Week 35 - Aug 30 Investment Moves

- Current US Market Condit @ 12:45 pm

- Aug 30 Option Trades

- ONON holding Update

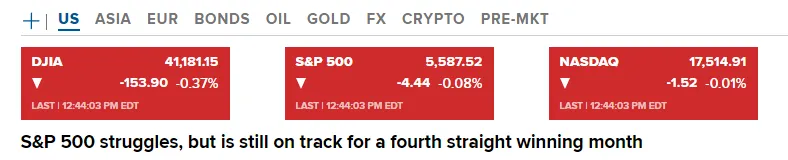

Current US Market Condit @ 12:45 pm

Here are the current markets:

The Dow hit a new high this week. S&P 500 and Small CAP are doing well also.

I'm not trying to predict the short-term direction of the markets. I will continue to play the market to make some extra income each month, so I can buy more ASSET (STOCK) to my portfolio. My long-term view is always bullish and I will not bet against the US stock market.

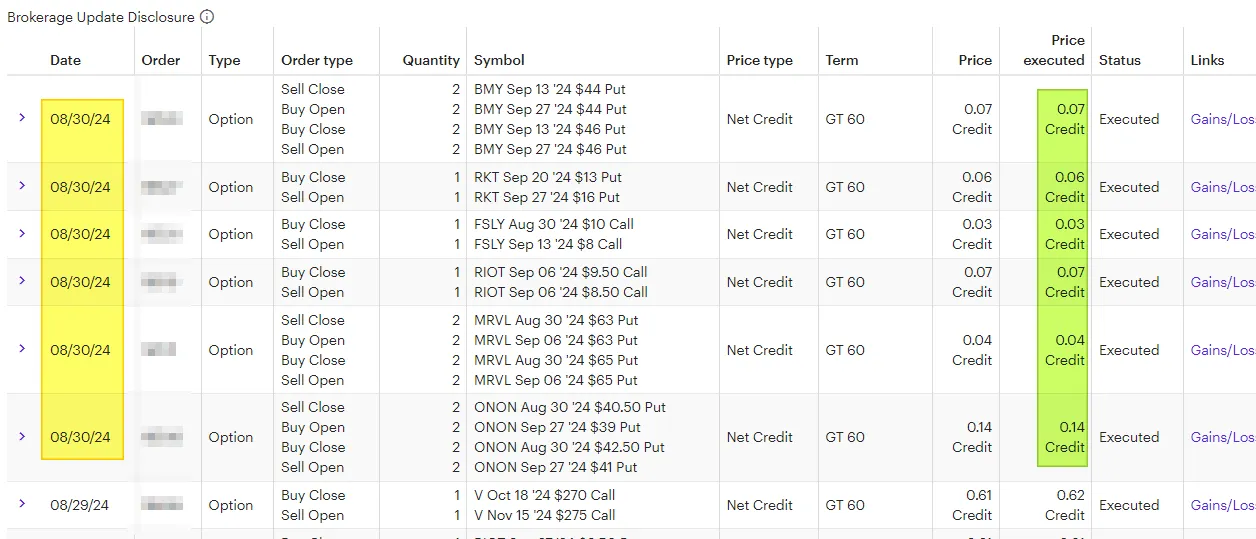

Aug 30 Option Trades @ 12:30 pm (EST)

Here are my trades as of 12:30 pm (EST):

All credits mean I was able to get cash today for whatever adjustment I made in my OPTION trades. Often, I look to "adjust" the risk and if I can make $2 - $5, I would be fine with that. The consistency and ability to do it over 5 years or 10 years makes me money. It is not the ONE time my trade goes bad or the one I luck out that makes (or loses) me money.

The key is the ability to adjust risk and do it over one month, one quarter, one year, and one decade. That is why I don't chase 10% or 20% returns. A profit is a profit and over time, if I can keep on making a profit, that will compound in the long run. Now some think I don't understand the importance of getting HIGHER returns. That is not true. If that was TRUE, why would I invest in BITCOIN or single stocks vs the SP500 Index? The answer is finding the right balance between risk and reward and designing your method around that.

Today Trades:

- Rolled BMY PUt credit spread out 2 more weeks for $7 each contract.

