddcoin (RDD) for example

1 month to go up and 6 months to go down! That is the "Hurry up and wait" syndrome that Haejin often alludes to in his posts about altcoins. Reddcoin has an average daily volume of around 1-2 million USD. In contrast, mainstream financial assets see much greater liquidity. For example, Apple Inc (AAPL) has an average daily trade volume of around 40 million USD.

In conclusion, the more liquidity an asset is exposed to, the more quickly a correction in that asset can be resolved.

I hope this answered your question (:

- DEFINITIONS (if needed) (;

Liquidity - volume of money changing hands

Spread - the difference between the highest price buy order and the lowest price sell order

Bull Market - when price goes up

Bear Market - when price goes down

RE: Ontology (ONT): Altcoins Don't Know How to Correct Quickly