- Rolled RKT CSP for $6.

- Rolled FSLY covered call (which is worth 1 penny) out two weeks for $3.

- Rolled RIOT covered call down for $7 today.

- Rolled MRVL put credit spread for $4 each.

- Rolled ONON put credit spread out 4 weeks for $14 each.

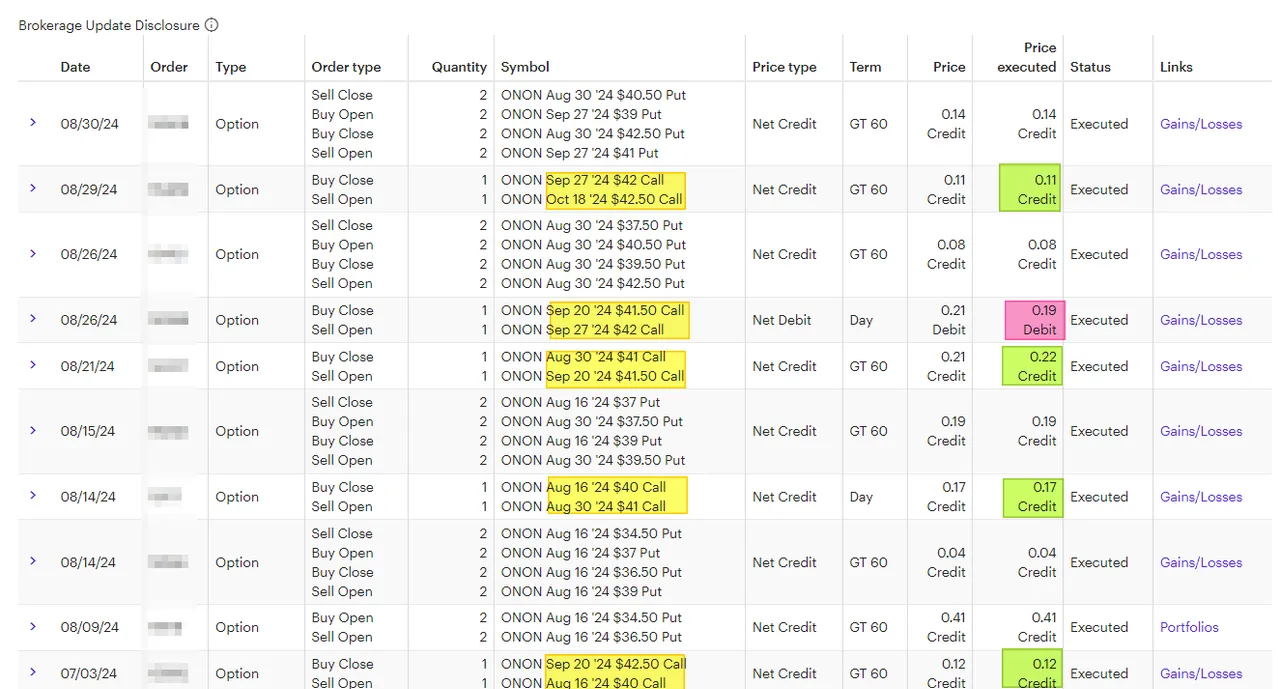

ONON holding Update

I purchased ONON this year in April 2024, before the Summer Olympics.

Detail:

- 100 shares. Up 43% in a few months (or $1400).

- My Covered call is ITM right now at $42.50 (which limits the upside). The covered call gives me CASH upfront. As long as I can adjust it in the future, I'm not worried if it is ITM.

- Then I added a PUT credit spread that is also giving me income.

- The key is the Put credit spread must be a LOWER strike price than the Covered call. Over time, my Covered call Strike price will move upwards (as you can see it went from $40 to $42.50). The Put CS, started at $36.50 and is now $41.

- I can lose on the covered call side or the PUT credit spread side, but I can't lose on BOTH sides. Also with 100 shares, I'm LONG on the STOCK and I win as long as ONON is worth more than $32.28! While it hit $45-47, I don't care about the "range" the stock trades between. The key is to make money on the covered call, put credit spread, and on the 100 shares. In 5 years, if ONON is trading at $100 a share, I will have the same setup using the OPTION.

Have a profitable day!